- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Euro Breaks Out, Will It Keep Going?

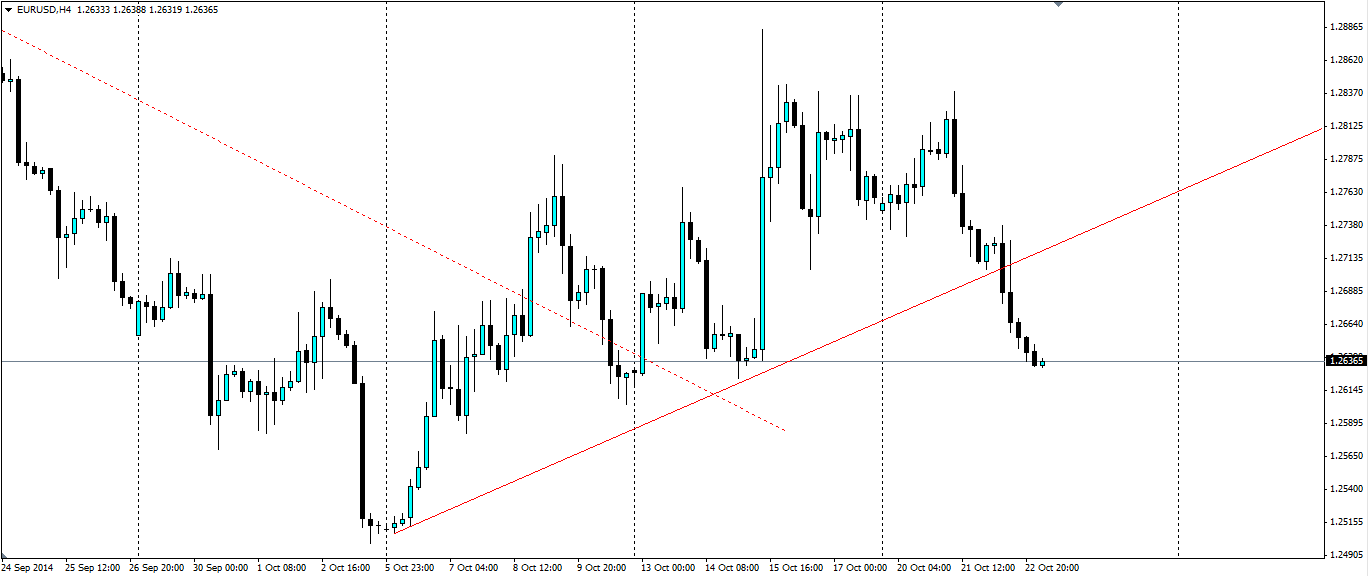

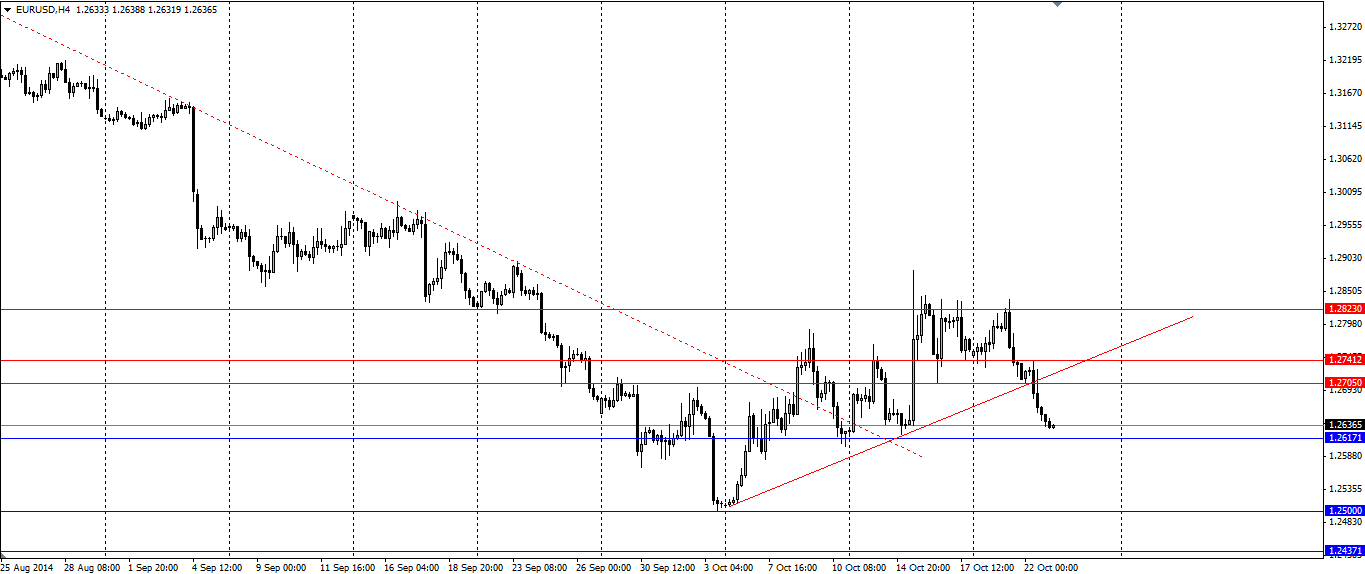

The Euro has been a bit of a surprise lately as it looked to form somewhat of a bullish trend as the US Dollar weakened. The run simply couldn’t last with the fundamentals and technicals lining up to break the Euro out of the bullish trend. So how far will it go?

The recent surge in the Euro has largely been on the back of the strength in the US dollar. Many in the market fear slowing global growth will reduce the likelihood of the US Federal Reserve raising interest rates by this time next year. The irony is that a large part of the fear is over the growth rates in Europe, yet the Euro benefits. Furthermore, last week we saw US Unemployment claims hit their lowest level in 14 years (April 2000).

The price has finally caught up with the fundamentals and the support along the bullish trend along with that at 1.2705 could no longer be sustained. From here we may see some slight consolidation, but I believe the euro will go on to test the recent lows around the 1.2500 mark.

The news expected out tonight is not going to be pleasant for anyone bullish on the Euro. Services and Manufacturing PMI results are expected for Germany, France and the EU as a whole. These have continually been trending downwards and the market expects that trend to continue. With these figures we will get a real sense of whether or not the stimulus packages from the ECB have been working or not. And if not, we are likely to see more, which is why the Euro will be punished if these results are less than favourable.

From the US side, it will pay to watch out for the weekly US unemployment claims due tonight. As stated above, these hit their lowest level in 14 years at 264k. The market is anticipating a figure of 281k, which is still well below the long term average. Anything below 300k is a decent result in my opinion.

For a continuation of the breakout, watch for support to be found at 1.2617, 1.2500 and 1.2437. If we see some surprising results in the PMIs, look for resistance to be found at 1.2705, 1.2741 and 1.2823, with the previous trend line acting as dynamic resistance.

The Euro has has the bearish momentum behind it currently and the economic news out later today could add to this. Look for the recent lows to be targeted especially if the prospect of more stimulus is raised.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.