- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

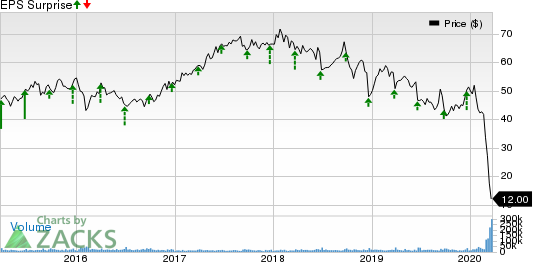

Factors Setting The Tone For Carnival's (CCL) Q1 Earnings

Factors at Play

Soft Passenger Tickets revenues amid the coronavirus outbreak might have negatively impacted the company’s performance in the first quarter. The Zacks Consensus Estimate for the segment’s revenues is pegged at $3,163 million, implying a 1.1% dip from the year-ago reported figure. Moreover, due to the coronavirus outbreak, increased cancellations are likely to affect results.

Sony Corporation (SNE): Free Stock Analysis Report

Carnival Corporation (CCL): Free Stock Analysis Report

General Mills, Inc. (GIS): Free Stock Analysis Report

CarMax, Inc. (KMX): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Here’s where I see stocks now: Yes, we’ve got some legitimate concerns as some economic warning signs appear—and run up against the tech-driven optimism that’s powered stocks to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.