- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Fitbit (FIT) Aids Keller Williams To Expand Wellness Program

Fitbit, Inc. (NYSE:FIT) recently announced a partnership with Keller Williams, which will help the latter to improve its health culture and employee wellness program.

Under the agreement, Fitbit will offer wearable devices at special prices and organize activity challenges at both national and local levels for more than 157,000 agents of Keller Williams across the United States.

Collaborating with Keller Williams will not only make its associates Fitbit’s prospective customers but also expand the latter’s brand awareness. Notably, Keller Williams’ agents can also provide Fitbit devices at special prices as appreciation gifts to new home buyers and sellers at closing.

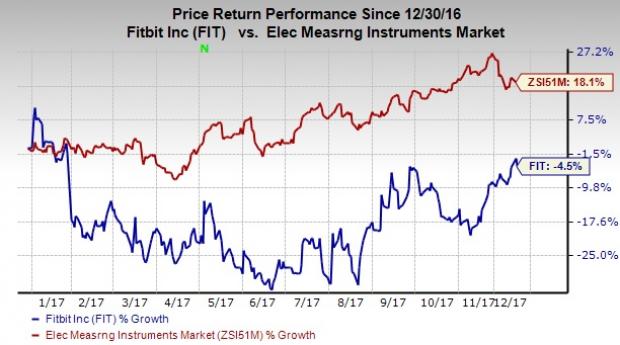

Shares of Fitbit have declined 4.5% year to date, underperforming the 18.1% rally of the industry it belongs to.

Corporate Wellness Holds the Key

Fitbit is expanding its enterprise business by selling fitness trackers and software subscriptions to employers as part of their corporate wellness programs. The company has already partnered with several enterprises and healthcare companies. It has over 1,300 enterprise customers and 70 of them are Fortune 500 companies.

The addition of Fitbit devices to the wellness programs of enterprises is expanding its footprint and improving brand awareness in the wearables market. These integrations are enabling the company to not only reach its partner’s employees but also to a much larger population.

This is expanding its customer base that bodes well for top-line growth.

Our Take

Fitbit’s prospects look bright since the company is focused on developing new features and services, increasing brand awareness and expanding its global distribution & presence in the corporate wellness market.

Per IDC, the market for wearable devices is expected to increase to 240.1 million units by 2021, at a compound annual growth rate (CAGR) of 18.2%. The watch category is expected to contribute 67% to total wearables shipment by 2021, which is presently contributing 56.9%. This bodes well for the company.

Moreover, Fitbit has been working with leading medical institutions, helping researchers overcome major challenges and engage patients in better ways. It also became HIPAA compliant in 2015, which increased the company’s credibility. Fitbit provides its corporate wellness program to HIPAA-covered entities like self-insured businesses, which boosts its growth prospects.

Zacks Rank & Stocks to Consider

Fitbit has a Zacks Rank #3 (Hold).

Orbotech Ltd. (NASDAQ:ORBK) , Aehr Test Systems (NASDAQ:AEHR) and Keysight Technologies Inc. (NYSE:KEYS) are some of the better-ranked stocks in the same industry. Orbotech, Aehr Test Systems and Keysight carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Orbotech, Aehr Test Systems and Keysight is projected to be 18.8%, 20% and 8.2%, respectively.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research. It's not the one you think.

See This Ticker Free >>

Orbotech Ltd. (ORBK): Free Stock Analysis Report

Keysight Technologies Inc. (KEYS): Free Stock Analysis Report

Fitbit, Inc. (FIT): Free Stock Analysis Report

Aehr Test Systems (AEHR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.