- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ericsson Awarded 5G Networking Equipment Contract By Verizon

Ericsson (BS:ERICAs) (NASDAQ:ERIC) has been selected by Verizon Communications Inc. (NYSE:VZ) to provide networking equipment for the latter’s commercial 5G launch. Verizon is scheduled to deploy the pre-standard 5G commercial radio network and the 5G Core network in certain markets in the second half of 2018.

Ericsson and Verizon are looking to pool their efforts to shift the mobile ecosystem toward rapid commercialization of 5G. The companies’ combined initiatives toward a clear roadmap and a robust ecosystem will help maximize the potential of 5G.

Over the past year, Ericsson and Verizon carried out fixed-wireless 5G trials using mmWave spectrum in multiple areas with varying geographies and housing densities. These trials have been crucial in understanding 5G technologies and mmWave propagation used in the Verizon 5GTF and the coming 3GPP 5G NR standard.

The firms’ new technologies will likely prove vital in catering to the increasing connectivity needs for emerging mobile and fixed wireless consumer broadband experiences. 5G marks a revolution in the field of communications and technology, and is the next key phase of mobile telecommunication standards.

Touted as the next generation of mobile technology, 5G has achieved rapid momentum over the past year. 5G networks have the capability to radically lessen latency, accelerate download and upload speeds, enhance network reliability and spectral efficiency. Also, these have the potential to support Internet of Things (IoT) development by considerably escalating the number of devices that can connect to the network simultaneously.

According to a research by Ovum, global 5G subscriptions are projected to reach 24 million by 2021, with the Asia-Pacific region having a 40% share and Europe accounting for 10%. Ericsson continues to aggressively drive progress in 5G technology and is engaged in multiple trial engagements with different operators across the world.

Earlier this year, Ericsson collaborated with technology behemoth, Intel Corporation (NASDAQ:INTC) , to launch an open industry platform — 5G Innovators Initiative (5GI2) — to create transformative experiences for clients. 5GI2 will facilitate the introduction of IoT solutions for a gamut of industries, ranging from aircraft and industrial plants to manufacturers and retailers.

However, as of now, the company continues to grapple with low investments in mobile broadband and all-pervasive weak demand. The beleaguered infrastructure giant’s repeated earnings misses, eroding profitability and steep revenue decline have left investors high and dry. The stock has lost 11.6% in the past six months in contrast to the industry’s gain of 0.4%.

Most of the company’s troubles have stemmed from flagging investments by major telecom equipment makers across the world. Particularly, uncertainty in the financial markets, reduced consumer telecom spending and delayed auctions of spectrums pose significant threats to Ericsson.

Overall, the company expects unfavorable industry trends and business mix in mobile broadband to persist this year as well. More restructuring charges are knocking on Ericsson’s door, and we also have a subdued view of operator spending and investments in R&D. Further adding to the woes, the company’s current savings plans and job reductions are not sufficient enough to counter macroeconomic miseries and swiftly waning product demand.

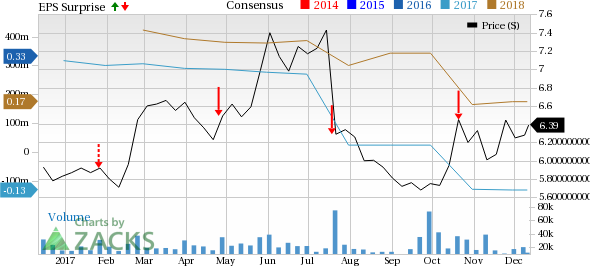

The consensus analyst community’s apathy toward the Zacks Rank #5 (Strong Sell) stock is reflected in its downward earnings estimate revisions. The stock has seen the Zacks Consensus Estimate for current-year earnings being revised downward to a dismal loss of 13 cents from earnings of 1 penny over the past 60 days. This downtrend move was triggered by four downward estimate revisions versus none upward. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ericsson Price, Consensus and EPS Surprise

Nevertheless, Ericsson expects to stabilize its operations amid a difficult market next year and remains hopeful of reaching its targeted operating margin of 12% beyond 2018. Slight positives from further managed service contract renegotiation and higher network software sales in the near future will likely be counteracted by strong headwinds of loss of momentum in China and loss of scale.

Ericsson plans to accelerate its planned cost cuts and expedite expansion plans that aren’t moving as anticipated, and reset the company’s focus on business of selling networking equipment prior to the expected roll-out of 5G networks.

With numerous headwinds on the company’s radar, several analysts have downgraded Ericsson since September, thanks to the bleak view of the company's revenues and margins. They believe a rollout of the 5G technology won't provide enough boost to the company's revenue base. Investors looking for exposure to the upcoming 5G upgrade cycle or IoT might consider better-placed players, namely Nokia (HE:NOKIA) and Cisco Systems, Inc. (NASDAQ:CSCO) .

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Ericsson (ERIC): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Intel Corporation (INTC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.