- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

EUR Strangled By Option Interest

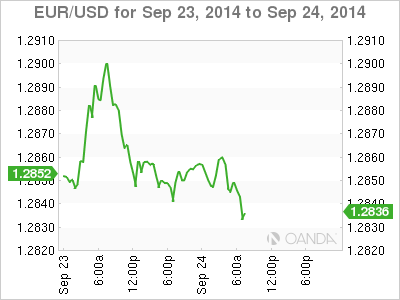

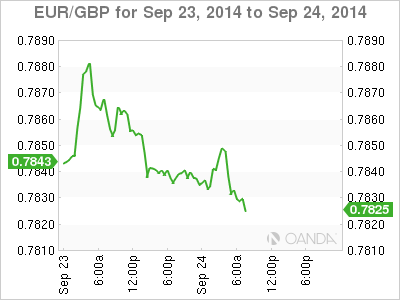

Since the Scottish sovereignty referendum, it has been difficult to get overly excited about forex, especially with the EUR/USD’s price action confined to a relatively tight trading range. The single units recent moves have been rather telegraphed, influenced mostly by option related deals and a few uninspiring PMI’s. Even this morning’s Euro bourses are trying to take a breather, ‘righting the ship’ after two consecutive days of selling. It seems that the global investor may have a new focus; the U.S. led Syrian airstrikes should keep the punters somewhat cautious as the market struggles for direction on the back of few miss leads from other regions.

This morning’s focus from investors has again been on Germany, where signs of further economic weakness could make it easier for the ECB to move to the QE stage of policy easing. The German Ifo business climate index has come in at 104.7, weaker than the 105.7 that was expected and follows the 106.3 August print. It’s the lowest reading in 18-months. The breakdown reveals further weakness in expectations (99.3 vs. 101.7 previous) and in current conditions (110.5 vs. 111.1 previous). Up to now, the market has been anticipating that German GDP is expected to return to growth this quarter after contraction in Q2, however, Germany’s latest Ifo results would suggest that a rebound could be relatively tame.

German data sends mixed signals

The mixed German Ifo data briefly managed to push the 18-member single unit to intraday highs (€1.2860), from where the EUR ran into a rally resistance. Some speculators have been waiting patiently to sell on upticks; recycling EUR’s to improve their “short” average cost positions. The EUR’s current consolidation seems to be easing the pressure on the “over-short” nature of the market as few individuals appear to be squeezed out of their positions in either direction. Currently, market offers in the €1.2865-75 area are holding the line while bids just ahead of this week’s lows €1.2825-35 are keeping the market relatively contained.

German data aids ECB decision

The steep drop in Germany’s Ifo index certainly supports the case for the ECB to engage in full-scale QE that include government bond purchases. Draghi has already indicated that they will buy asset backed securities and covered bonds, but ‘no’ mention of public debt. The latest disappointments on Euro economic activity (PMI’s and Ifo) will only support council members who want to purchase debt on a broader front. Germany’s 10-year Bund yield is again testing the +1% level amid assorted Euro data. While Euro’s peripheral debt continue to trade mixed – Spain 10-year bonds are outperforming, while Greek debt continues to underperform. The US 10-Year note is trading slightly weaker following its recent gains ahead of this morning’s U.S. August new home sales data.

Gold soft touch not forever

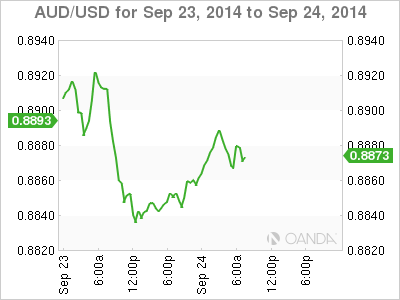

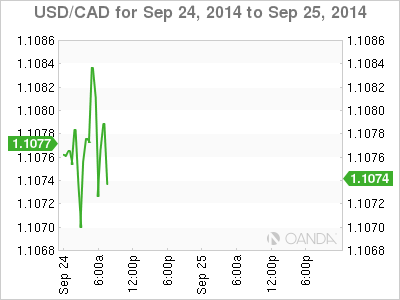

Commodity currencies, like the AUD and CAD, have been on the back foot of late. Their current prices have been highly influenced by their respective Central Bank rhetoric and softer commodity prices. Governor Stevens at the RBA seems to have made it his legacy to talk the AUD down at any opportunity. The Aussie’s value ($0.8878) is highly sensitive to its largest trading partner domestic successes and woes. Recent data from China has been relatively mixed. Some of the current risk-averse currency trading strategies can be attributed to the recent comments made by China’s Finance Minister Lou Jiwei, who indicated that Beijing would not amend economic policies despite some softening of last month’s economic indicators. From Governor Poloz perspective, the BoC’s solid ‘neutral’ monetary stance continues to put the loonie (CAD$1.1072) under pressure, aided obviously by weaker commodity prices.

Nevertheless, there is a potential event risk coming up for the gold market ($1,223.30) that could benefit both respective currencies and that is a Swiss referendum scheduled for the end of November.

The referendum will cover three aspects:

- The SNB stops selling its gold reserves

- The SNB’s gold held in foreign vaults is repatriated back to Switzerland

- The SNB’s holds at least +20% of its assets in gold

If the referendum were passed, the Swiss Central Bank would be required to buy approximately +1,500 tonnes of the yellow metal over a three-year period. That according to analysts would equate to about half of the world’s annual production and would eventually filter down to support commodity sensitive currencies. Nevertheless, the potential event risk is a couple of months away, but an event and a date to remember, especially if the yellow metal does seem to be outperforming despite a stronger dollar.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.