The forex market has seen some movement. Any decent change in currency prices provides investors opportunity, something that has been in short supply over the past month. This week a plethora of economic data releases, coupled with a handful of Central Banks rhetoric is expected to make a meaningful impact. Over night in Australasia, it was the BoJ and the RBA who got the ball rolling. However, they have both been trumped by price data out of the UK and consumer sentiment in Germany so far in the euro session ahead of the stateside handover.

UK Inflation on the rise

UK inflation accelerated last month and house prices continued their upward march in May, sign that the economy continues to strengthen and that a change in interest rate policy by Governor Carney at the BoE is getting closer.

In June, UK's annual rate of inflation rose +1.9% from +1.5% in May, buoyed by the usual suspects (food drink cloths and seasonal airfares). The pick up in prices is certainly knocking at the BoE's +2% target. This is the seventh consecutive month that inflation has been at or near the Bank's target price. However, it's not inflation alone that's going to convince the "old Lady." UK policy makers want to see unemployment fall further and average wages beginning to rise before they ever consider any hike in rates. The futures market is pricing in a UK rate hike at the beginning of next year, however, persistent inflation rises will for the BoE's hand to act soon, maybe the end of this year. The Fed on the other hand is priced in to go in the mid of 2015.

Mind you, higher June inflation numbers may prove temporary, as inflation pressures elsewhere remain weak (wage growth remains subdued, and prices charged by factories only increased +0.2%, y/y in June, while raw material prices was down -4.4%, y/y). Rising prices only seem to be an issue in the UK housing market where prices rose +10.5%, y/y, dragged higher by London's record rise of +20.1%.

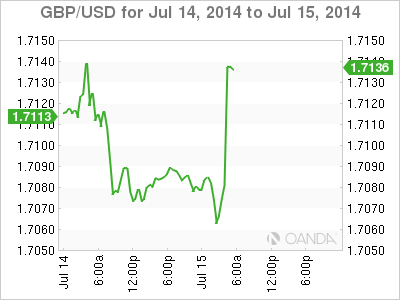

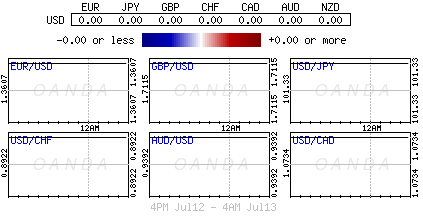

Obviously numbers like this favor the pound, at least until the whole story has been digested. GBP has managed to spike to £1.7145 from around £1.7075, having traded at a fresh monthly low of £1.7059 earlier in today's Euro session. GBP is also having an impact on the crosses with EUR/GBP dropping to £0.7935 after touching a two-week high earlier this morning (£0.7982). In money markets, September gilts managed to shed around 20-ticks on the price inflation headline and currently trades 12-ticks in the red at 1110.52 and the 10-year cash yields are at +2.62%. Any hint of Central Bank rate divergence brings forth more opportunities.

German sentiment disappoints

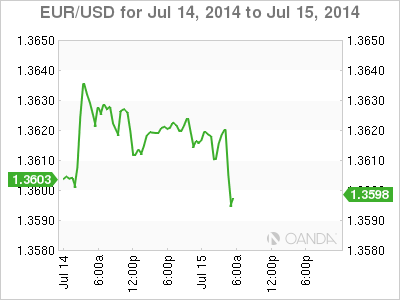

The EUR is being squeezed on the crosses; however, not helping its cause was this morning's disappointing German ZEW Economic sentiment print. It has come in weak, with the headline down to 27.1 from 29.8 while current conditions has plummeted to 61.8 from 67.7. This is another negative piece that can be thrown on the Euro pile and extends the string of softer core euro-zone data of late. Last Monday, the euro-zone IP numbers beat some expectations, however they were still down -1.1% on the month in May). This morning's weaker data has given Bunds a lift (also supported by weaker stocks being pushed by Portugal's BES drama) and is trying to push the EUR lower through the psychological €1.3600 level with some conviction. The single currency has managed to wipe out today's gains against the dollar, certainly impacted by the sharp selloff of EUR/GBP. The next line of significant support appears around €1.3570-75. One thing for sure, the ECB has to remain on its toes to continue its fight again potential 'deflation.'

No Surprises from the BoJ

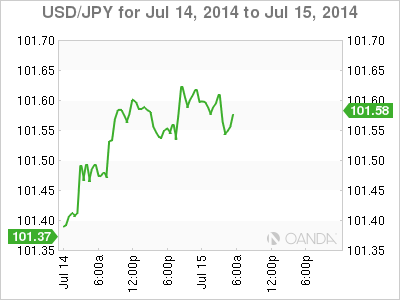

In the overnight session, the BoJ policy decision produced little reaction in Japan in either equities or the currency markets. As rumored, the BoJ cut its 2014/15 GPD forecast to +1.0% from +1.1% as part of its quarterly review of targets, but also maintained projections from 2015-17 for GDP as well as CPI. Japanese policy makers have also maintained their economic assessment for the 12th consecutive meeting, reiterating their views on all segments of the economy. Regarding forward outlook, the BoJ added the "effects of decline in demand following front-loaded increase prior to consumption tax hike are expected to wane gradually." Also of note, Japanese press speculated the Cabinet Office would boost its economic outlook in the upcoming monthly report for the first time since January. Overall, Japanese officials seem to feel little urgency to add to their aggressive stimulus measures. USD/JPY (¥101.58) continues to remain contained and influenced more by outside variables. The markets will now begin focusing on Federal Reserve Chairwoman Janet Yellen's testimony later today. She begins her semi-annual 2-day testimony on Capitol Hill. It's here that traders are hoping for more clues on when the Fed will begin raising interest rates.

RBA sticks to the same story

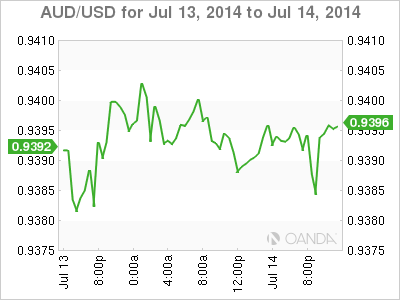

The RBA meeting minutes from July 1st were largely a reiteration of the statement, solidifying expectations of rates remaining unchanged (+2.5%) despite the "historically high" level of the exchange rate. RBA's Edwards says that higher Aussie yields are behind the AUD strength ($0.9363) and does not expect the AUD to fall until the Fed begins hiking rates. Immediately after the release of the statement, the AUD saw a brief and modest lift, with fixed income markets tipping back in favor of a rate hold over the 12-month period.

With comments like Edwards, the RBA is obviously getting more concerned with their own currency value. Perhaps the RBA needs to indicate a potential rate cut sooner rather than later. A low volatile and volume-trading environment promotes the "carry" trade and the AUD with its higher yields has been a currency in demand. Funded mostly by borrowing EUR's to purchase the AUD - this has certainly become a crowded trade and any suggestions to weak the Aussie should cause a huge cleanout on the left hand side. It's interesting to see lower commodity prices not having a larger negative impact on currencies like the AUD or CAD. The AUD in particular does not seem to have traced commodity price fall this years. Yesterday, gold happened to fall -2.3% while the AUD stood tall, mostly supported by the carry trade interest. A high domestic currency will only further pinch the earning's of Aussie exporters.

The market has now to look to Yellen for direction! Original post

Original post