- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ericsson (ERIC) To Modernize Deutsche Telekom Infrastructure

Ericsson (BS:ERICAs) (NASDAQ:ERIC) has been selected by Deutsche Telekom (DE:DTEGn) to modernize its mobile network with 5G-ready multi-standard solutions in Germany. Ericsson is scheduled to supply Deutsche Telekom’s current and future network in one of two market areas of the company in Germany.

Deutsche Telekom's 2G, 3G and 4G network with a multi-standard solution will be modernized by Ericsson. The modernized network will offer an improved network performance experience to the company’s subscribers. The five-year agreement will see Ericsson deliver a multi-standard Radio Access Network, founded on the company's Baseband 6630 product and multi-standard radios, Ericsson Network Manager for OSS, & hardware and software support and services. For instance, the OSS for the radio network facilitates unified network management.

Existing Business Scenario

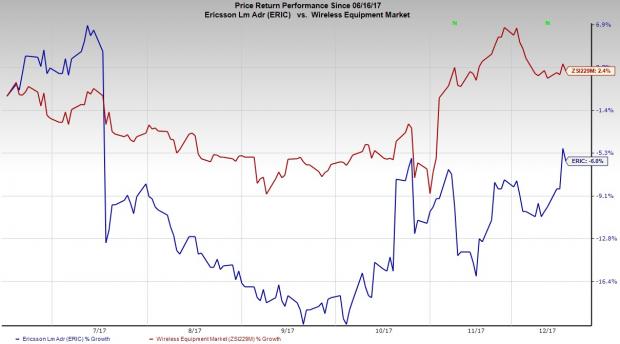

Although the company expects to stabilize IT and cloud product portfolio, along with re-establishing profitability in managed services, it is grappling with negative industry trends and a declining wireless equipment market. Further, the company expects an increasingly challenging investment environment in Europe and Latin America. Notably, the stock has lost 6% in the past six months in contrast to the industry’s growth of 2.4%.

Soft mobile broadband demand and challenging macroeconomic conditions in the emerging markets are acting as a deterrent for major investments by telecom equipment behemoths, and this significantly dented performance. The company anticipates a drop of 8% in the market for radio access networks this year, which is worse than previously expected.

Persistent low investments in mobile broadband in certain markets and lower managed services sales have impacted the sales of Networks segment, while lower legacy product sales have hurt IT & Cloud revenues. Overall, the company expects the negative industry trends and business mix in mobile broadband to prevail this year as well.

This apart, the Zacks Rank #5 (Strong Sell) company functions in an extremely competitive environment, which comprises various big multinational wireless telecom service providers as well as newly established companies.

Stocks to Consider

Some better-ranked stocks from the same space include Analog Devices, Inc. (NASDAQ:ADI) , Adobe Systems Incorporated (NASDAQ:ADBE) and AMTEK, Inc. (NYSE:AME) . While Analog Devices sports a Zacks Rank #1 (Strong Buy), Adobe Systems and AMTEK carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Analog Devices has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 16.3%.

Adobe Systems has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 7.8%.

AMTEK has outpaced estimates thrice in the preceding four quarters, with an average earnings surprise of 4.1%.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Ericsson (ERIC): Free Stock Analysis Report

Adobe Systems Incorporated (ADBE): Free Stock Analysis Report

Analog Devices, Inc. (ADI): Free Stock Analysis Report

AMTEK, Inc. (AME): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.