EUR/USD

The euro has enjoyed a solid move higher now for the last week however in the last day or so it has ran into a wall of resistance at 1.38 and been fended off. To finish out last week and to start this week it moved very well away from the key 1.3550 level and to 1.38, representing a new six week high. To finish out the week a couple of weeks ago the euro settled right around the 1.36 level after earlier in that week moving up strongly through the resistance at 1.3550. In the week prior the euro did well to bounce strongly off support at 1.34 and recover the lost ground from the previous couple of days which saw it fall from the resistance level around 1.3550. This was after a few weeks which saw it move steadily higher from a support level at 1.33 back up to a three week high just above 1.3550. Over the last month or so 1.3550 has been a key level. Towards the end of October the euro enjoyed a strong surge higher to move through to its highest level in nearly two years just above 1.38 before spending that week content to consolidate around this level. Over the following three weeks it fell heavily down to a support level at 1.33 before recovering well over the last few weeks. It moved quite well throughout the middle of October after breaking higher from its sideways range. For the month leading up to that, the euro traded within a narrow range between 1.3450 and 1.3650 before the range narrowed down to between 1.35 and 1.36. The former level of 1.35 was strongly tested a few weeks ago and has resurfaced as a significant level presently.

Throughout August the 1.34 level had been causing the euro headaches however several weeks ago it surged higher and moved through there to its then highest level since February just shy of 1.3570, which was past a couple of weeks ago moving to just shy of 1.3650. About a month ago the euro fell strongly away from the resistance level at 1.34 back to below the support level at 1.32 and in doing so traded to its lowest level in seven weeks very close to 1.31. Looking at the bigger picture the euro spent a lot of August and September trading within a range between 1.32 and 1.34 before recently pushing its range to between 1.3450 and 1.3650. Back in early July the euro was content to maintain the level above 1.31 and settle there, as it received solid support from both 1.30 and 1.31. On a couple of occasions it made an attempt to move within reach of the longer term resistance level at 1.32 and finally it finds itself trading on the other side of this level and being well established there.

Throughout May and most of June the euro surged higher to a four month high above 1.34. Before that in the first half of May, the euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the euro received solid support around 1.28 and this level was called upon to provide additional support. Throughout this year the euro has moved very strongly in both directions. Throughout February and March the euro fell sharply from around 1.37 down to its lowest level since the middle of November around 1.2750. Sentiment has completely changed with the euro over the last few weeks and the last couple of months has seen a rollercoaster ride for the euro as it continued to move strongly towards 1.34 before falling very sharply to below 1.29 and setting a 6 week low.

A top official at the european Central Bank has signaled it will try to force euro zone banks to hold capital against sovereign bonds, in an attempt to stop weak lenders using its cash to hoover up the debts of crisis-hit countries. In an interview with the Financial Times, Peter Praet, an ECB executive board member, outlined how the central bank could combine its new powers as chief banking regulator with its existing role as currency issuer to toughen up the requirements on sovereign bonds, which have traditionally been classed as risk-free. The central bank will try to bring about the change in regulatory thinking using its health check of the euro zone's 130 biggest lenders alongside any new offer of cheap long-term liquidity. Mr Praet said if sovereign bonds were treated "according to the risk that they pose to banks' capital" during the health check, then lenders would be less likely to use central bank liquidity to buy yet more government debt. EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="551" height="233">

EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="551" height="233"> EUR/USD 4 Hourly Chart" title="EUR/USD 4 Hourly Chart" width="551" height="233">

EUR/USD 4 Hourly Chart" title="EUR/USD 4 Hourly Chart" width="551" height="233">

EUR/USD December 12 at 21:20 GMT 1.3752 H: 1.3803 L: 1.3737 EUR/USD Technical Chart" title="EUR/USD Technical Chart" width="551" height="233">

EUR/USD Technical Chart" title="EUR/USD Technical Chart" width="551" height="233">

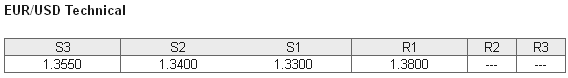

During the early hours of the Asian trading session on Friday, the euro is trying to rally back up towards 1.3750 after its strong fall away from the resistance level at 1.38. Current range: just above 1.3750 around 1.3755.

Further levels in both directions:

• Below: 1.3550, 1.3400 and 1.3300.

• Above: 1.3800. EUR/USD Position Ratios Chart" title="EUR/USD Position Ratios Chart" width="551" height="233">

EUR/USD Position Ratios Chart" title="EUR/USD Position Ratios Chart" width="551" height="233">

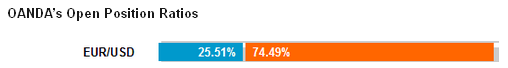

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio continue to falls below 30% as the euro remains above 1.3750. The trader sentiment remains strongly in favour of short positions.

Economic Releases

- 04:30 JP Capacity Utilisation (Oct)

- 04:30 JP Industrial Production (Final) (Oct)

- 13:30 US PPI (Nov)

- US S&P Dow Jones Index Quarterly Review Final Announcement

- US S&P Index Quarterly Review