EUR/USD for Monday, December 16, 2013

The Euro has enjoyed a solid move higher over the last couple of weeks before easing back to finish out last week. This move higher saw it return to a wall of resistance at 1.38 and in doing so move to a six week high. A couple of weeks ago it moved very well away from the key 1.3550 level and back to 1.38. To finish out the week a few weeks ago the Euro settled right around the 1.36 level after earlier in that week moving up strongly through the resistance at 1.3550. In the week prior the Euro did well to bounce strongly off support at 1.34 and recover the lost ground from the previous couple of days which saw it fall from the resistance level around 1.3550. This was after a few weeks which saw it move steadily higher from a support level at 1.33 back up to a three week high just above 1.3550. Over the last month or so 1.3550 has been a key level. Towards the end of October the Euro enjoyed a strong surge higher to move through to its highest level in nearly two years just above 1.38 before spending that week content to consolidate around this level. Over the following three weeks it fell heavily down to a support level at 1.33 before recovering well over the last few weeks. It moved quite well throughout the middle of October after breaking higher from its sideways range. For the month leading up to that, the Euro traded within a narrow range between 1.3450 and 1.3650 before the range narrowed down to between 1.35 and 1.36. The former level of 1.35 was strongly tested a few weeks ago and has resurfaced as a significant level presently.

Throughout August the 1.34 level had been causing the Euro headaches however several weeks ago it surged higher and moved through there to its then highest level since February just shy of 1.3570, which was past a couple of weeks ago moving to just shy of 1.3650. About a month ago the Euro fell strongly away from the resistance level at 1.34 back to below the support level at 1.32 and in doing so traded to its lowest level in seven weeks very close to 1.31. Looking at the bigger picture the Euro spent a lot of August and September trading within a range between 1.32 and 1.34 before recently pushing its range to between 1.3450 and 1.3650. Back in early July the Euro was content to maintain the level above 1.31 and settle there, as it received solid support from both 1.30 and 1.31. On a couple of occasions it made an attempt to move within reach of the longer term resistance level at 1.32 and finally it finds itself trading on the other side of this level and being well established there.

Throughout May and most of June the Euro surged higher to a four month high above 1.34. Before that in the first half of May, the Euro fell considerably from near 1.32 down to six week lows near 1.28. Back at the beginning of April the Euro received solid support around 1.28 and this level was called upon to provide additional support. Throughout this year the Euro has moved very strongly in both directions. Throughout February and March the Euro fell sharply from around 1.37 down to its lowest level since the middle of November around 1.2750. Sentiment has completely changed with the Euro over the last few weeks and the last couple of months has seen a rollercoaster ride for the Euro as it continued to move strongly towards 1.34 before falling very sharply to below 1.29 and setting a 6 week low.

There is no shortage of ECB-eligible collateral in any euro zone country meaning that banks could easily increase their use of its funding if they so wished, ECB Vice-President, Vitor Constancio, said on Wednesday. Money market rates and the euro have both risen in recent weeks as the amount of spare ECB cash that has long kept borrowing costs pinned at record lows has continued to dwindle. "I can tell you, there is eligible collateral in all countries, in all banking sectors right now that they could use to come to us and get very cheap funding," Constancio said at an event at the Goethe University Frankfurt. He added that it was very difficult for the ECB to influence how banks used the cash, but said he hoped lending to the economy would pick-up once the recovery gathered momentum. EUR/USD Daily Chart" title="EUR/USD Daily Chart" height="226" width="550">

EUR/USD Daily Chart" title="EUR/USD Daily Chart" height="226" width="550"> EUR/USD 4 Hourly Chart" title="EUR/USD 4 Hourly Chart" height="226" width="550">

EUR/USD 4 Hourly Chart" title="EUR/USD 4 Hourly Chart" height="226" width="550">

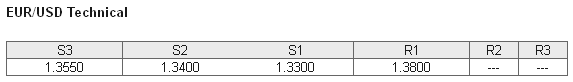

EUR/USD December 15 at 22:00 GMT 1.3729 H: 1.3743 L: 1.3728 EUR/USD Technical" title="EUR/USD Technical" height="226" width="550">

EUR/USD Technical" title="EUR/USD Technical" height="226" width="550">

During the early hours of the Asian trading session on Monday, the Euro is really yet to get going as it tries to hold onto the 1.3750 level. Current range: just below 1.3750 around 1.3730.

Further levels in both directions:

• Below: 1.3550, 1.3400 and 1.3300.

• Above: 1.3800. EUR/USD Open Position Ratios" title="EUR/USD Open Position Ratios" height="226" width="550">

EUR/USD Open Position Ratios" title="EUR/USD Open Position Ratios" height="226" width="550">

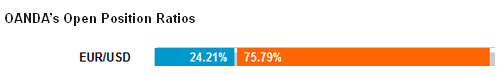

(Shows the ratio of long vs. short positions held for the EUR/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The EUR/USD long position ratio continue to falls below 30% as the Euro remains above 1.3750. The trader sentiment remains strongly in favour of short positions.

Economic Releases

- 08:58 EU Flash Composite PMI (Dec)

- 08:58 EU Flash Manufacturing PMI (Dec)

- 08:58 EU Flash Services PMI (Dec)

- 10:00 EU Trade Balance (Oct)

- 11:00 UK CBI Industrial Trends (Dec)

- 13:30 US Empire State Survey (Dec)

- 13:30 US Non Farm Productivity (Final) (Q3)

- 13:30 US Unit Labour Costs (Final) (Q3)

- 13:58 US Flash Manufacturing PMI (Dec)

- 14:00 US Net Long-term TICS Flows (Oct)

- 14:15 US Capacity utilisation (Nov)

- 14:15 US Industrial production (Nov)

- EU Foreign Ministers hold meeting in Brussels