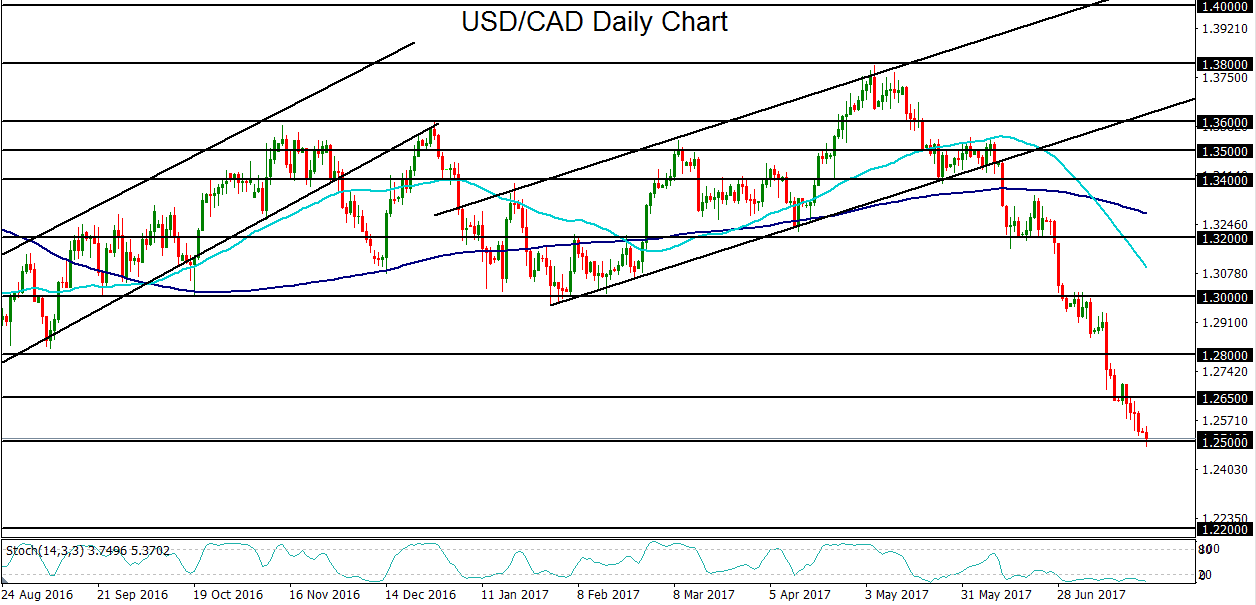

The dramatic USD/CAD plunge since the early-May highs near 1.3800 has been one of the major currency stories within the past few months. As of Monday, the latest culmination of this plunge has been the establishment of a new 14-month low around the key 1.2500 psychological support target. So far, the USD/CAD exchange rate has fallen by more than 9% in only around two-and-a-half months, representing an exceptionally significant currency price move.

This strong move has been driven mostly by opposite shifts in relevant central bank stances. The Bank of Canada recently made a sudden shift towards policy tightening, launching the process less than two weeks ago with its first rate hike since 2010. Meanwhile, the US Federal Reserve has been subtly shifting in the opposite direction within its own rate hike cycle, now talking down the prospect of regular rate increases going forward.

A result of these opposing shifts has been a dramatic strengthening of the Canadian dollar combined with a simultaneous weakening of the US dollar, prompting the recent USD/CAD plummet. This drop accelerated in mid-June, when the pair broke down below a key uptrend channel. This was followed by a subsequent breakdown below both 1.3200 support and the key 1.3000 psychological level in late June. In mid-July, USD/CAD went on to break down below 1.2800 support when the Bank of Canada raised its overnight rate, as mentioned. Most recently, last week saw the currency pair break below the 1.2650 support area before further extending its plunge to its current position around the noted 1.2500 psychological support target.

This week, key events likely to affect USD/CAD include Wednesday’s FOMC policy decision, as well as major GDP releases from both Canada and the US on Friday. Perhaps the most critical takeaway for USD/CAD from this week’s events will be the market’s perception of the Fed’s policy stance on Wednesday. An interpretation of sustained Fed dovishness could exacerbate pressure on USD/CAD, potentially pushing the currency pair towards its next major downside target around the 1.2200 support level.