EUR/USD is almost unchanged in Wednesday trading, as the pair trades quietly in the mid-1.37 range in the European session. In economic news, it's another slow day, with no major releases out of Europe or the US. In the Eurozone, French Final Non-Farm Payrolls and German Final CPI both matched their estimates. Over in the US, today's highlight is Crude Oil Inventories.

European Union finance ministers met in Brussels on Tuesday and high on the agenda was a proposal for a European banking union. The aim is to relieve debt-ridden countries from the burden of rescuing failing banks in their countries. Instead, the banks would tap a Eurozone rescue fund, the Single Resolution Mechanism. However, no agreement has been reached on the SRM, and the finance ministers are likely to meet again next week to try and hammer out details of a banking union. ECB head Mario Draghi is a firm supporter of a banking union and has urged national governments to move forward with the plan.

German economic data remains a source of concern and the October numbers haven't brought much cheer. Germany's trade surplus shrank to 16.8 billion euros, down from 18.8 billion in October. Industrial Production declined by 1.2%, the third decline in the past four readings. The estimate stood at 0.8%. On Wednesday, German CPI gained 0.2%, which matched the estimate. Although just a modest gain, this was the best figure we've seen in the past four months. If German numbers don't improve, we're unlikely to see much growth out of the struggling Eurozone economy.

In the US, last week's employment numbers were excellent, as Unemployment Claims, Non-Farm Payrolls and the Unemployment Rate all impressed. The Fed has said that a stronger employment picture is a prerequisite to QE tapering, and last week's numbers certainly increase the possibility of the Fed taking action at its December policy meeting. Currently, the Fed is purchasing $85 billion in assets every month, and a Fed taper would likely boost the US dollar against the major currencies.

With memories of the October government shutdown still fresh on Capitol Hill, lawmakers have reached a budget deal which Congress will have to approve. The agreement will remove the risk of a government shutdown and reduce the deficit by a modest $23 billion. Democrats and Republicans both had criticism of the proposal, but there is general agreement in Washington that the compromise reached is a positive step which removes some of the economic uncertainty we've seen in recent months. Congress must approve a budget, or the US could face another government shutdown in mid-January. EUR/USD" border="0" height="300" width="400">

EUR/USD" border="0" height="300" width="400">

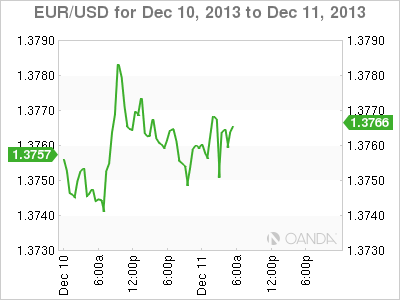

EUR/USD December 11 at 11:20 GMT

EUR/USD 1.3765 H: 1.3774 L: 1.3742 EUR/USD Technical" title="EUR/USD Technical" height="79" width="569">

EUR/USD Technical" title="EUR/USD Technical" height="79" width="569">

- EUR/USD has taken a pause and is almost unchanged on Wednesday. The pair touched a low of 1.3742 in the Asian session but has edged higher.

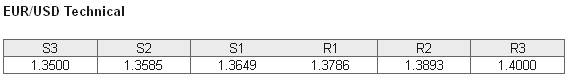

- On the downside, 1.3649 continues to provide support. This line has some breathing room as the pair trades at higher levels. This is followed by support at 1.3585.

- The pair continues to face resistance at 1.3786. This line has weakened and could face more pressure if the euro can break out and move higher. Next, there is resistance line at 1.3893, which has remained intact since October 2011.

- Current range: 1.3649 to 1.3786

Further levels in both directions:

- Below: 1.3649, 1.3585, 1.3500, 1.3410 and 1.3325

- Above: 1.3786, 1.3893, 1.4000 and 1.4140

OANDA's Open Positions Ratio

EUR/USD ratio has reversed positions on Wednesday, pointing to a gain in short positions. This is not reflected in the pair, which is showing little movement. A large majority of the open positions remain short, indicative of a trader bias towards the dollar reversing directions and posting gains against the euro.

The pair is trading quietly in the mid-1.37 range on Wednesday. With no major releases out of Europe or the US today, we could see this trend continue during the day.

EUR/USD Fundamentals

- 6:30 French Final Non-Farm Payrolls. Estimate -0.1%. Actual -0.1%.

- 7:00 German Final CPI. Estimate 0.2%, Actual 0.2%.

- 15:00 US Treasury Secretary Jack Lew Speaks.

- 15:30 US Crude Oil Inventories. Estimate -2.2M.

- 18:01 US 10-year Bond Auction.

- 19:00 US Federal Budget Balance. Estimate -142.6B.