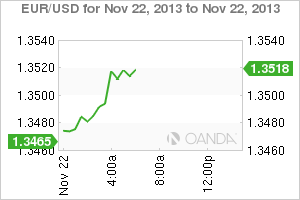

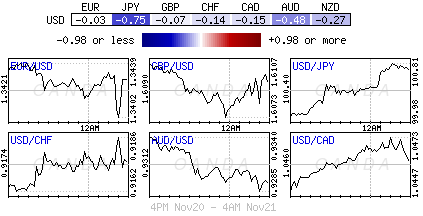

This has been a week of words. A plethora of policy makers from the G10 countries have, at one moment or another garnered the markets attention with their opinions and thoughts this week. Policy makers from down-under to the northern hemisphere have covertly been wagering a war on the value of their own domestic currencies. Every dove and hawk seems to have got equal airtime. If nothing else, they managed to bring back some volatility to a market that had lost some of the 'mojo' to its sister asset classes. EUR/USD" width="300" height="200">

EUR/USD" width="300" height="200">

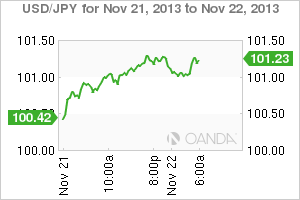

On the fundamental front, the US bows out this week in quite fashion. Next week could get interesting despite it been a holiday shortened one. Will the upward dollar momentum persist? Currently there is nothing to say otherwise. If the respected G3 Central Banks continue along the current vein then the 'mighty' buck is expected to have a distinct advantage. Many remain fundamentally bullish on the USD. There are even those who believe that any upside surprises in US data could push market expectations in favor of a December tapering decision. The Fed this week has indicated it's soon, but next month may come a bit too quickly. The safer prediction would be sometime in Q1. USD/JPY" width="300" height="200">

USD/JPY" width="300" height="200">

This week, the EUR has fallen foul on a number of occasions to Central Bank antics surrounding the possible implementation of negative deposit rates. The 17-member single currency was able to finally pick it self off the floor after Draghi publically stated that the possibility of negative rates had not been discussed since the last Central Bank meeting. Also aiding a currency in distress is this morning's German data. Business sentiment in Europe's most dominant country rebounded sharply this month. The Ifo business confidence index rose 1.9 points to 109.3, more than compensating for the previous months drop and beating the streets call of 107.7. Combined with this weeks stronger German PMI report should help investors dismiss any thoughts that the slow German economic growth reported in Q3 has the makings of a 'new' trend that could possible be carried over into the new-year. German manufactures are seeing the same thing, that both the current business situation and the trade outlook improved this month in Europe's strongest economy.  USD/JPY" width="300" height="200">

USD/JPY" width="300" height="200">

The 17-member single currency has managed to penetrate the 1.3500 on the topside again, mostly on the back of the weak short positions entered on the ECB negative deposit rate story. These positions have come undone by the evidence of increasing strength recorded by the core of the Euro-zone. Stronger German expectations and current conditions have been able to trigger stops north of 1.3510. However, the run up this morning has a fair amount of resistance to get through if it wants to maintain any upward momentum. There is reported corporate EUR interest to go between 1.3535-50. However, a mass of vanilla options with a 1.35 strike price may have the strength to keep spot close to the figure until after expiries at 10am EST this morning.

For the remaining few that have limited positions to ponder over, deciphering the latest copy from the plethora of Euro policy makers, albeit boring, could give you a better understanding of what they are really thinking. Their thoughts and stance on deflation, how much of a burden is the unique current debt situation having on the member countries, low rates for how long, and the scenarios surrounding stagflation. Talk is generally cheap, however, not this week. It's given back volume and volatility to the forex space. It may only be a limited time offer, but when the "sun shines it worth making hay."

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR Moves Not Just On Words

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.