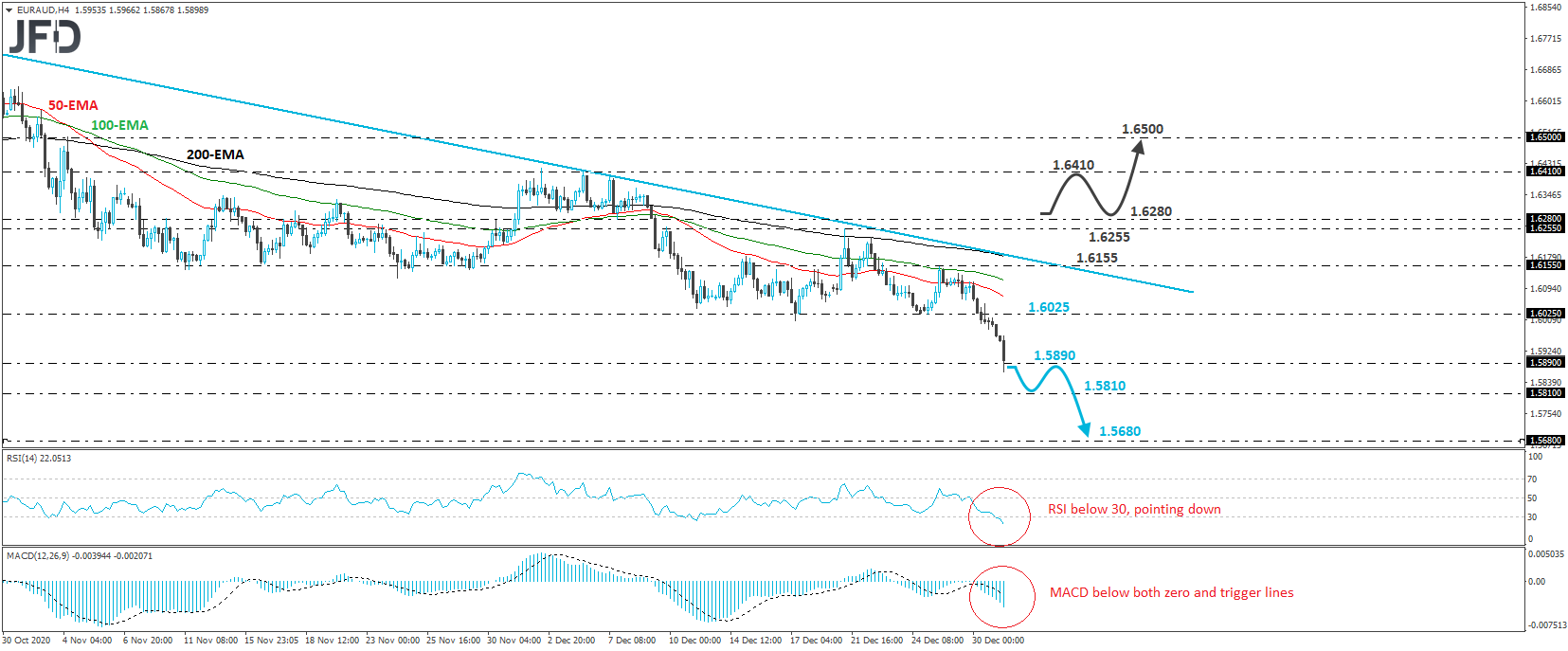

EUR/AUD traded south yesterday, falling below the 1.6025 key support (now turned into resistance) barrier, which is marked by the lows of Dec. 24 and Dec. 28. Overall, the pair continues to trade below the downside resistance line taken from the high of Oct. 20, while yesterday’s fall has confirmed a forthcoming lower low. All this paints a negative near-term picture, in our view.

Today, the pair hit support slightly below 1.5890, marked by the lows of June 22-23, 2019, and then it rebounded somewhat. That said, if the bears regain control and drive the battle decently below 1.5890, we expect them to aim for the lows of April 26 and April 29, 2019, at around 1.5810. If that zone is not able to halt the fall either, then the next area to consider as a support is at 1.5680, marked by the low of April 17, 2019.

Shifting attention to our short-term oscillators, we see that the RSI fell below 30 and continues to point down, while the MACD lies below both its zero and trigger lines, pointing down as well. Both indicators detect strong downside momentum and corroborate our view for further declines in this exchange rate.

On the upside, we would like to see a strong recovery above 1.6280, marked by the low of Dec. 7, before we abandon the bearish case and start examining a bullish reversal. The rate would already be above the aforementioned downside line and the bulls may shoot for the 1.6410 territory, defined as a resistance by the peak of December 4th. A break higher may extend the advance toward the psychological zone of 1.6500, which is slightly below the peak of Nov. 4.