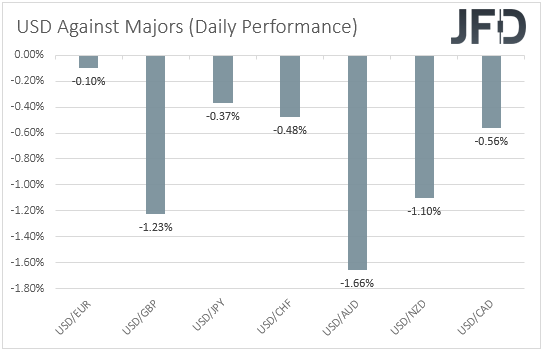

The US dollar traded lower against all the other major currencies on Wednesday and during the Asian session Thursday, with the second loser in line being the euro. The euro slid after ECB President Lagarde tempered expectations about the ECB helping indebted nations. At the same time, the dollar fell even after the Fed hiked by 75bps and matched market expectations about the upcoming rate path.

Today, the central bank torch will be passed to the BoE, which we expect to hike by 25bps and sound again concerned over a possible recession.

USD Pulls Back Despite Hawkish Fed, BoE Expected to hike by 25bps

The US dollar was found lower against all the other major currencies during the early European morning Thursday. It lost the most ground versus AUD, GBP, and NZD, while it underperformed the least against EUR.

The weakening of the US dollar, combined with the strengthening of the risk-linked Aussie and Kiwi, suggests that the financial world may have turned to risk-on trading yesterday and today in Asia.

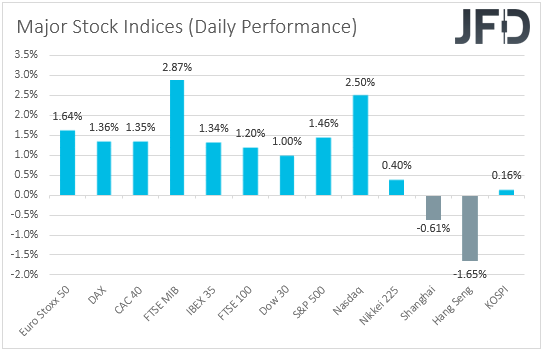

Turning our gaze to the equity world, we see that major EU and US indices traded in the green, with appetite turning more mixed today during the Asian session.

European shares may have benefited from the ECB’s decision to hold an ad-hoc gathering to discuss market conditions. This was interpreted as positive as at its prior gathering. The bank failed to clearly communicate how they will deal with “fragmentation” risks when they start raising interest rates.

Reversing course around a week later, the bank said it would direct cash to more indebted nations from debt maturing and work on a new instrument to prevent an excessive divergence in borrowing costs.

That’s why we saw the euro recovering ground and European equities rebounding. However, the common currency gave back those gains very soon, as ECB President Lagarde said that the ECB’s job is taming inflation and not helping budgets.

Later in the day, the spotlight turned to the FOMC decision. In line with the market pricing in the aftermath of Friday’s data revealing accelerating inflation, the Committee raised interest rates by 75bps, taking them to the 1.50 – 1.75% range.

The new dot plot was also very close to the path priced in by the financial community. The median dot for 2022 was at 3.4%, up from 1.9%, which implies another 175bps by the end of the year. In other words, the market has been pricing in another triple hike in July and two more doubles after that. For 2023, the median dot was up to 3.8% from 2.8%, suggesting another 40 bps during the year, while in 2024, officials saw the rate at 3.4%, down 40bps.

Initially, the US dollar strengthened on such a hawkish outcome, but it came under selling interest during Chair Powell’s press conference. The Chief said that they delivered a triple hike due to the upside surprise in inflation, but he added that at the next meeting, they might hike either by 50 or 75 bps, depending on incoming data. In our view, this means that a 75bps liftoff is not a deal as the market pricing has been suggesting, and maybe that’s why we saw the US dollar trading south and finishing lower against every other major currency.

However, our view remains the same as ahead of the meeting. We will treat the setback as a corrective move. After all, with such a decision, the Fed remains at the top of the list of the most hawkish major central banks. Thus, we see the case for the greenback to reclaim that lost ground soon, and against some currencies, maybe even today. One of those currencies may be the British pound, for which we see decent chances for another round of selling in the aftermath of today’s BoE decision.

So, speaking about the pound and the BoE, let’s fly to the UK, where expectations are for a quarter-point liftoff. There is some speculation for a 50bps hike, but we see that case as somewhat unlikely. The reason is that since the prior gathering, preliminary GDP data for Q1 revealed a slowdown, and according to the PMIs, the weakness continued in Q2 as well, at a time when inflation remained elevated at +9.0% YoY.

Indeed, on Monday, monthly data revealed a contraction during April. In our view, this adds credence to officials’ concerns over a recession, and although they may continue lifting rates due to very high inflation, their path may be slower than other major central banks, like the Fed and the BoC. Thus, we believe that officials will hike by only 25bps today and repeat their recession warnings, which may weigh on the British pound.

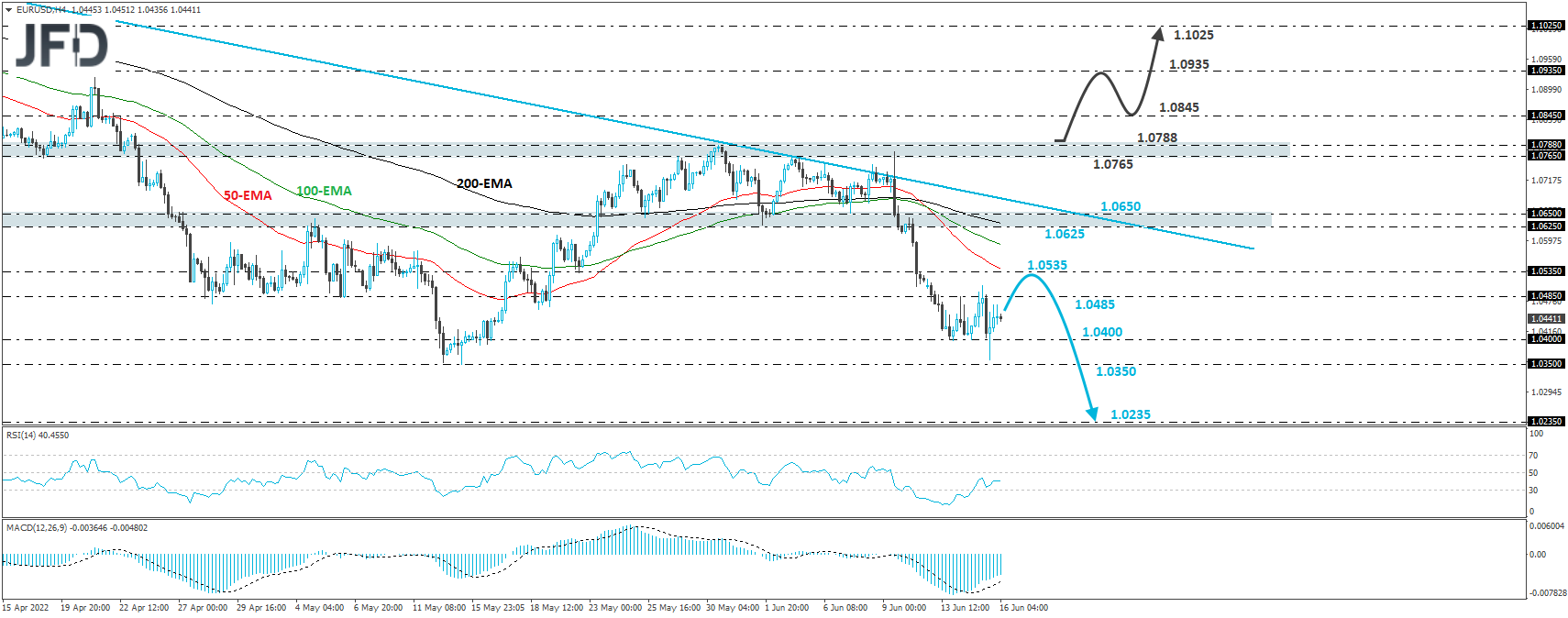

EUR/USD – Technical Outlook

EUR/USD traded lower yesterday after hitting resistance slightly above the 1.0485 barrier. However, the slide was stopped slightly above the 1.0350 zone, marked by the lows of May 12th and 13th. The pair rebounded again. EUR/USD remains well below the downside resistance line drawn from the high of Feb. 10 and below the key resistance zone of 1.0625/50. In our view, this keeps the near-term outlook negative.

Even if the rebound continues for a while, we could see the bears retaking charge from near the 1.0535 barrier, marked by the inside swing low of May 20. This could result in another slide and another test at 1.0350, the break of which will take the pair into territories last tested in 2002, with the next possible support zone being at around 1.0235, marked by the inside swing high of Jul. 14, 2002.

Now, to examine the bullish case, we would like to see a break above the 1.0765/88 zone, which acted as the ceiling of the range the pair traded within from May 23 until Jun. 9. This could also signal the valid break above the aforementioned downside resistance line.

The next stop may be at 1.0845, the break of which could encourage advances towards the high of Apr. 21, at 1.0935. Another break above 1.0935 could carry extensions towards the inside swing low of Apr. 1, at around 1.1025.

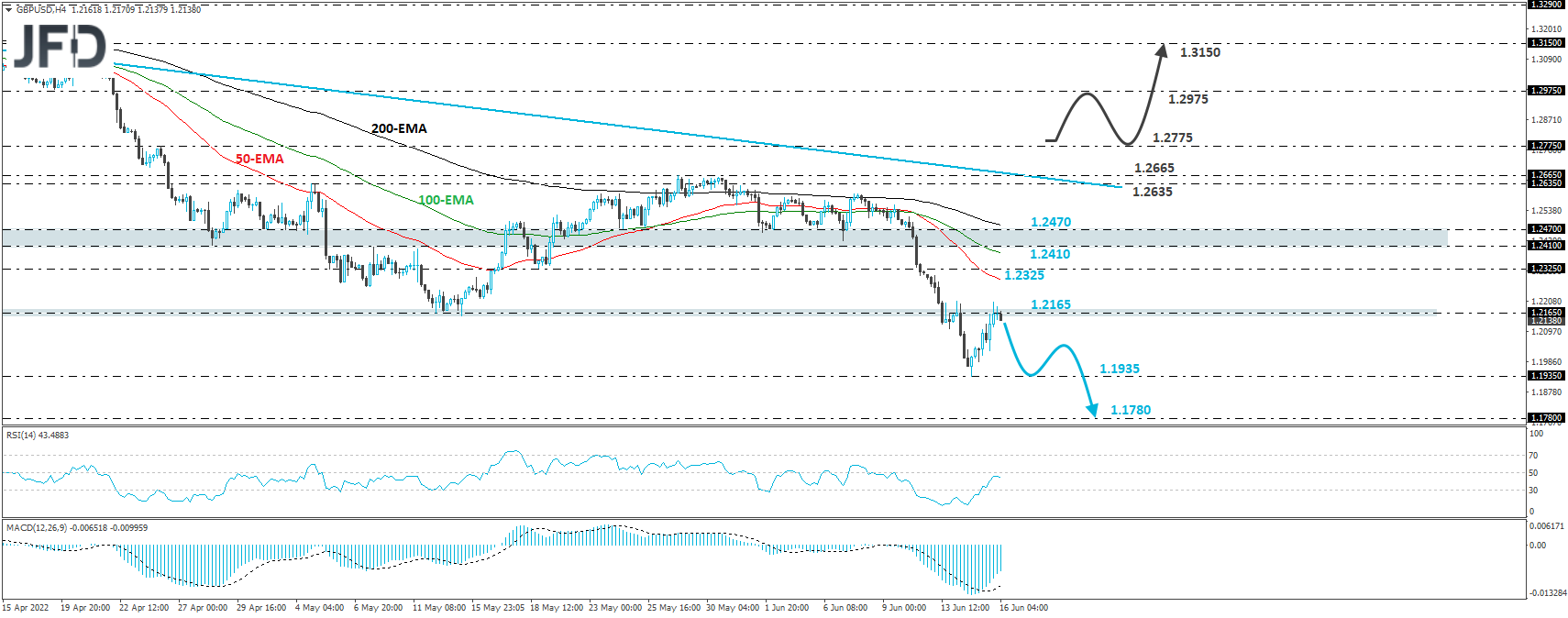

GBP/USD – Technical Outlook

GBP/USD traded higher on Tuesday and Wednesday after hitting support at 1.1935. However, the recovery was stopped slightly above the key resistance zone of 1.2165, which stopped the rate from drifting lower on May 12th and 13th. The cable remains well below the downside resistance line taken from the high of Mar. 23; thus, we expect the bears to recharge from there soon.

If so, we could see them aiming for another test at Tuesday’s low of 1.1935, a break of which could extend the fall towards the inside swing high of Mar. 25, 2020, at around 1.1980. On the upside, we would like to see a clear break above 1.2775 before we start examining whether the bulls have stolen all the bears’ swords.

The rate will be well above the downside line taken from the high of Mar. 23, and we may experience extensions towards the 1.2975 zone, which provided strong support between April 8th and 19th. Another break, above 1.2975, could carry extensions towards the peak of Apr. 14, at around 1.3150.