As earnings fall across the banking sector, and SEC criminal charges rise, new signs are emerging of a US banking collapse that may be already underway.

One of the most shocking facts about Brexit was the massive panic selling in US banks. The average decline for the country's six biggest banks was -7.59%. Apparently, banks were not seen as a safe place to put money.

Banks depend on interest income more than ever now that government regulation has stripped trading desks ability to generate revenues and profits.

US Banking Collapse Of Earnings Means Things Are Getting Desperate, Ugly

Big banks are using dirty "small-print" tactics in a desperate attempt to produce income.

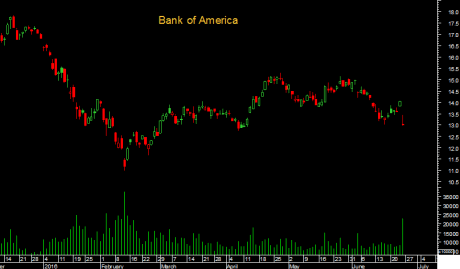

Bank of America (NYSE:BAC) is one of the largest banks in the US, with more than $2.1 trillion total assets.

According to a recent report in The Wall Street Journal, the SEC is getting set to take action against Merrill Lynch, the wealth management arm of Bank of America, because of regulatory violations in structured notes the bank sold to investors in 2010. The value of the notes fell as much as 95 percent. Investors said there was no clear explanation of the banknotes risk.

A banknote is a type of negotiable instrument known as a promissory note, made by a bank, payable to the bearer on demand. A long time ago, commercial banks were legally required to redeem the notes for gold or silver. Historically, banks sought to ensure that they could always pay customers in gold coins when they presented banknotes for payment.

This practice of "backing" notes with something of substance is the basis for the history of central banks backing their currencies with gold or silver. Today, most national currencies have no backing in precious metals or commodities and have value only by fiat.

Just three days ago, Bank of America reached a settlement agreement with the SEC on yet another shady matter. Through the agreement, Bank of America will pay $415 million over allegations that it misused customer funds to generate profits.

Bank of America's weighted average cost of capital stands at 5.4 percent, while its return on invested capital is 4.5 percent. In other words, the bank's returns are lower than its costs, so they are losing money fast.

These types of illegal and desperate moves by the largest US banks are because they are under financial stress.

Bank Revenues Have Been Falling For Years

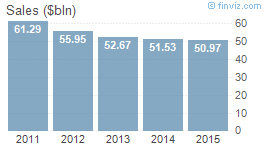

JP Morgan Chase (NYSE:JPM)'s revenue is dropping.

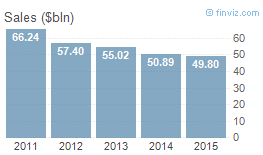

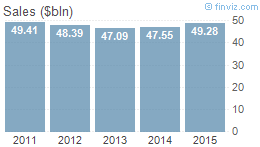

Bank of America's revenue is falling.

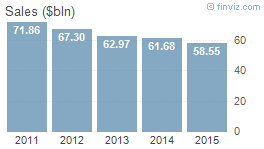

Revenue at Citigroup (NYSE:C) is declining.

Revenue at Wells Fargo (NYSE:WFC) did a slight uptick.

In case you think Wells Fargo is the safest of the bunch, it is not. It is the most hedged out of the major banks, expanding into trading in risky credit-default swaps. Trading in credit-default swaps did not work out well for Deutsche Bank (DE:DBKGn), who stopped the hazardous activity in 2014.

I Thought Stress Tests Guarantee A US Banking Collapse Will Not Happen?

Banks did pass stress tests, but the basis of those stress tests are on the assumption that the Federal Reserve will continue to pay 50 basis points of interest on excess reserves. The Fed funds rate is paying around 38 basis points.

In other words, the Fed is paying a 35 percent premium on excess reserves! The Fed is still propping up banks some eight years since the last recession. The same banks that the Fed is propping up, it is also stress testing.

Who Stress Tests The Federal Reserve?

The Federal Reserve is propping up the largest US banks by paying 50 basis points of interest on their excess reserves. A US banking collapse would have already happened if not for the Fed. The Federal Reserve has $4.5 trillion on their balance sheet. That's more assets than the two largest US banks JP Morgan Chase and Bank of America COMBINED.

Why is the Federal Reserve not being stress tested to make sure that the risk to the Fed, the US Treasury, and the economy as a whole will not result in a complete collapse of the US banking system? Think about it. The Fed is holding a lot of toxic "underwater" assets on their balance sheet. What happens when the Fed has to sell these assets at a loss?