Lam Research Corporation (NASDAQ:LRCX) reported first-quarter fiscal 2018 non-GAAP earnings of $3.46 per share, surpassing the Zacks Consensus Estimate of $3.27. Earnings increased 11.3% sequentially and 91.2% year over year.

The stock increased 1.14% driven by better-than-expected first-quarter revenues and earnings figures.

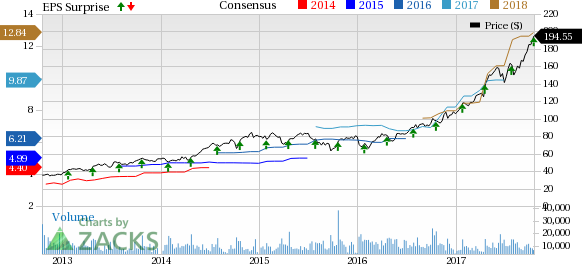

Also, on a year-to-date basis, the stock has outperformed the industry it belongs to. It has increased 82.7% compared with the industry’s gain of 63.9%.

Revenues

Revenues of $2.48 billion increased 5.7% sequentially and 31.7% year over year. Also, revenues came in above the Zacks Consensus Estimate of $2.46 billion.

Revenues by Geography

Region wise, Korea contributed 38%, Japan accounted for 20% and Taiwan and China generated 14% each of first-quarter revenues. The United States, Southeast Asia and Europe generated 6%, 5% and 3%, respectively.

Shipments

Total system shipments were $2.38 billion during the reported quarter, down 6.3% from $2.54 billion reported last quarter. However, shipments were above the Zacks Consensus Estimate of $2.35 billion.

Martin Anstice, president and chief executive officer of Lam Research, expects strong shipments growth in the calendar year of 2017.

Margins

Non-GAAP gross profit was $1.17 billion or 47.2% of revenues, reflecting an increase of 70 bps sequentially.

Total adjusted operating expenses were $438.1 million, reflecting an increase of 0.5% sequentially. Operating margin was 29.6%, increasing 190 bps from the prior quarter.

Net Income

GAAP net income was $590.7 million compared with $526.4 million in the last quarter and $263.8 million in the year-ago quarter.

Non-GAAP net income was $627.8 million compared with $565.5 million in the last quarter.

Balance Sheet

Exiting first-quarter fiscal 2018, cash and cash equivalents, short-term investments, and restricted cash and investment balances were $6.2 billion compared with $6.04 billion at the end of fourth-quarter fiscal 2017.

Cash flow from operating activities was $858.0 million against $729.2 million in the previous quarter. Capital expenditures amounted to $60.0 million. The company paid $73.0 million in cash dividends and spent approximately $155.0 million on share repurchases.

Guidance

Lam Research provided guidance for second-quarter fiscal 2018.

On a non-GAAP basis, the company expects revenues of approximately $2.55 billion (+/- $100 million). The Zacks Consensus Estimate is pegged at $2.50 billion. Shipments are projected to be roughly $2.60 billion (+/- $100 million). Gross margin is predicted at around 47.5% (+/-1%), while operating margin is likely to be about 30% (+/-1%).

Earnings per share are projected at $3.65 (+/- 12 cents) on a share count of nearly 182 million. The Zacks Consensus Estimate is pegged at $3.39 per share, which makes guidance better than expected. GAAP earnings per share are projected at $3.40 (+/- 12 cents).

Our Take

Lam Research delivered strong first-quarter fiscal 2018 results with both earnings and revenues outperforming estimates.

The company is doing well and continues to taste success in the areas of device architecture, process flow and advanced packaging technology inflections.

The company has been improving on the WFE market share significantly since 2013 and expects to make strong gains by the end of calendar year 2017.

Management said that strong demand for bit growth in server DRAM and NAND will continue to expand, driven by cloud computing and IoT, creating more opportunities for Lam Research in the near future. In fact, the company expects memory semiconductor segments to grow approximately 60% to about $130 billion in 2017 at strong levels of profitability.

Lam Research continues to see increased adoption rates of 3D NAND technology, FinFETs and multi-patterning. The company has taken cost-reduction activities and density scaling for 3D NAND and new memory technologies.

Moreover, the company anticipates continued strong demand for leading-edge silicon in the enterprise market courtesy of the long-term move to the cloud, storage and networking applications.

Stocks to Consider

Currently, Lam Research has a Zacks Rank #1 (Strong Buy). A few other better-ranked stocks in the broader technology sector are Applied Materials, Inc. (NASDAQ:AMAT) and NVIDIA Corporation (NASDAQ:NVDA) , both sporting a Zacks Rank #1 (Strong Buy), while ASML Holding (NASDAQ:ASML) , holding a Zacks Rank #2 (Buy). You can seethe complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings per share growth rate for Applied Materials, NVIDIA Corporation and ASML Holding N.V. is projected to be 17.1%, 10.3% and 21.4%, respectively.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

NVIDIA Corporation (NVDA): Free Stock Analysis Report

ASML Holding N.V. (ASML): Free Stock Analysis Report

Lam Research Corporation (LRCX): Free Stock Analysis Report

Applied Materials, Inc. (AMAT): Free Stock Analysis Report

Original post

Zacks Investment Research