- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Falling Earnings Estimates Signal Weakness Ahead For Francesca's (FRAN)

Similar to wise buying decisions, exiting certain underperformers at the right time helps maximize portfolio returns. Selling off losers can be difficult, but if both the share price and estimates are falling, it could be time to get rid of the security before more losses hit your portfolio.

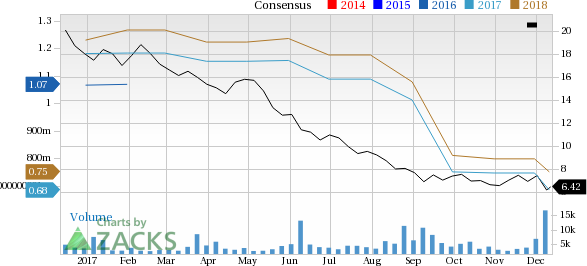

One such stock that you may want to consider dropping is Francesca's Holdings Corporation (NASDAQ:FRAN) , which has witnessed a significant price decline in the past four weeks, and it has seen negative earnings estimate revisions for the current quarter and the current year. A Zacks Rank #4 (Sell) further confirms weakness in FRAN.

A key reason for this move has been the negative trend in earnings estimate revisions. For the full year, we have seen five estimates moving down in the past 30 days, compared with no upward revisions. This trend has caused the consensus estimate to trend lower, going from 75 cents a share a month ago to its current level of 68 cents.

Also, for the current quarter, Francesca's has seen four downward estimate revisions versus no revisions in the opposite direction, dragging the consensus estimate down to 36 cents a share from 40 cents over the past 30 days.

The stock also has seen some pretty dismal trading lately, as the share price has dropped 9.4% in the past month.

So it may not be a good decision to keep this stock in your portfolio anymore, at least if you don’t have a long time horizon to wait.

If you are still interested in the Shoes and Retail Apparel industry, you may instead consider a better-ranked stock - Deckers Outdoor Corporation (NYSE:DECK) . The stock currently holds a Zacks Rank #1 (Strong Buy) and may be a better selection at this time. You can see the complete list of today’s Zacks #1 Rank stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Deckers Outdoor Corporation (DECK): Free Stock Analysis Report

Francesca's Holdings Corporation (FRAN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.