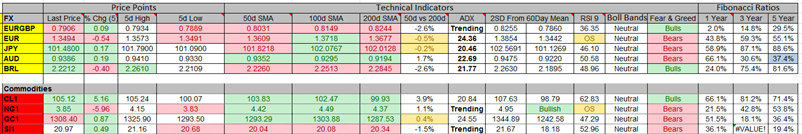

Currencies

- EUR/USD: The pair has broken its support zone of 1.3497-1.3432 on a 60 minute time frame and this shows a weakness for the price. The next support is at 1.3419 and the next resistance is at 1.3695.

- USD/JPY: The pair has formed a symmetrical triangle pattern on a 60 minute time frame. The next support is at 100.99 and resistance at 102.84

- GBP/USD: The pair is trading below the downward trend line on a 60 minute time frame. The resistance is near the 1.7183 and the support is at 1.7018.

Indicators

Indices

- Asian Markets closed higher by confirming more gains for the Asian indices on top of yesterday. The Hang Seng was the best performing index during the session and it closed higher with a gain of 0.80%. The index is up nearly by 2.18% in the past 5 days.

- European stock markets are trading higher during the early hours of trading. The DAX index is the best performing index during the session and it is trading higher with a gain of 0.51%. The index is up by almost 0.64% in the past 5 days.

- US Indices futures are trading higher ahead of the crude inventory data. Most indices closed higher yesterday and the NASDAQ index was the best performer with a gain of 0.98%.

TOP News

- The Australian CPI data came in at 0.5%, while the previous reading was at 0.6% which shows that the weakness.

- The MPC asset purchase facility votes remain the same with the final number of 0-0-9.

- The UK’s BBA mortgage approvals came in at 43.3K which matched the forecast, but it was higher than the previous reading of 41.9K

Things to Remember

- Stops are your biggest friends so make sure use them.

Market Sentiment

- Gold: The precious metal is consolidating near the support of 1300. The next support is near the 1260 level and the resistance is at 1340

- Crude Oil: The black gold is trading below the 50day but above the100 day moving average on a 30 minute time frame. The next resistance is at 106 and the support is at 100.50

- VIX: Volatility index gained nearly 622% yesterday.

News Agenda For Today

08:30 GMT

GBP - MPC Asset Purchase Facility Votes

GBP – MPC Official Bank Rate Votes

11:45 GMT

GBP – BOE Gov Carney Speaks

12:30 GMT

CAD - Core Retail Sales m/m

21:00 GMT

NZD – Official Cash Rate

NZD - RBNZ Rate Statement

22:45 GMT

NZD - Trade Balance

Trend

The AUD and CHF are trending up against the USD, while the EUR and CAD are trading lower against the USD on an intra-day basis.

Disclaimer: The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.