- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Textron (TXT) Tops Q2 Earnings, Lowers '17 EPS Outlook

Textron Inc. (NYSE:TXT) reported third-quarter 2017 adjusted earnings from continuing operations of 65 cents per share, beating the Zacks Consensus Estimate of 62 cents by 4.8%. Adjusted earnings were up 6.6% from 61 cents in the year-ago quarter.

Excluding one-time items, the diversified U.S. conglomerate reported earnings of 60 cents, reflecting a year-over-year decline of 61.3%.

Revenues

Total revenues in the quarter was $3.48 billion, which missed the Zacks Consensus Estimate of $3.54 billion by 1.5%. Reported revenues however improved 7.2% from the year-ago figure of $3.26 billion, due to higher contribution from Bell, Industrial as well as Textron Systems segments.

Manufacturing revenues were up 7.3% to $3.47 billion, while revenues at the Finance division declined 10% to $18 million.

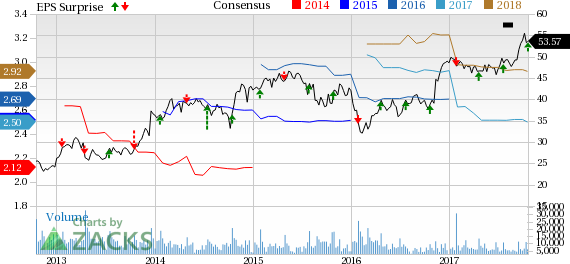

Textron Inc. Price, Consensus and EPS Surprise

Segment Performance

Textron Aviation: Revenues during the quarter fell 3.7% to $1,154 million from $1,198 million in the year-ago quarter owing to lower military and commercial turboprop volumes.

The company delivered 41 new Citation jets, five Beechcraft T-6 trainers and 24 King Air turboprops compared with 41 jets, 29 trainers and 8 King Air turboprops in the prior-year quarter.

The segment registered profits of $93 million compared with $100 million in the year-ago quarter. Order backlog at the end of the quarter under review was $1.2 billion, up by $142 million sequentially.

Bell: Segment revenues were $812 million, up from the year-ago level of $734 million.

The segment delivered 39 commercial helicopters compared with 25 units in the prior-year quarter. Bell also delivered five V-22s (down from six in the third-quarter 2016) and eight H-1s (in line with the numbers delivered in third-quarter 2016).

Segmental profits improved 9.3% to $106 million on favorable performance. Bell’s order backlog at the end of the quarter was $5 billion, down by $413 million from the preceding quarter.

Textron Systems: Revenues during the quarter came in at $458 million, up 10.9% year over year, mainly driven by higher volumes in the Marine and Land Systems product line, partially offset by lower volume in the Weapons and Sensors product line.

Segmental profits declined to $40 million from $44 million.

Textron Systems’ backlog at the end of the quarter was $1.5 billion, down by $85 million from the end of the second quarter of 2017.

Industrial: Segmental revenues grew 17.6% to $1,042 million primarily driven by the impact of the Arctic Cat acquisition.

Segmental profits declined 25.8% to $49 million due to unfavorable volume and mix, pricing and inflation.

Financials

As of Sep 30, 2017, cash and cash equivalents were $1,104 million compared with $1,137 million as of Dec 31, 2016.

Cash flow from operating activities were $119 million at the end of the third quarter, compared to $175 million in the prior year quarter.

Capital expenditure during the quarter was $138 million compared with $99 million in the year-ago quarter.

Long-term debt was $3,078 million as of Sep 30, 2017, up from $2,414 million as of Dec 31, 2016.

Guidance

Textron lowered the upper limit of its adjusted earnings guidance range for 2017. The company currently expects to generate adjusted earnings in the range of $2.40-$2.50 per share, compared to prior guidance range of $2.40-$2.60 per share.

The company however raised its cash flow from continuing operations (of the manufacturing group) before pension contributions to the range of $800-$900 million for 2017, from earlier band of $650-$750 million.

It has reduced its net cash provided by operating activities of continuing operations of the manufacturing group guidance to the range of $895-$995 million from the prior guidance band of in $1,045-1,145 million.

Upcoming Peer Releases

General Dynamics Corp. (NYSE:GD) is expected to report quarterly results on Oct 25.

The Boeing Company (NYSE:BA) is also slated to report quarterly results on Oct 25.

Zacks Rank

Textron presently carries a Zacks Rank #4 (Sell). A better-ranked stock in the same space is Northrop Grumman Corp. (NYSE:NOC) , which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Northrop has surpassed the Zacks Consensus Estimate in the past four quarters with an average of 12.60%. The company boasts a decent long-term earnings growth rate of 7.50%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Northrop Grumman Corporation (NOC): Free Stock Analysis Report

Boeing Company (The) (BA): Free Stock Analysis Report

General Dynamics Corporation (GD): Free Stock Analysis Report

Textron Inc. (TXT): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Warren Buffett and Berkshire Hathaway (NYSE:BRKa) always make headlines in February when the firm holds its annual meeting. Among the many takeaways is what the company has been...

While Tuesday I wrote about the strength of junk bonds in the face of risk-off ratios (TLT v. SPY, HYG), today, I am still quite concerned about Granny Retail or the consumer...

Nvidia (NASDAQ:NVDA) shook things up by reporting revenue of $39.3 billion for the quarter while guiding next quarter to $43 billion. This was slightly below the pattern’s...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.