- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

EUR/USD: Steady Ahead Of US Inflation Data

EUR/USD is trading quietly in the mid-1.37 range in Friday trading.. In economic news, US Unemployment Claims shot higher, while Retail Sales beat the estimate. On Friday, German WPI posted a decline of 0.2%. Eurozone Employment Change posted a flat reading of 0.0%, matching the forecast. We'll get a look at US inflation numbers later, with the release of PPI and Core CPI.

Eurozone manufacturing data continues to struggle. On Thursday, Eurozone Industrial Production declined 1.1% for November, its weakest showing in three months. The markets had expected a gain of 0.4%. Earlier in the week, German and French Industrial Production posted declines and fell short of market expectations. These indicators underscore weak economic activity which is hobbling the Eurozone. However, the euro has managed to shrug off weak Eurozone data, and has gained closed to 200 points against the greenback since the start of December.

European Union finance ministers met in Brussels on Tuesday and high on the agenda was a proposal for a European banking union. The aim is to relieve debt-ridden countries from the burden of rescuing failing banks in their countries. Instead, the banks would tap a Eurozone rescue fund, the Single Resolution Mechanism. However, no agreement has been reached on the SRM, and the finance ministers are likely to meet again next week to try and hammer out details of a banking union. ECB head Mario Draghi is a firm supporter of a banking union and has urged national governments to move forward with the plan.

Last week's US employment numbers were excellent, but Thursday's Unemployment Claims, the highest in nine weeks, dampened the party. The Fed has said that a stronger employment picture is a prerequisite to QE tapering, and last week's numbers certainly increase the possibility of the Fed taking action at its December policy meeting. Currently, the Fed is purchasing $85 billion in assets every month, and a Fed taper would likely boost the US dollar against the major currencies.

There was some good news on the fiscal front, as the US House of Representatives easily passed a budget deal on Thursday. The agreement, which will be voted on by the Senate next week, will remove the risk of a government shutdown and reduces the deficit by a modest $23 billion. Democrats and Republicans both had criticism of the proposal, but there is general agreement in Washington that the compromise reached is a positive step which removes some of the fiscal uncertainty we've seen in recent months.

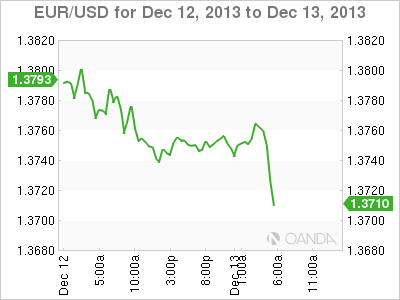

EUR/USD December 13 at 10:00 GMT

EUR/USD 1.3753 H: 1.3769 L: 1.3742

- EUR/USD is showing little movement in Friday trading. The pair touched a high of 1.3770 earlier in the European session.

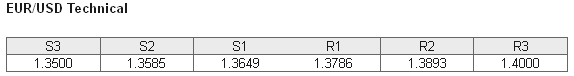

- On the downside, 1.3649 continues to provide support. This line has some breathing room as the pair trades at higher levels. This is followed by support at 1.3585.

- The pair continues to face resistance at 1.3786. This is followed by a resistance line at 1.3893, which has remained intact since October 2011.

- Current range: 1.3649 to 1.3786

Further levels in both directions:

- Below: 1.3649, 1.3585, 1.3500, 1.3410 and 1.3325

- Above: 1.3786, 1.3893, 1.4000 and 1.4140

OANDA's Open Positions Ratio

EUR/USD ratio has reversed positions on Friday, pointing to gains in long positions. This is not reflected in the pair, with the pair showing little movement. A large majority of the open positions remain short, indicative of a trader bias towards the dollar posting gains against the euro.

The pair continues to trade in the mid-1.37 range. With the US releasing key inflation later on, we could see some movement from the pair during the North American session.

EUR/USD Fundamentals

- 7:00 German WPI. Exp. 0.4%, Actual -0.2%.

- 10:00 Eurozone Employment Change. Exp. 0.0%. Actual 0.0%.

- 13:30 US PPI. Exp. 0.0%.

- 13:30 US Core CPI. Exp. 0.1%.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Japanese yen is slightly lower on Wednesday. In the North American session, USD/JPY is trading at 148.92, down 0.07% on the day. What is the best performing G-10 currency...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.