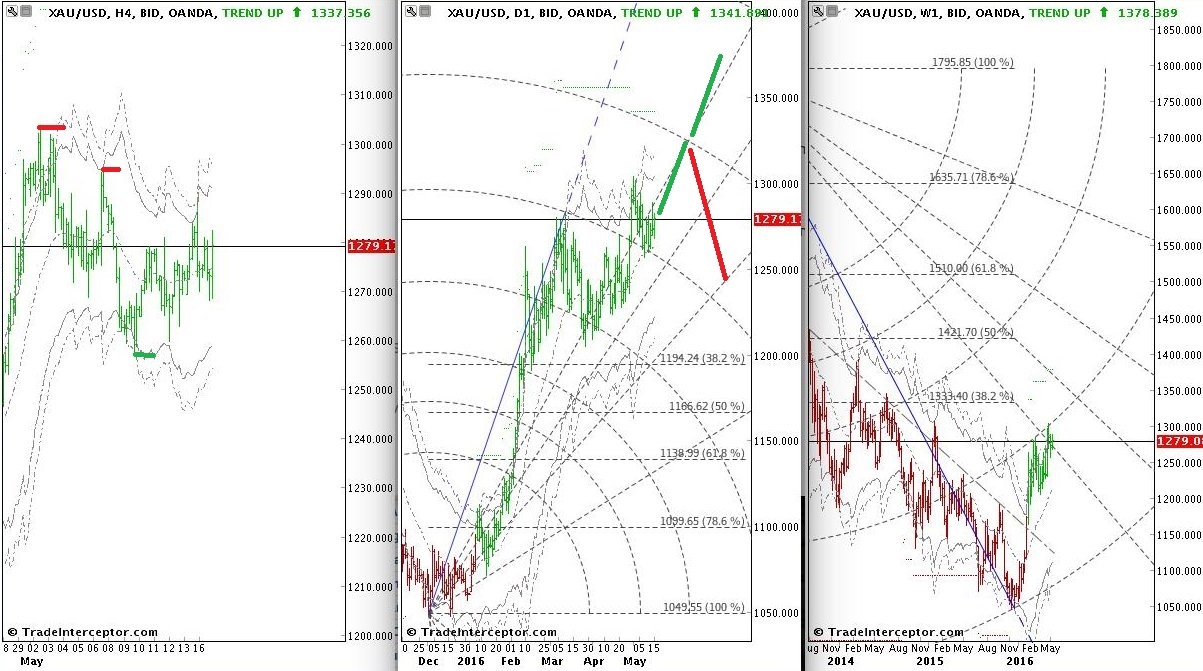

Our risk free short was stopped out for minimal gains, and unfortunately price did not behave as we expected in our April 18th article to test the breakout so we can join the bulls at a cheaper price. Since then price had been pushing to the upside, testing the key $1,300 level as speculation was ripe that Feds was not going to be able to raise rate anytime soon, given the global economic slowdown.

The CME FedWatch indicates only a 15% chance of a rate hike this June, 30% in July, 38% in September, 39% in November and 42% in December. All of which expecting a 25 basis points increase. Recent Feds comments about market underestimating the strength of the US economy, has waved some dollar bulls back in and push the price of the precious metal to close lower for the past two weeks. This also has caused some profits taking as we see speculators reduced their net long by 4% for the first time since March 15th.

A further look at the US Dollar Index futures for June delivery, showed that speculators further reduced their net long by more than 14% (from 13,849 to 12,117 contracts) since our last article.

We believe quite a chunk of these dollars are going into the precious metal market as recent US regulatory filing confirmed that world renowned investors George Soros has bought call options on 1.05 million shares in SPDR Gold Shares (NYSE:GLD) as well as acquired 1.7% stake in the world's biggest gold producer - the Barrick Gold Corporation (TO:ABX).

Halal Traders have placed a limit order to buy gold at $1,250 with an open target strategy and a stop at $1,200.

Please read our risk warning disclaimer.