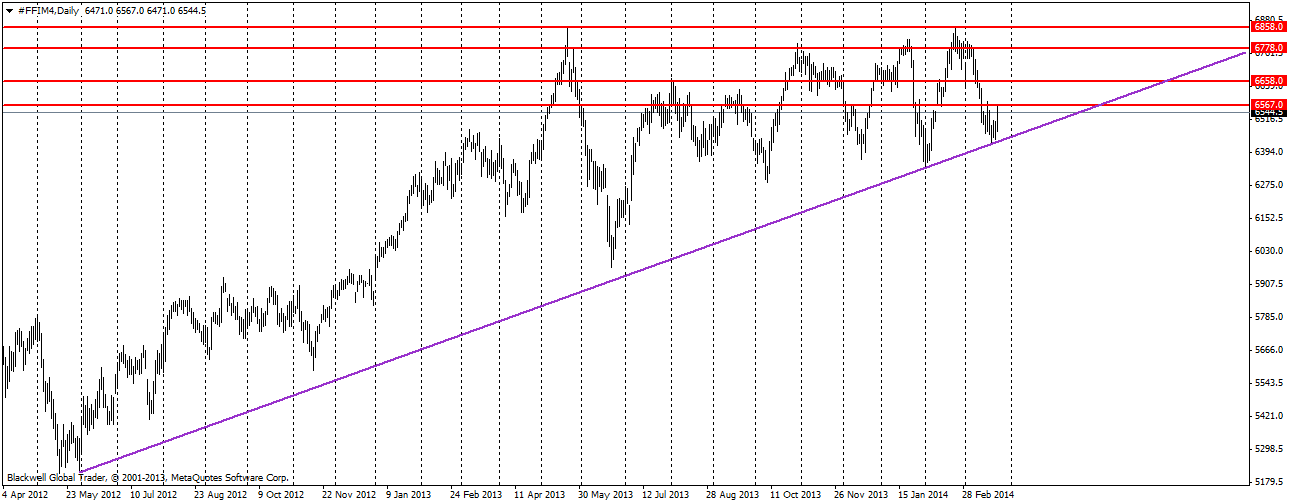

The FTSE 100 has been looking like its usual self in the markets as of late as it looks to test the trend line in play. With the testing phase now completed, the FTSE 100 has looked to jump back up heavily.

Currently, the bullish trend line has been solid for some time, and for the most part I was weary whether markets would actually look to use it again and bounce off it. On Monday, markets confirmed the trend line and how solid it was by pulling back sharply on moves lower. Certainly, it looks unlikely to break in the current market climate, which is hungry for riskier assets.

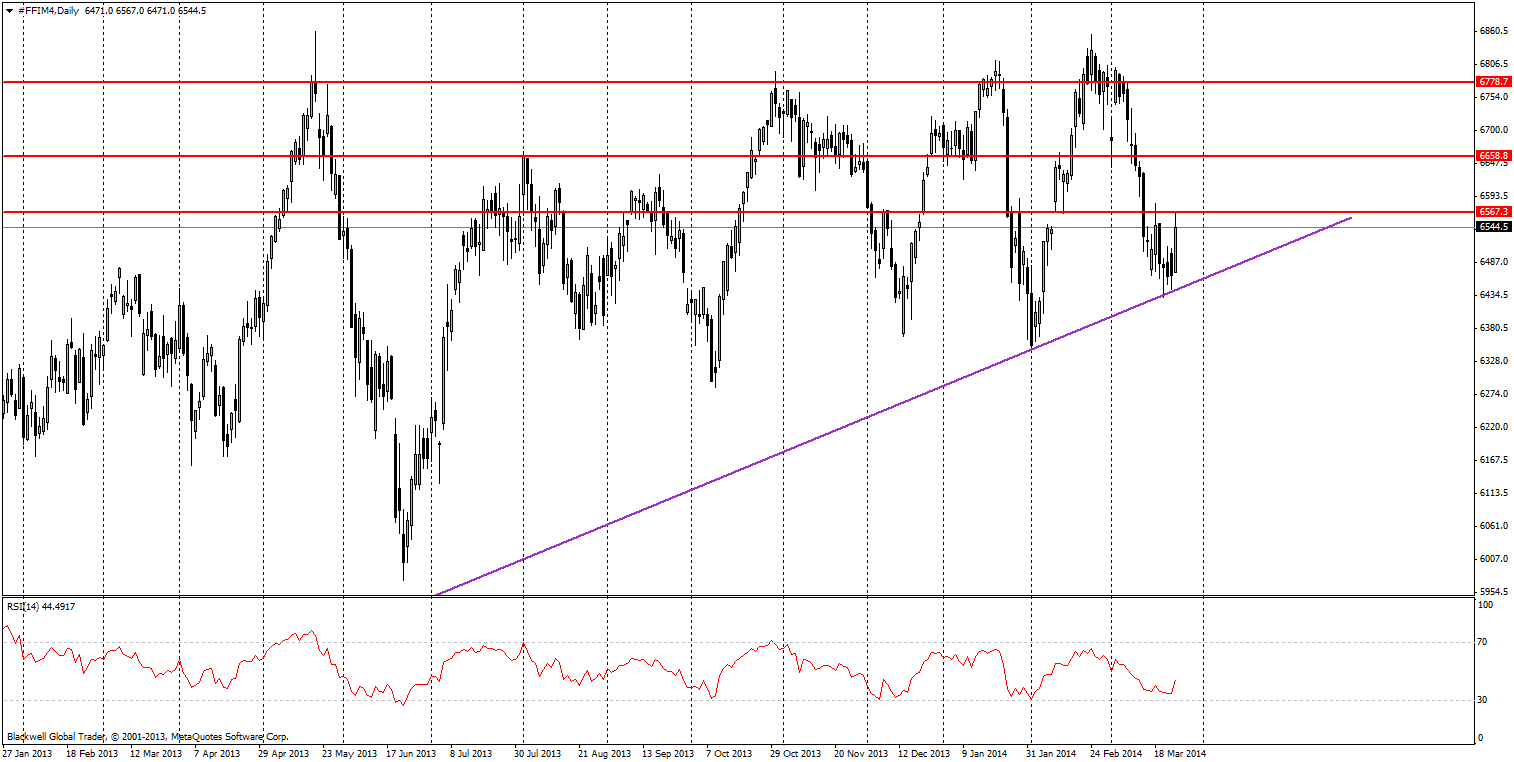

Resistance levels can be found at 6567, 6658, 6778 and 6858. These levels are likely to be tested heavily as the market lifts higher. The 6650-6750 levels are likely to see consolidation based on past movements – though we may see pushes higher again to test new levels if UK economic data is exceptionally positive.

Any further movements above 6778 are likely to be the market testing to see if there are higher levels above 6858. If anything, moves this high are likely to be very volatile and unlikely to budge the resistance ceiling in play.

While the FTSE is a great trade for bullish trend traders, there is also the risk of bears pushing lower, and any risk management should look at the trend line and use it as dynamic support.

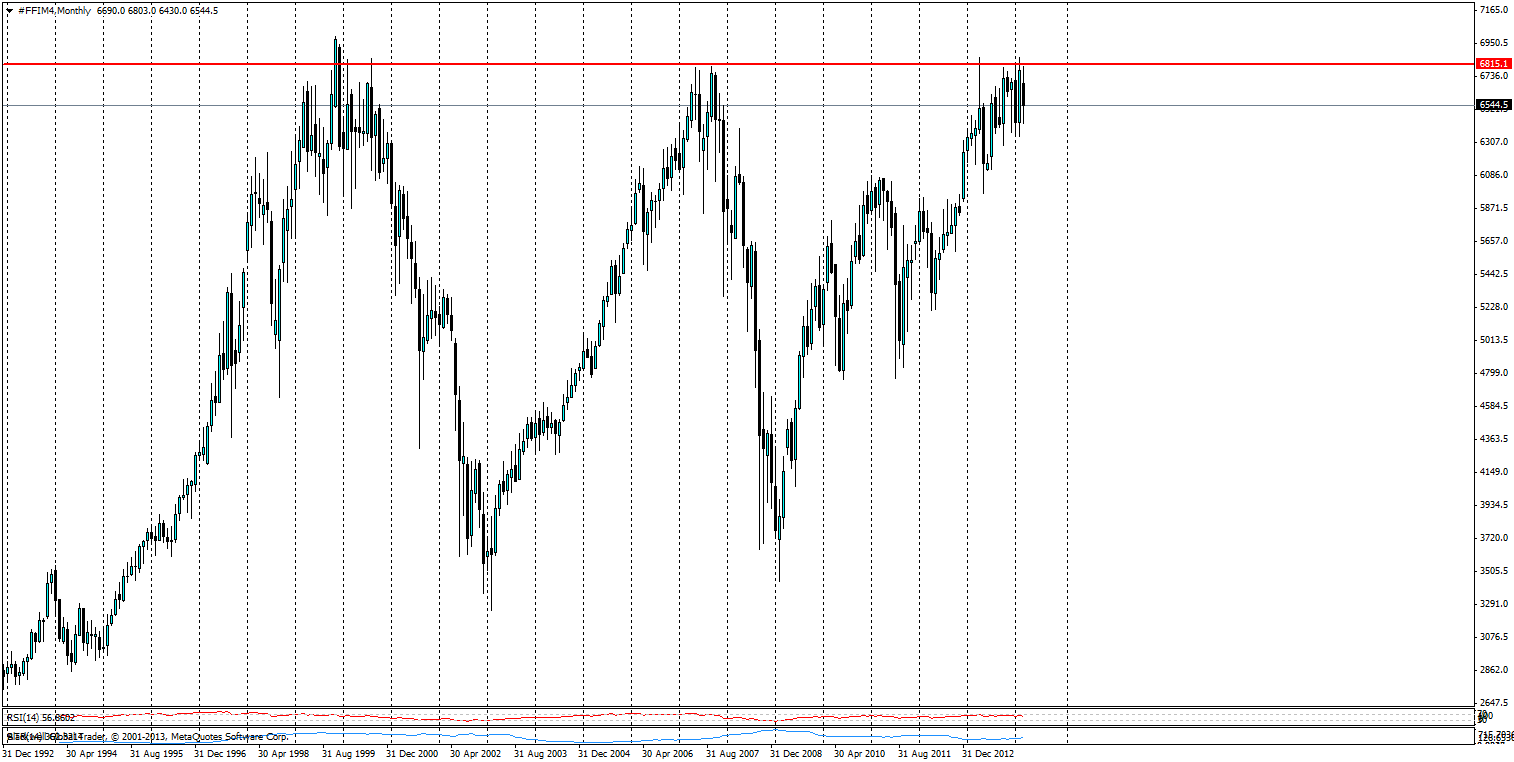

One thing I do want traders to take notice is the chart from a monthly standpoint.

Looking at the monthly chart, we can see that it's certainly at a peak in regards to its historical highs. Though this peak is one to be watched, if anything, the last two tops showed pull back signals in the form of a double top and head and shoulders pattern, and so far we have seen neither, except for volatility. It’s clear that this run may not be over for some time, and traders should be aware of the monthly chart when using patterns.