The US Dollar was under pressure with the US Dollar Index (USDX), which is a basket of major currencies against the US Dollar closed 0.32% lower as the British Pound was strong after positive GDP numbers from the UK and the Euro zone is expecting an interest rate decision from the ECB on Thursday. The South African Rand (ZAR) was under enormous pressure, losing more than 2% against the US Dollar after the Finance ministry announced lower economic growth and higher government debt expectations. The Turkish Lira traded against the Euro at an all-time low as tensions between Turkey and “the west” rise and Germany reportedly tightened funding procedures to Turkish entities from German and European banking institutions.

Gold traded slightly up but remained under pressure as it is reported that US President Trump is considering John Taylor as new Federal Reserve chair. Markets anticipate that Taylor as FED chair would be more inclined to raise rates faster than current chairwoman Yellen.

Oil traded lower as a report by the EIA suggested rising US crude oil production and higher stockpiles of crude oil by 856 thousand barrels in the last reporting window, while analysts expected stockpiles to fall by 2.6 million barrels.

US equities traded lower as some company earnings significantly disappointed the market like those from AMD and AT&T (NYSE:T) disappointed.

Cryptocurrencies traded mixed with the Bitcoin recovering more than 3% and reaching again the level of around $5,700 after the new fork “Bitcoin Gold” put it under pressure on Tuesday. This comes as Bitcoin Gold starting at around $500 is now worth less than $150, showing a similar pattern to the other fork, Bitcoin Cash which after a positive start also came under pressure.

On Thursday the European Central Bank (ECB) is due to publish private sector lending and monetary supply (M3) statistics and later make its interest rate decision. The US will release jobless and home sales figures. In the Asian trading session Japan will release on Friday its inflation data.

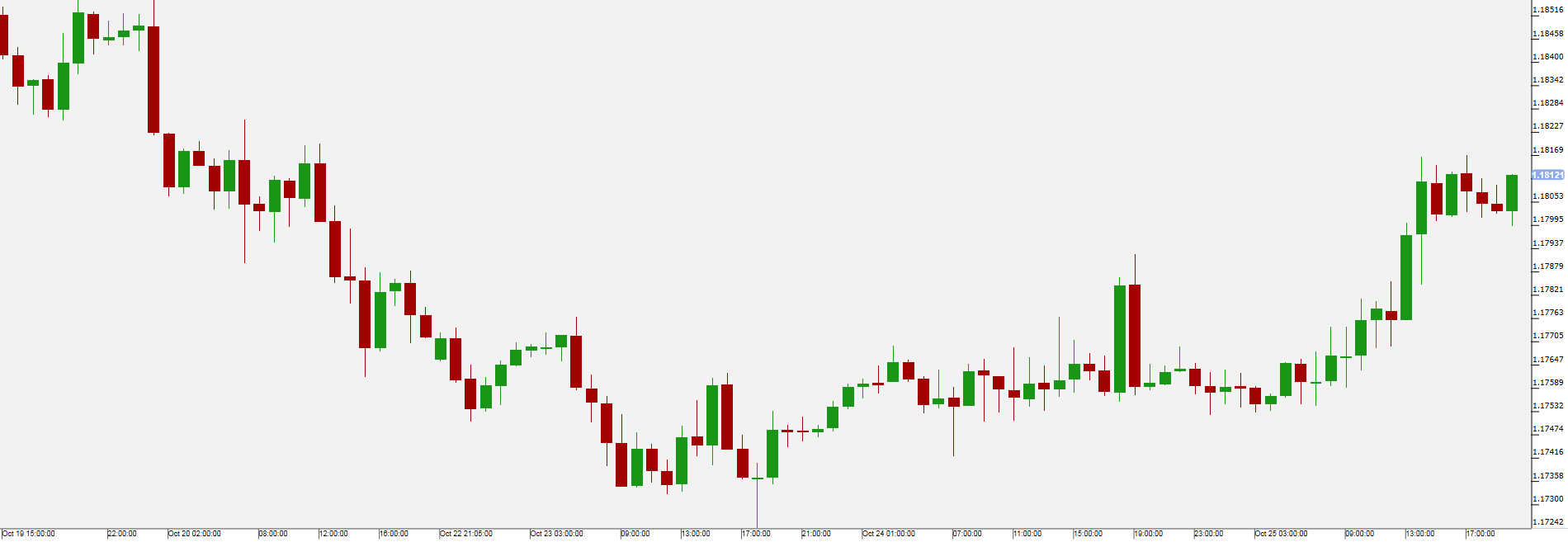

EUR/USD was up on Wednesday as traders are looking forward to the ECB (European Central Bank) meeting on Thursday which could deliver a decision to change the interest rates. The Dollar declined against the Euro on Wednesday even though economic data such as durable goods orders were positive. Before the interest rate decision the ECB will also publish private sector lending and monetary supply (M3) statistics on Thursday. The US will release jobless, home sales and monetary supply (M2) statistics the same day.

Pivot: 1.177

Support: 1.177 1.175 1.174

Resistance: 1.182 1.184 1.186

Scenario 1: long positions above 1.1770 with targets at 1.1820 & 1.1840 in extension.

Scenario 2: below 1.1770 look for further downside with 1.1750 & 1.1740 as targets.

Comment: the RSI advocates for further upside.

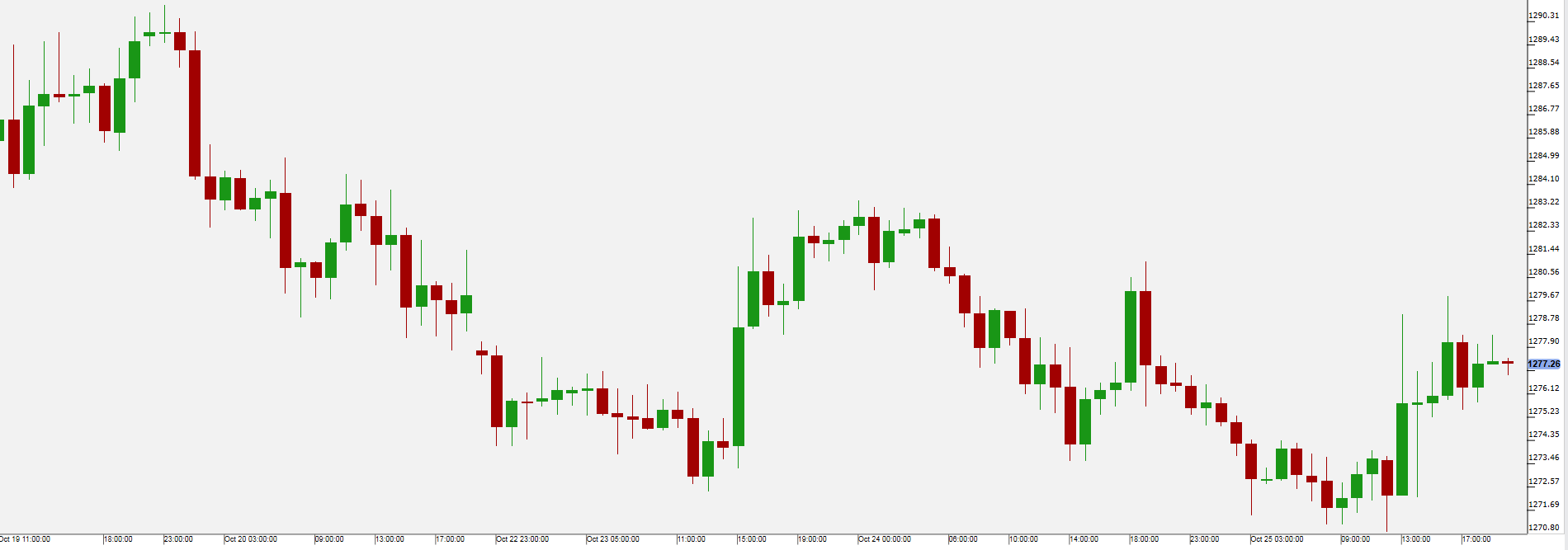

Gold

Gold was trading slightly up on Wednesday supported by a weaker US Dollar. Gold remained under pressure as it is reported that US President Donald Trump might appoint John Taylor as the next Federal Reserve chair, who is expected by the market to raise rates faster than current chair Yellen.

As economic fundamental data plays a major role in central bank rates decisions markets will pay attention to how jobless claims and home sales (released Thursday) and GDP data (Friday) from the US will look like as the US Dollar is still the major trading currency for gold.

Pivot: 1271

Support: 1271 1267 1264

Resistance: 1281 1283 1286

Scenario 1: long positions above 1271.00 with targets at 1281.00 & 1283.50 in extension.

Scenario 2: below 1271.00 look for further downside with 1267.00 & 1264.00 as targets.

Comment: the RSI broke above a bearish trend line.

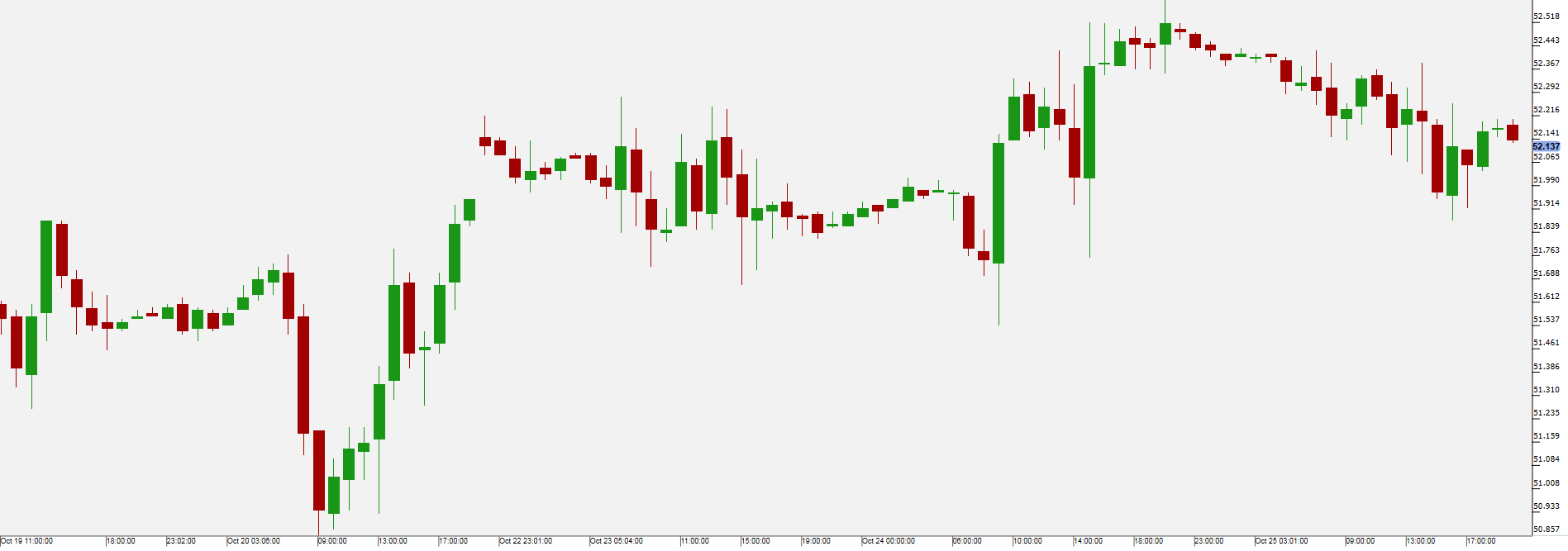

WTI Oil

Crude oil settled lower on Wednesday as the market has concerns about increasing oil production in the US. The EIA (Energy Information Administration) oil stockpile report indicated increased crude oil stockpiles by 0.9 million barrels, while gasoline and distillate stockpiles reduced by 5.5 and 5.2 million barrels respectively. Pressure comes from reports that the daily production of crude oil in the US reached 9.5 million barrels per day while 7.66 million barrels per day in US crude, petroleum, diesel and other products are exported raising fears of a continued global supply glut. The OPEC continues discussion for an extension of production cuts until the end of 2018 and tries to assure markets that even after the end of those cuts the market would not be flooded by OPEC suppliers.

Pivot: 51.78

Support: 51.78 51.55 51.22

Resistance: 52.55 52.8 53.1

Scenario 1: long positions above 51.78 with targets at 52.55 & 52.80 in extension.

Scenario 2: below 51.78 look for further downside with 51.55 & 51.22 as targets.

Comment: the RSI broke above a bearish trend line.

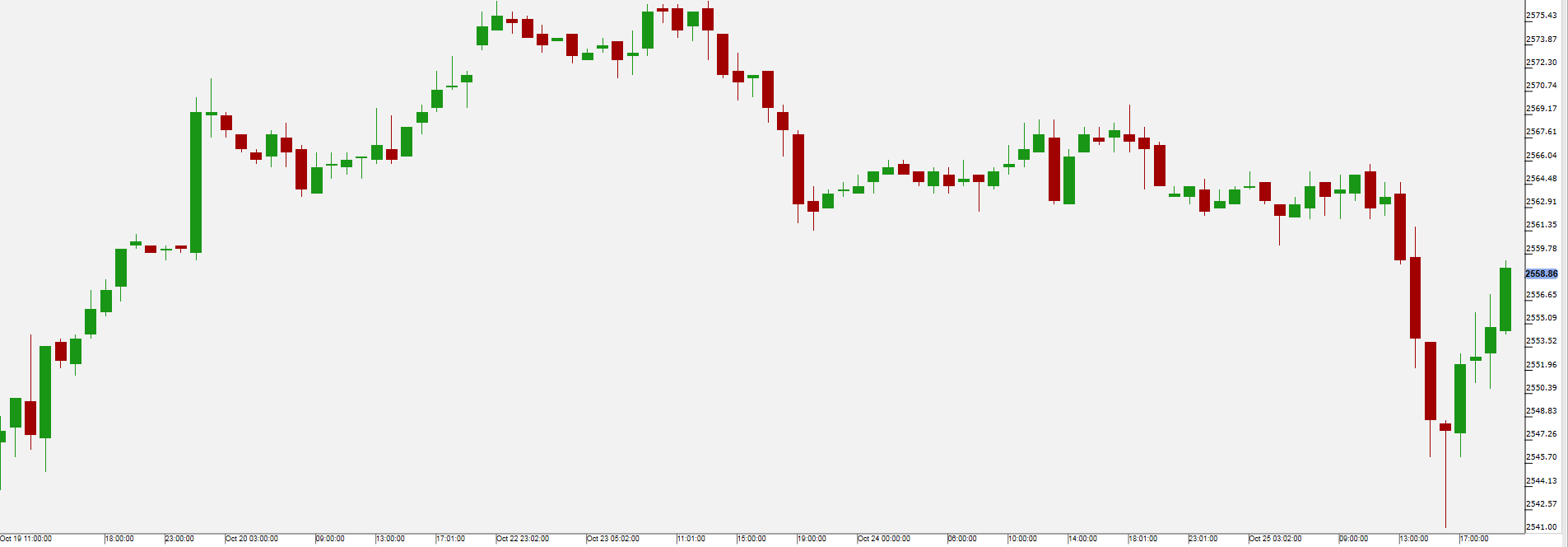

US 500

US equity indices closed across the board lower with the S&P 500 (US 500) closing 0.20% lower as some earning figures like from chip maker AMD disappointed the market and put it overall under pressure. The industry (US Industry ETF) and biotech (US Biotech ETF) sector were some of the most affected sectors of the day with both ETF closing 0.98% lower. Electric car maker Tesla (NASDAQ:TSLA) lost 3.27% as traders are looking forward to the Q3 earnings with some doubts while Mercedes went ahead of Tesla with the unveiling of its first electric Truck prototype, something Tesla announced to unveil very soon as well. Thursday jobless claims and home sales figures could be moving the general market sentiment.

Pivot: 2561.75

Support: 2547 2542 2539

Resistance: 2561.75 2570 2577

Scenario 1: short positions below 2561.75 with targets at 2547.00 & 2542.00 in extension.

Scenario 2: above 2561.75 look for further upside with 2570.00 & 2577.00 as targets.

Comment: the RSI is mixed to bearish