- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Shock Rattle And Roll

Loose lips sink ships and overnight comments in the Financial Times cited Peter Navarro, director of Trump’s new National Trade Council and senior trade adviser, saying that Germany is using a “grossly undervalued” euro to exploit the U.S. and its EU partners. His comments sent the greenback into a tailspin. It appears that no one is safe, friend or foe from the wrath of this new U.S. administration when it comes to trade.

Moreover, while I have been in utter shock about the new U.S. government’s attitudes towards global commerce, it is hard to argue that Germany has not benefited from the fixed exchange rate that the Euro secures between itself and its prime European markets. The fact is the Euro as a whole, is a much weaker currency than the standalone Deutsche Mark would be and is making German exports notably cheaper. While such comments are usually left unsaid, it is quickly becoming clear that partnership is not President Trump’s primary objective on foreign policy.

What was initially viewed as a few stray comments from Peter Navarro quickly cascaded into a dollar rout when the news wires lit up after President Trump stated,

Our country has been run so badly, we know nothing about devaluation

He then went on to single out Japan and China again. The market viewed this as a classic case of verbal intervention sending newly minted long dollar positions into full unfurl mode. Whether this is nothing more than grandstanding to establish a position of strength before entering contentious trade negotiations, who knows? We are entering uncharted territory on the trade front.

Indeed, the mighty greenback has entered February like a lamb and only time will tell if it goes out like a lion. However, one thing is sure; we should expect markets to get whipsawed again and again. Welcome to the Brave New Market of the political headline.

The market awaits Trump’s Supreme Court pick.

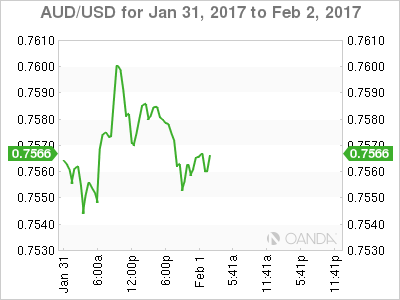

Australian Dollar

The Aussie remains mired in the .75-76 range despite the heavy U.S. dollar sell-off overnight, which looks set to resume in early APAC trade. President Trump’s verbal intervention directed at the USD has had muted impact on the Aussie as investors are now viewing commodity price action as a flimsy excuse to chase the topside. Also with little clarity offered on the U.S. Fiscal front, the Aussie bulls are content to sit idle. Commodity bloc traders are concerned that much of the speculative run on prices came on the back of Trumpenomics, which at this stage is looking like a circumspect proposition.

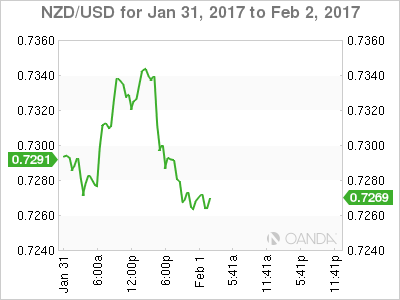

New Zealand Dollar

The NZD wobbled and fell under immediate pressure as the unemployment rate came in above expectations, which will have future implication on the wage component of the CPI down the road. After the kiwi surged last week on the stronger Dec CPI print, raising expectations for a possible RBNZ rate hike, today's bad miss on the unemployment front brings huge doubt in the market’s current RBNZ interest rate lean. The plot thickens in the Antipodeans

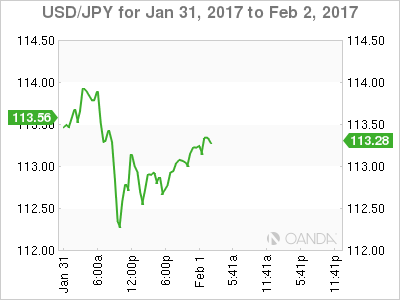

Japanese Yen

Bank of Japan’s policy meeting offered little substance and had little influence on currency markets, but the JPY is so caught up in the verbal intervention, and risk aversion from President Trump’s recent executive orders, which have undercut the USD and effectively destabilized global markets.

Market sentiment is horrible and would have to believe the USD/JPY is extremely vulnerable to more headline-driven bouts of risk off. Not even sure a hawkish FOMC can turn the tide during this period of extreme dollar negativity.

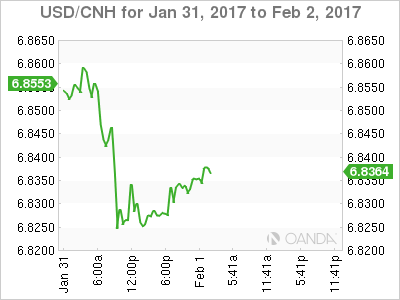

Chinese Yuan

JPY and CNH are having a parallel conversation with the USD after President Trump singled out China and Japan in his recent trade tantrum. We are entering the “Twilight Zone” so discard market fundamentals and the usual asset class correlations for a top notch news reader, as Trump headlines will continue to take center stage for the foreseeable future.

As an aside

Back in 2007, the former president of France, Nicolas Sarkozy, ramped up the political rhetoric on a visit to Washington DC because he was equally alarmed about the U.S. dollar weakness, which at that time, boosted America’s trade competitiveness over Europe. While these battles have raged behind closed doors for ages, the market is just not used to U.S. Presidents airing their dirty laundry in public. Needless to say, we should.

Related Articles

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

EUR/USD remains resilient after dipping below 1.05, hinting at a potential breakout. Weak US data and stagflation fears fuel Fed rate cut bets, pressuring the dollar. A break...

Forex Strategy is Bullish: We are currently @ 1.2660 in a channel. Nice bounce here and if GBP/USD continues, we are looking for a continuation to the ATR target @ 1.2725 area,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.