PPG Industries, Inc. (NYSE:PPG) has a diversified business and a leading position in several paints and coatings end markets. The company has taken steps to grow its business organically as well as reduce costs. However, PPG Industries faces a number of headwinds, including a still sluggish global economy.

Let’s have a quick look at this Pittsburgh-based coatings giant’s third-quarter 2017 release.

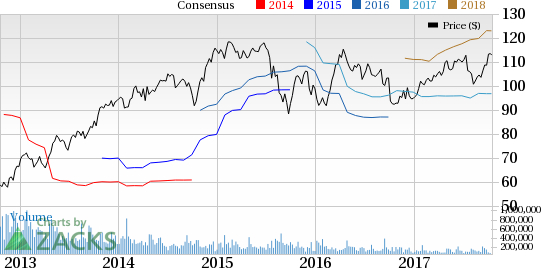

Estimate Trend & Surprise History

Investors should note that the earnings estimate for PPG Industries for the third quarter has been going down over the last month. PPG Industries has beaten the Zacks Consensus Estimate in three of the trailing four quarters with an average beat of 1.09%.

Earnings

PPG Industries’ earnings from continuing operations were $1.52 per share for the quarter, compared with a net loss from continuing operations of 79 cents per share a year ago. It was in line with the Zacks Consensus Estimate.

Revenues

PPG Industries posted third-quarter revenues of $3,776 million, up 3.2% year over year. It surpassed the Zacks Consensus Estimate of $3,748 million. Favorable currency swings improved net sales by around 2%.

Key Stats/Developments to Note

PPG Industries expects continued moderate global economic growth. Post the mayhem caused by the recent natural disasters, the company doesn’t anticipate any further decline in the level of raw material cost inflation for the balance of this year. Along with addressing the inflationary environment, it remains on tracks with its restructuring program that is expected to deliver full-year savings of more than $45 million.

PPG Industries expects the recent natural disasters to unfavorably impact the fourth quarter earnings by up to 5 cents per share.

PPG Industries, Inc. Price, Consensus and EPS Surprise

PPG Industries, Inc. (PPG): Free Stock Analysis Report

Original post