- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fortune Brands Ups Dividend By 11%, To Buyback $250M Shares

Fortune Brands Home & Security, Inc. (NYSE:FBHS) announced that on Dec 8 its board of directors approved an 11% increase in the quarterly dividend rate and authorized a $250 million share buyback program.

Such disbursements reflect the company’s strong cash position and its commitment toward rewarding its shareholders handsomely.

In the last three months, Fortune Brands’ shares have yielded 5.2% return, outperforming 2.7% decline of the industry.

Details on the Twin Rewards

As revealed, the quarterly dividend rate was increased from 18 cents to 20 cents, marking the fifth consecutive year of double digit increase. The annualized rate now is 80 cents versus the earlier 72 cents per share. The company will pay the revised quarterly dividend on Mar 14, 2018 to shareholders on record as of Feb 23, 2018.

Also, Fortune Brands noted that the authorized $250 million common share buyback program is valid for the next two years. It can repurchase shares in the open market or through privately negotiated transactions. This program along with $300 million left of the earlier program — authorized in March and expires on Feb 28, 2019 — gives the company a chance of repurchase up to $550 million of its common shares.

Our Take

We believe that the rise in Fortune Brands’ profitability and a strong cash position will enable it to return higher value to its shareholders in the years ahead. Notably, the company’s net income jumped 10% year over year in the first nine months of 2017. Dividend paid during the period totaled $82.7 million. Net cash generated from operating activities in the period was $352.6 million while cash and cash equivalents exiting the period was $277.1 million.

In the last four years (2013-2016), the company’s annual dividend rate has increased from 42 cents to 66 cents per share.

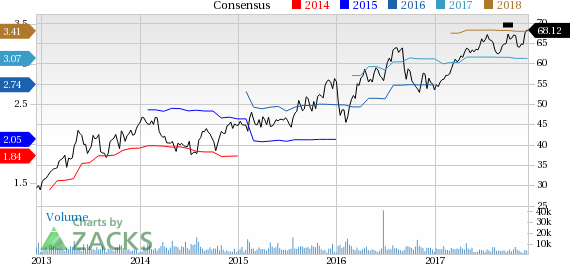

Over the last 30 days, the Zacks Consensus for the stock has been pegged at $3.07 for 2017 and $3.41 for 2018. These estimates reflect year-over-year growth of 11.7% for 2017 and 11.1% for 2018.

Fortune Brands Home & Security, Inc. Price and Consensus

Sun Hydraulics Corporation (SNHY): Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC): Free Stock Analysis Report

Fortune Brands Home & Security, Inc. (FBHS): Free Stock Analysis Report

Net 1 UEPS Technologies, Inc. (UEPS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.