With Jackson Hole anticipation keeping markets bottled up, traders are turning their attention to the currency crosses for some potential daytrading setups.

I’ll spare you the rehashed quotes from analysts that keep popping up all over my screen and get right into the charts. We’re traders after all!

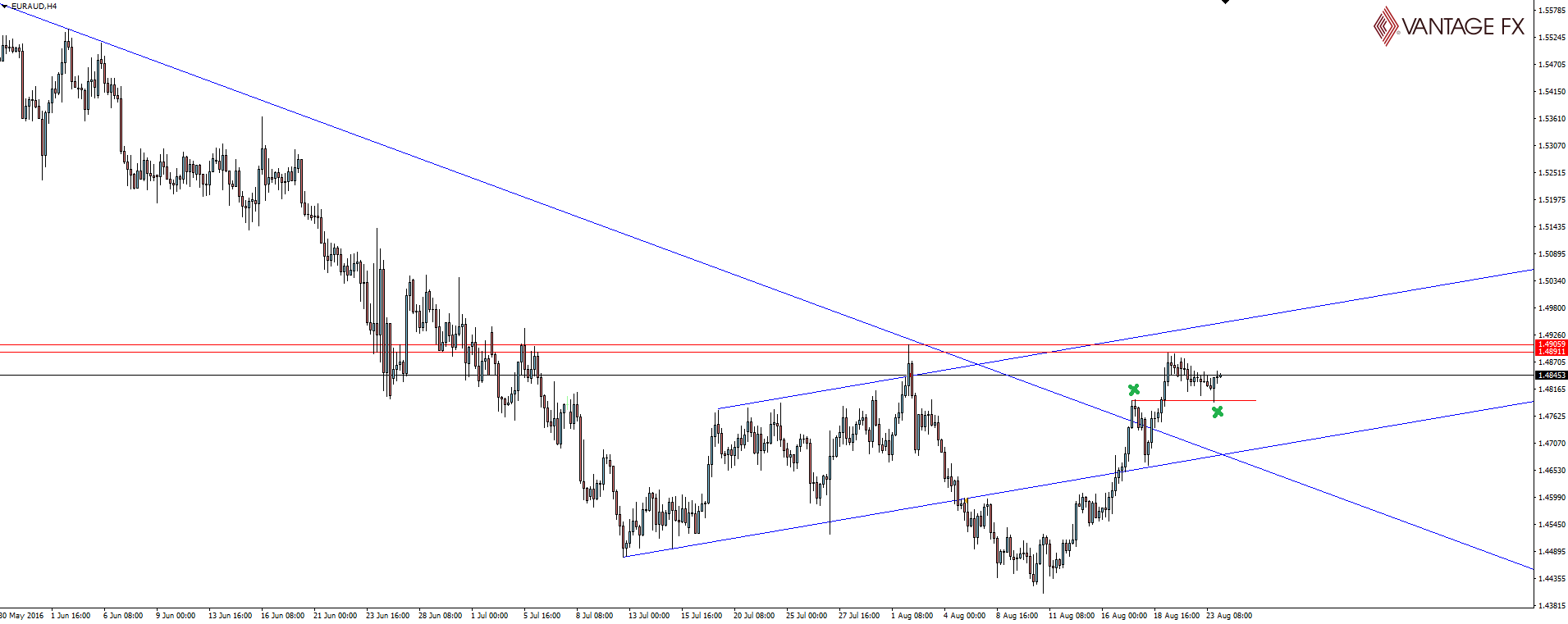

One chart that comes to mind, back when we were speaking about trading misplaced market expectations, was EUR/AUD. The currency cross was approaching a confluence of resistance in a higher time frame bearish trend, and we were looking for the RBA to put a rocket under the Aussie Dollar and cause the pair to sell off.

As we remember from following price action on the @VantageFX Twitter account, price spiked into resistance and with the RBA missing market expectations, we got a HUGE 500 pip selloff from top to bottom. Of course you didn’t get it all, but there was definitely a huge chunk of profit to be taken from that one.

Moving forward and you can now see that price has broken the major bearish trend line, re-tested the breakout and is now holding close to its highs.

We have marked (x) yesterday’s price action with a re-test of previous swing high resistance, this time as support. We’re 50 pips off the level now, but the opportunity is there to use it to manage risk around if you’re targeting new highs.

While we’re looking at the Euro currency crosses, there’s a similar setup in the midst of forming over on EUR/GBP.

EUR/GBP 4 Hourly:

The setup is actually a carbon copy!

Price has broken the major bearish trend line and is now re-testing the breakout. Whether that tells us that this is just a lagging setup, or shows inherent weakness is up to you as a trader to decide before entering.

Stay safe and keep your stops smart while trading short term setups. It will all start to get interesting come Friday!

On the Calendar Wednesday:

USD Crude Oil Inventories

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, forex news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently, any person acting on it does so entirely at their own risk. The expert writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.