The Australian dollar has posted considerable gains on Monday. AUD/USD is trading in the mid-0.75 range in the North American session. On the release front, Australian Building Approvals posted a sharp drop of 5.2%. The ANZ Job Advertisements report posted a gain of 0.5%. There are no US releases on Monday, with US markets closed for the Fourth of July holiday. Later in the day, Australia will release Retail Sales and Trade Balance. If these releases are not within expectations, we can expect some volatility from AUD/USD. On Tuesday, the RBC will set its benchmark rate, which is expected to remain unchanged at 1.75%.

With the financial markets understandably focused on the stunning Brexit vote, the Federal Reserve’s monetary policy has shifted to the back-burner. That could change later this week, with the release of the Federal Reserve minutes. Will the minutes provide any clues about a rate hike? Yellen and her colleagues have sounded cautious about the US economy, and the financial instability caused by Brexit could delay any hikes until 2017. Gone are the heady days of last December, when the Fed raised rates and talked about a series of rate hikes in 2016. Meanwhile, June has come and gone, and the Fed hasn’t made a move so far this year. Bottom line? Traders shouldn’t count on an imminent rate hike to boost the US dollar; rather, the direction of the currency will largely be data-dependent – the Fed is unlikely to seriously consider any rate hikes unless we see significantly improved employment and inflation numbers.

The Brexit vote to leave the European Union continues to cause deep instability in Europe and the UK and wiped out a staggering $3 trillion from global stock markets. Although the financial markets have stabilized, the British pound has shed about 11 percent since the vote, and continued to drop last week. British politicians have sought to calm the public and the markets, but the pound’s sharp drop last week underscores that the situation is anything but normal. The country’s political picture is fluid, as the Conservatives are choosing a new leader, the Labor Party is in turmoil and elections may not be far away. On the financial front, the pound and the markets have taken a beating and London’s position as a world financial center has been shaken. Last week, the normally even-keel BoE Governor Mark Carney was surprisingly blunt, stating that the BoE planned to lower interest rates during the summer.

The UK may have voted “Out”, but there is no timetable as to when the exit will take place or what type of trade agreement will define the new economic relationship between the EU and Britain. British leaders are in no rush to leave, but European leaders have called on Britain to exit as soon as possible in order to minimize the uncertainty and instability caused by the Brexit vote. When it comes to the EU, Britain finds itself in limbo (“neither in nor out”), and such uncertainty could weigh on the currency markets until some decisions are reached regarding Britain’s exit from the EU.

Sunday (July 3)

- 21:00 Australian MI Inflation Gauge. Actual 0.6%

- 21:30 Australian Building Approvals. Estimate -3.6%. Actual -5.2%

- 21:30 Australian ANZ Job Advertisements. Actual 0.5%

Monday (June 4)

- 21:30 Australian AIG Services Index

- 21:30 Australian Retail Sales. Estimate 0.3%

- 21:30 Australian Trade Balance. Estimate -1.72B

Upcoming Key Events

Tuesday (July 5)

- 00:30 Australian Cash Rate. Estimate 1.75%

- 00:30 RBA Rate Statement

*Key releases are highlighted in bold

*All release times are EDT

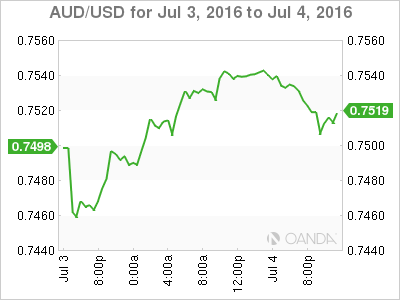

AUD/USD for Monday, July 4, 2016

AUD/USD July 4 at 12:0 EDT

Open: 0.7462 Low: 0.7461 High: 0.7544 Close: 0.7538

AUD/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 0.7251 | 0.7339 | 0.7472 | 0.7612 | 0.7739 | 0.7835 |

- AUD/USD posted slight losses in the Asian session and has rose slightly in European session. The pair is steady in the North American session.

- 0.7472 has switched to a support role following strong gains by AUD/USD

- There is resistance at 0.7612

- Current range: 0.7472 to 0.7612

Further levels in both directions:

- Below: 0.7472, 0.7339, 0.7251 and 0.7160

- Above: 0.7612, 0.7739 and 0.7835

OANDA’s Open Positions Ratio

AUD/USD ratio is showing gains in short positions on Monday. This is consistent with strong gains by AUD/USD which resulted in the covering of long positions. Long positions have a small majority (52%), indicative of slight trader bias towards AUD/USD continuing to climb higher.