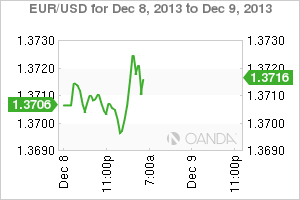

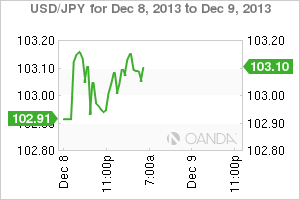

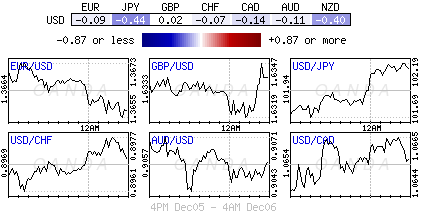

As we go deeper into the month of December various forex trades will be capable of pushing investors down several market routes that sometimes make little sense. These directional trades tend to occur because of a lack of market liquidity - a questionable currency volume write-off. By this year's "turn," this season will have throw forth some directional trades that will have confused and frustrated the average investor. Nevertheless, both this years "patience" trade (long USD/JPY) and "pain" trade (long EUR/USD) continue to dominate positional play. The market feels comfortable being short yen across the board, but being long EUR's never feels like a natural fundamental position. EUR/USD" title="EUR/USD" height="200" width="300">

EUR/USD" title="EUR/USD" height="200" width="300">

Being short the 17-member single currency this quarter has been both expensive and the wrong position. Another natural squeeze on the weak short EUR positions has been in play since Friday's US NFP report. The stronger than anticipated November non-farm payroll report was expected to go some ways to support Bernanke and company to begin paring back on their $85b a month-bond-buying program. That should have led to the USD rallying against Emerging Market currencies. Instead, the knee-jerk pro-tapering trades got battered in a market reversal. It seems that the market is comfortable pricing out a potential December taper believing that there will not be enough support amongst the voting Fed members to push through a taper start this month. In fact the next FOMC meeting in less than two-weeks time has probably come too soon. Bernanke and company do not need to hurry, its policy intention seem to have been successfully filtered into the markets that it's "tapering and interest rate hike are different" and will not take place together.  USD/CNY" border="0" height="200" width="300">

USD/CNY" border="0" height="200" width="300">

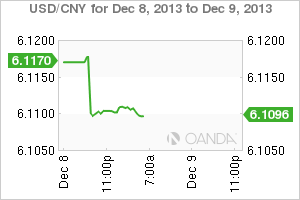

Overnight, the Chinese Yuan rose to a record high outright (6.1130) as the PBoC guided the currency upward after the country posted its biggest trade surplus in almost five-years over the weekend. The Yuan move is very much inline with the broad dollar weakness and not wholly a proactive Central Bank initiative. To many the +13% jump in last month Chinese exports may bode well for the country rebound, but for its rivals in the US and Europe, perhaps not so much. A strong export number equates to increasing market share for Chinese goods. In the report, exports to both regions by China had increased by +18% year-over-year. China seems to be successfully taking market share away from both territories. This ongoing scenario will only increase friction between the economic regions – a general them for 2014. Other data revealed that China's CPI gain moderated in November. No one seems too concerned, as they expect Beijing to give market forces a greater role to eventually boost inflation.  EUR/JPY" border="0" height="200" width="300">

EUR/JPY" border="0" height="200" width="300">

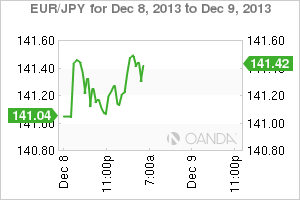

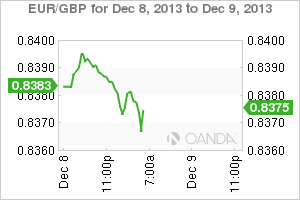

Despite Germany's trade surplus being lower than expected in October (€16.8b), as imports sharply rose from September (China exports increasing), the single currency continues to find support this morning on pull-backs. The EUR slipped a few ticks on the news that this month's Euro Sentix index eased (economic health) to +9.3 from a +10.4 forecasted. However, for now consensus believes the pair will remain resilient to both weaker fundamental data and the ECB. The market continues to look for levels to position themselves long EUR's, particularly Asian Central Banks who seem to have an increasing appetite for the single currency.  EUR/GBP" border="0" height="200" width="300">

EUR/GBP" border="0" height="200" width="300">

Considering such things as rate spreads, the outperformance of US financial institutions compared to their Euro counterparts, and stronger US fundamentals, the EUR looks "pricy." The market obviously disagrees – it continues to feel comfortable owning EUR's, but, at the right level. Technically the scope is for the currency to retest above €1.3800+ now that a new high was printed this morning. The techies believe a close north of €1.3700 today will accelerate that move.  USD/JPY" border="0">

USD/JPY" border="0">

Stateside, following in the footsteps of last week’s revision to GDP, market focus will be on retail sales later this week. Some analysts expect the US business inventory report will get more attention than usual. Investors should anticipate market noise surrounding the Fed's policy decision to pick up in intensity until next week's FOMC decision on December 18. However, prior to the announcement, expect all economic data to be dissected for clues to a decision. Despite Ben and company being data dependent in its decision-making — one data point never made a trend. Today is the final day of Fed speaks prior to next week’s FOMC announcement (Richmond Fed Lacker - non-voter, hawk, St. Louis Fed Bullard 2013 voter, dove and Dallas Fed Fisher 2014 voter, hawk).

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR Pain Trade: A Persistent Squeeze

Published 12/09/2013, 07:06 AM

Updated 07/09/2023, 06:31 AM

EUR Pain Trade: A Persistent Squeeze

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.