- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Franklin's (BEN) November AUM Up On Higher Equity Assets

Franklin Resources Inc. (NYSE:BEN) announced preliminary assets under management (AUM) by its subsidiaries of $753.2 billion for November 2017. Results displayed improvement from $750.7 billion recorded as of Oct 30, 2017. Also, the figure moved up 5.4% from the prior-year quarter.

Month-end total equity assets came in at $318.8 billion, slightly up from the prior month and 7.8% year over year. Of the total equity assets, around 65% were from international sources, while the remaining 35% came in from the United States.

Total fixed income assets were $285.1 billion, up nearly 1% from the previous month and 3.1% from the prior year. Overall, tax-free assets accounted for only 24% of the fixed income assets, while the remaining 76% was taxable.

Franklin recorded $142.8 billion in hybrid assets, which was down slightly from $143 billion recorded in the previous month but up 5.1% from $135.9 billion in November 2016.

Cash management funds were reported at $6.5 billion, flat sequentially and up 4.8% from the year-ago period.

The company’s global footprint is an exceptionally favorable strategic point as its AUM is well diversified. Nevertheless, regulatory restrictions and sluggish economic recovery might mar AUM growth and escalate costs.

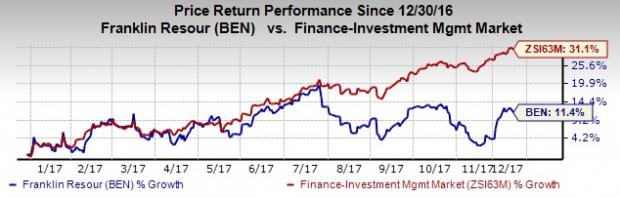

Franklin currently carries a Zacks Rank #3 (Hold). Shares of the company have gained 11.4% so far this year, underperforming 31.1% growth recorded by the industry.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Among other asset managers, Invesco Ltd. (NYSE:IVZ) , T. Rowe Price Group, Inc. (NASDAQ:TROW) and Legg Mason Inc. (NYSE:LM) are expected to release preliminary AUM results for November 2017 this week.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

T. Rowe Price Group, Inc. (TROW): Free Stock Analysis Report

Invesco PLC (IVZ): Free Stock Analysis Report

Legg Mason, Inc. (LM): Free Stock Analysis Report

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.