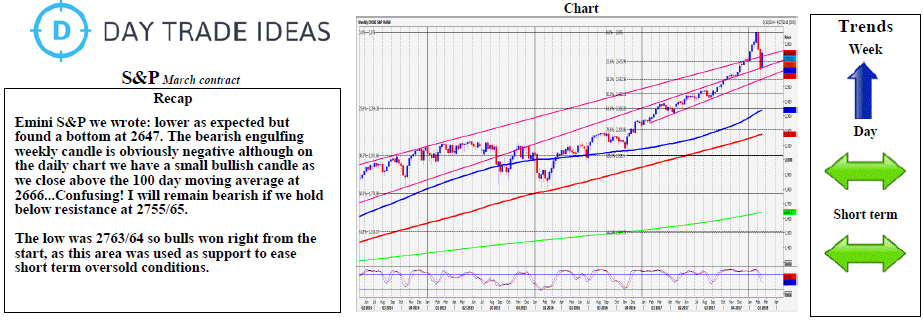

Emini S&P 500 bulls dove in using 2755/65 as support and the break above first resistance at 2690/2700 (key to direction) triggered a move towards minor resistance at 2735/37 but we only reached 2727. Above 2730 targets minor resistance at 2735/37 and we could pause here. If we continue higher look for 2744/46, perhaps as far as 2755/60. A test of trend line resistance at 2765/67 tells us if we are in a bear market - try shorts with stops above 2775.

Failure to beat very minor 23.6% Fibonacci resistance at 2728/29 (shorts are risky here) targets 2718/19 and 2709/07, with support at 2702/00. Longs need stops below 2690. A break lower targets support at 2680/2675 and if you think bulls can step in here, try longs with stops below 2665. A break lower is more negative and risks a slide to then 6 year trend line support at 2648/44. (This offered no support on the February collapse but held on Friday). Longs need stops below 2635. A break lower should be a sell signal targeting 2628/26 and 2620/28.