- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fluor (FLR) Secures EPCM Contract From Vopak Terminal Durban

Fluor Corporation (NYSE:FLR) recently announced that it has clinched an engineering, procurement and construction management (“EPCM”) contract from Vopak Terminal Durban (Pty) Ltd to deliver the Vopak Growth 4 Project in Durban. The engineering and construction firm booked undisclosed value of the contract in fourth-quarter 2017.

One of Vopak’s largest storage facility projects in South Africa, this expansion project is pertinent to the Vopak’s program of facilitating enhanced demand for fuel with cleaner specifications in Southern Africa. Fluor will use its Zero Base Execution approach to develop fit-for-purpose integrated solutions in order to optimize the expansion of the facility.

Flour will leverage extensive networks to source material and equipment competitively, which would add value to the project. Further, the company will use local contractors as well as vendors to develop and sustain the local labor market as well as enterprises.

Our Take

Fluor has a solid track record of receiving awards, and management remains optimistic about continuation of this trend in future as well, which is expected to drive growth. Going forward, it anticipates an increase in front-end engineering awards. Moreover, the company remains optimistic about investment projects, particularly on LNG projects in North America, chemical facilities and pipeline projects in the United States, as well as refining and chemical projects in the Middle East and Asia.

The company’s healthy level of backlog in infrastructure, government, life sciences and advanced manufacturing has allowed it to offset multiyear decline in mining, metals and oil & gas markets. The long-term prospects of the company also remain strong with existing growth opportunities in renewable energy, gas-fired combined cycle generation and air emissions compliance projects for existing coal-fired power plants.

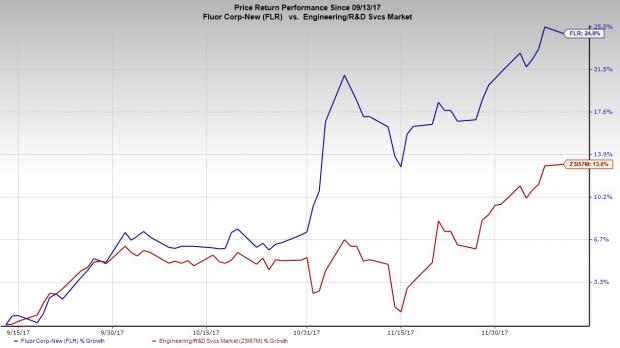

Notably, the Zacks Rank #3 (Hold) company has returned 24.9% in the past three months, outperforming the industry’s growth of 12.9%.

However the fact remains that, currently, the company is facing a dearth of engineering and new awards which has hurt its growth prospects significantly. Presently, the company’s margins are under pressure as it is transitioning from higher margin engineering to lower margin construction activities, particularly related to Energy & Chemicals & Mining segment.

Volatility in commodity prices, and the cyclical nature of its commodity-based business lines, poses significant challenges for the company in the upcoming quarters. This apart, sluggish economic growth worldwide and softness in key geographic regions also pose challenges. These conditions are hurting the company’s non-oil and gas end markets as well.

Stocks to Consider

Some better-ranked stocks from the same space include EMCOR Group, Inc. (NYSE:EME) , D.R. Horton, Inc. (NYSE:DHI) and Willdan Group, Inc. (NASDAQ:WLDN) . While EMCOR Group sports a Zacks Rank #1 (Strong Buy), D.R. Horton and Willdan Group carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

EMCOR Group has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 17.0%.

D.R. Horton has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 5.0%.

Willdan Group has outpaced estimates in the preceding four quarters, with an average earnings surprise of 44.8%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

EMCOR Group, Inc. (EME): Free Stock Analysis Report

D.R. Horton, Inc. (DHI): Free Stock Analysis Report

Fluor Corporation (FLR): Free Stock Analysis Report

Willdan Group, Inc. (WLDN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.