The EUR/GBP Pair is in a downward slide and fundamentals point to this continuing.

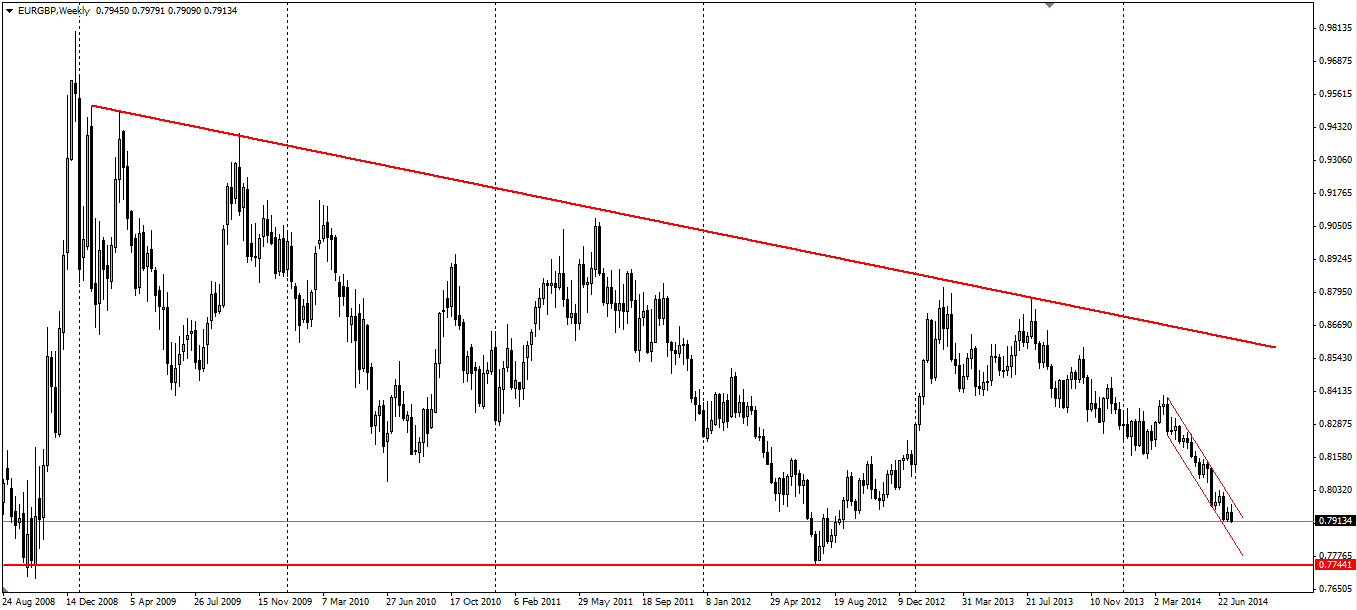

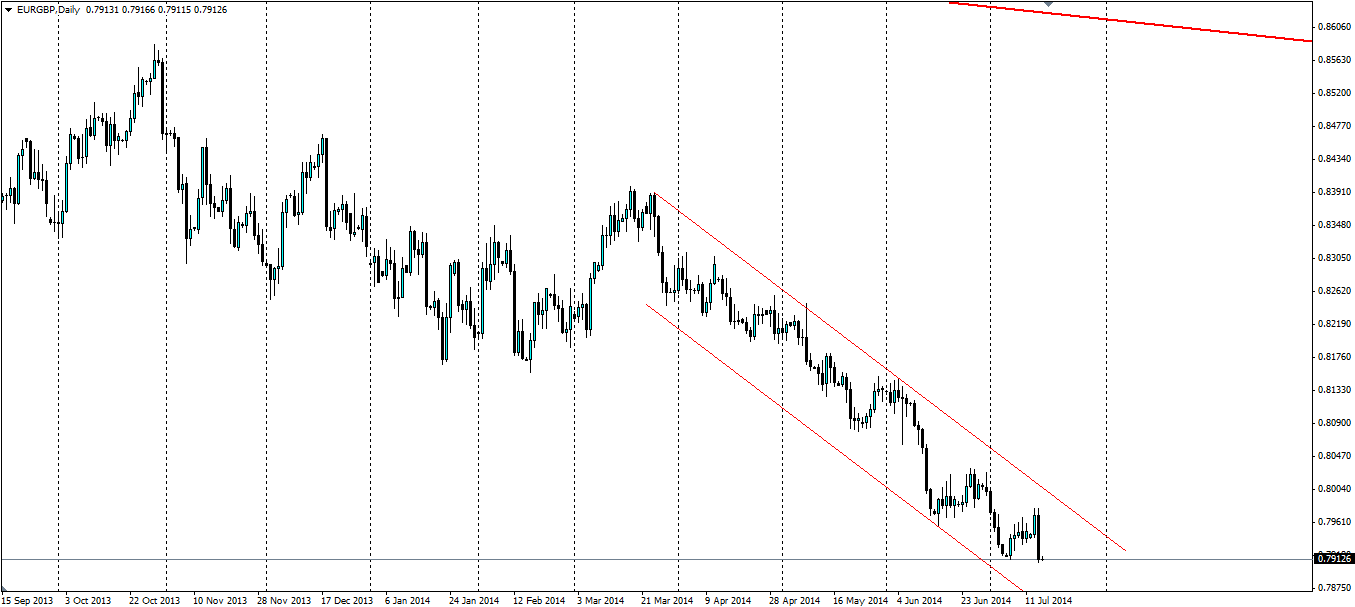

The weekly chart for the EUR/GBP shows a clear downward sloping triangle with support on the bottom at 0.7744 and a bearish line on top that was last tested in June last year. Since then the pair has trended downward, with a sharp downward channel forming that looks likely to collide with the support at 0.7744.

The Pound has been going from strength to strength. Against the US Dollar it recently posted a fresh five year high, and against the Euro it hit a level not seen in almost two years. There are good reasons for this, and they lie in the fundamental differences of the economies of the UK and Europe.

Yesterday’s inflation figures reported as 1.9% year on year; up from 1.5% a month ago, were just the latest in a series of reports that paint a very rosy picture for the UK. The services PMI, which accounts for over three quarters of the UK economy, reported 57.7 at the beginning of July. This was down slightly on the 58.6 a month earlier, however 57.7 is solid expansion and shows how robust the UK economy is at the moment. Construction and Manufacturing also reported PMIs of 62.6 and 57.5 respectively.

By contrast the economic situation in Europe is shaky at best. Yesterday’s ZEW economic sentiment surveys in Germany and the EU as a whole left much to be desired. Germany’s score of 27.1 was down from 29.8 a month ago and the EU figure was down from 58.4 to 48.1. These figures follow on from a potential crisis in the banking sector as a Portuguese bank failed to make debt payments on time, sending equities and the Euro lower and gold up as traders feared the worst. Luckily the situation has been resolved; however, it highlights how fragile the recovery from the sovereign debt crisis really is.

There is also a gulf between the monetary policies of the UK and the EU. The recent inflation figure of 1.9% will no doubt put a bit more pressure on the Bank of England (BoE) to raise interest rates from their historic low of 0.5%, but they will not look at seriously doing this until inflation becomes a problem. But the mere fact that the next likely step for the BoE is raising interest rates, gives us an idea of where these two economies stand in relation to each other.

The European Central Bank (ECB) has the unenviable position of enacting stimulus to stave off deflation. In June the ECB lowered rates on deposits to -0.1% and loans to 0.1% in order to keep the EU banking system flush with cash and to keep investment ticking over. The market believes this may not be enough and are hoping the ECB will introduce an asset purchasing policy similar to the UK’s QE programme. With EU CPI figures tipped to stay at 0.5% year on year, next week, we may see the ECB talk about such a programme in the near future.

One of the main desires of the ECB is for a devalued Euro as this will boost the competitiveness of EU exports and the recent stimulus has had an effect, however, there is certainly further to fall against the Pound, especially if another round of stimulus is announced. The UK does not benefit from a high Pound, however, they are not about to introduce stimulus to bring it down. The likely course of action is to raise interest rates, which will only boost the Pound, but we are a while off that yet.

In the meantime, the channel is likely to hold steady for fundamental reasons.