For the 24 hours to 23:00 GMT, the EUR rose 1.44% against the USD and closed at 1.1341, following hawkish remarks from the European Central Bank (ECB) President, Mario Draghi.

The ECB Chief signalled that the central bank could scale back its stimulus efforts if the economy continues to be on the strong recovery path, but added that any such move would be gradual. However, Draghi noted that the Euro-bloc still requires a substantial monetary stimulus to bring a durable and self-sustaining rise in inflation.

On the macro front, Italy’s consumer confidence index rose more-than-expected to a level of 106.4 in June, compared to market expectations of a rise to a level of 105.8. In the previous month, the index had registered a level of 105.4.

The greenback lost ground against a basket of major currencies, after a vote on healthcare legislation was delayed in the US Senate, casting doubt on the ability of the US President, Donald Trump to implement his agenda of tax reform and infrastructure spending.

On the macro front, the US CB consumer confidence index unexpectedly advanced to a level of 118.9 in June, propelled by a buoyant labour market and improved business conditions. The index had registered a revised reading of 117.6 in the previous month, compared to market expectations of a fall to a level of 116.0.

Separately, the International Monetary Fund (IMF) downgraded its growth forecast for the US economy to 2.1% in 2017, down from 2.3% estimated in April, as promises made by the US President regarding fiscal policy, tax cuts and deregulation look less likely to be implemented. Further, the organisation trimmed growth for next year and warned that the economy would have a hard time achieving the 3.0% growth target set in the President’s first budget.

Meanwhile, the Philadelphia Federal Reserve (Fed) President, Patrick Harker, London, reaffirmed his stance for raising interest rate one more time this year. However, he warned that Fed may have to rethink on its monetary policy trajectory if inflation continues to abate.

In the Asian session, at GMT0300, the pair is trading at 1.135, with the EUR trading 0.08% higher against the USD from yesterday’s close.

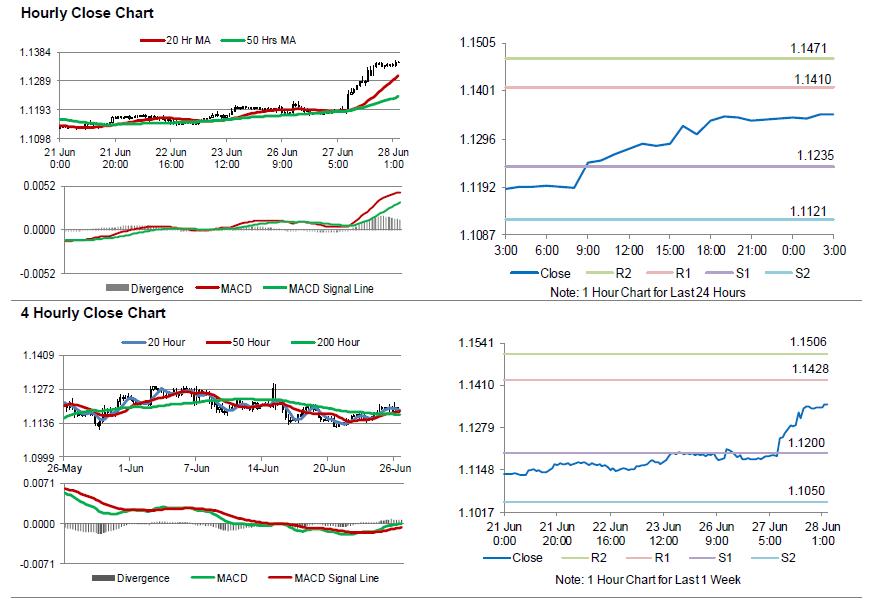

The pair is expected to find support at 1.1235, and a fall through could take it to the next support level of 1.1121. The pair is expected to find its first resistance at 1.1410, and a rise through could take it to the next resistance level of 1.1471.

In absence of any crucial economic releases in the Euro-zone today, investors will await the release of the US advance goods trade balance, flash wholesale inventories and pending home sales data, all for May, scheduled to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.