This weekend’s G20 meeting in Mexico has garnered a few headlines from putting pressure on Germany to increase the size of the European bailout fund, although the argument behind it is not exactly news. The thinking goes that should Germany decide to increase their contributions to the European Stability Mechanism then that will make it more politically viable for non-European countries to contribute further funds via the IMF to the European situation. Historically Germany has been against this of course, as they refuse to pay for their poorer European cousins’ indiscretions.

Reports suggest that the opposition to this may be softening however, although this may not be as a result of committing more money but instead agreeing to the combination of the EFSF and ESM to form one super fund. Germany still has to ratify its contribution to the latest EUR130bn bailout for Greece although this does not look like being a problem. Wolfgang Schäuble, the German finance minister, summarised exactly the market’s thinking towards the latest Greece deal by saying that “he could not with any certainty exclude” the possibility that it could fail later on down the line and that more money may need to be committed.

The overnight Asian session has been quiet with GBPUSD remaining elevated whilst GBPEUR rattles around sub-1.18. The euro remains bid on oil flows as the price of Brent crude remains bid on tensions from the Middle East. A UN nuclear report published late Friday showed that there has been a large expansion of uranium enrichment in Iran of late. This, combined with supply troubles from Syria and Libya, has made sure that the oil price in both euro and sterling terms stayed at record levels through the weekend break. As we pointed out on Friday, the problems that oil price inflation can cause to a recovery are various and serious, we will explore these in today’s Sterling Update, published this afternoon.

The data calendar is light today as traders get ready for Wednesday’s liquidity operation from the ECB. Estimates on how much banks will borrow at the second opening of the LTRO vary from around EUR400bn to over EUR1trn. The first injection has, alongside improvements in data from the US, been the catalyst for the rally in equities, the euro and the lowering of peripheral bond yields since the middle of December and the ECB hopes that a similar effect will be forthcoming from this latest batch.

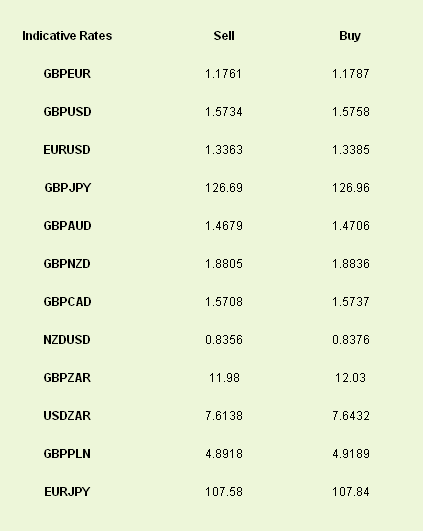

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

G20 Pressures Germany for More Funds

Published 02/27/2012, 05:18 AM

Updated 07/09/2023, 06:31 AM

G20 Pressures Germany for More Funds

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.