UK data encouraging but leadership race remains a drag on GBP

It’s all gone a little quiet in the UK recently, well, compared to the Brexit noise we’ve become accustomed to.

The Conservative leadership race has put Brexit on hold for now, which is handy as the new end of October deadline creeps ever closer. The number of candidates remains at 10 but with a number of the front-runners Brexiteers, it’s no surprise that the pound remains out of favour.

OANDA fxTrade Advanced Charting Platform

Boris Johnson is probably seen as the greatest risk for the currency and while we keep getting told that the favourite never wins, it’s not providing much comfort at the moment.

We have no UK data out today but what we have had so far this week has been mixed which is pretty consistent really. April was a bad month for the economy but was primarily driven by one-off factors which suggests we’ll return to modest growth soon enough.

The labour market data was far more encouraging and may well give policymakers at the BoE a decision to make later this year is Brexit can be resolved in an orderly and undisruptive manner.

BoE Interest Rate Probability

Source – Thomson Reuters Eikon

We are seeing a small bounce in the pound at the minute but as long as Brexiteers – particularly those that aren’t against no-deal – remain in the race, the rallies may feel like swimming against the tide. Of course, this always depends on what it’s trading against but even against a soft dollar, the pound is making hard work of it.

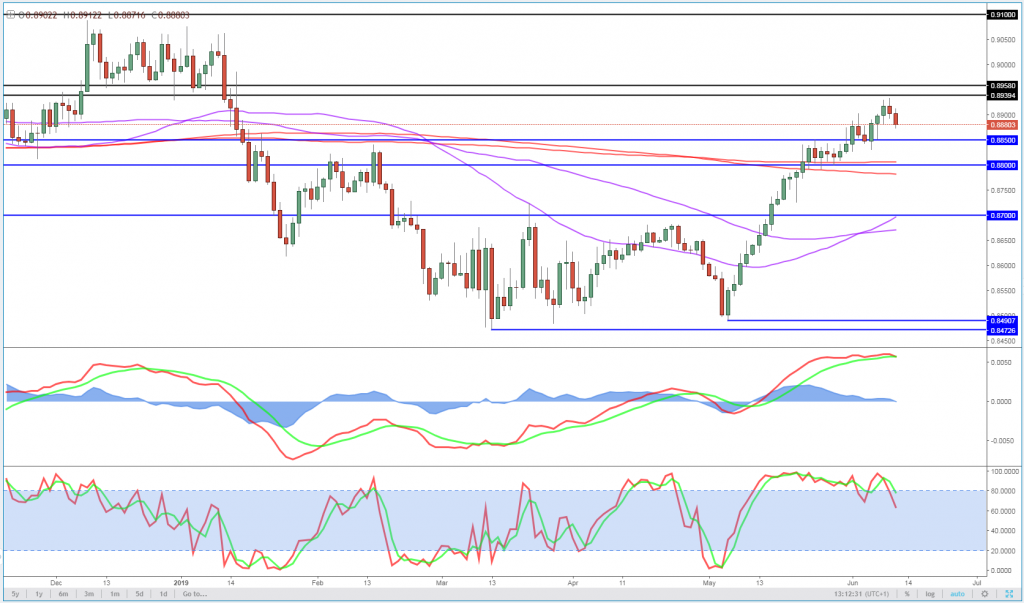

The next key level is 0.88, a break of which could be a near-term catalyst but for the reasons above, even this may be a slow decline. It’s also far from guaranteed that a break will happen. It could also find support around 0.8850 which has been an interesting level of support and resistance over the last few weeks and also coincides with the 55/89 simple moving average band which has tracked the pair higher. That said, the momentum indicators may tell us more if it does continue to drop and they currently look quite healthy.