Updated 6:55 a.m.

Pre-Open Market Analysis

Today is the Alabama senator vote. If Moore loses, traders will believe that Trump is weaker. Therefore, senators will be less willing to agree with his proposals. That includes tax reform.

Another catalyst for a 5% correction comes at Wednesday’s 11 a.m. FOMC announcement. That is when the Fed will probably raise interest rates. Everyone knows that the Fed will be raising rates for several years. However, if the Fed changes the wording regarding the speed of the rate increase, that could be a negative surprise.

The Emini has rallied for 4 days after 2 strong, brief reversals down on the daily chart. Yesterday’s strong close increases the chance of a new all-time high today. In addition, it increases the odds of a gap up to a new high. However, the extreme buy climaxes on the daily, weekly, and monthly charts will limit how much longer the Trump rally will continue. Yet, until there are consecutive big bear trend days, the odds continue to favor at least slightly higher prices.

Overnight Emini Globex

The Emini is up 2 points in the Globex market. It might gap up today, possibly to a new all-time high. Since that high is resistance, there is an increased chance of a big rally above or a big reversal down. More likely, it will enter a trading range around the high. Since tomorrow is an FOMC announcement, today has an increased chance of being quiet.

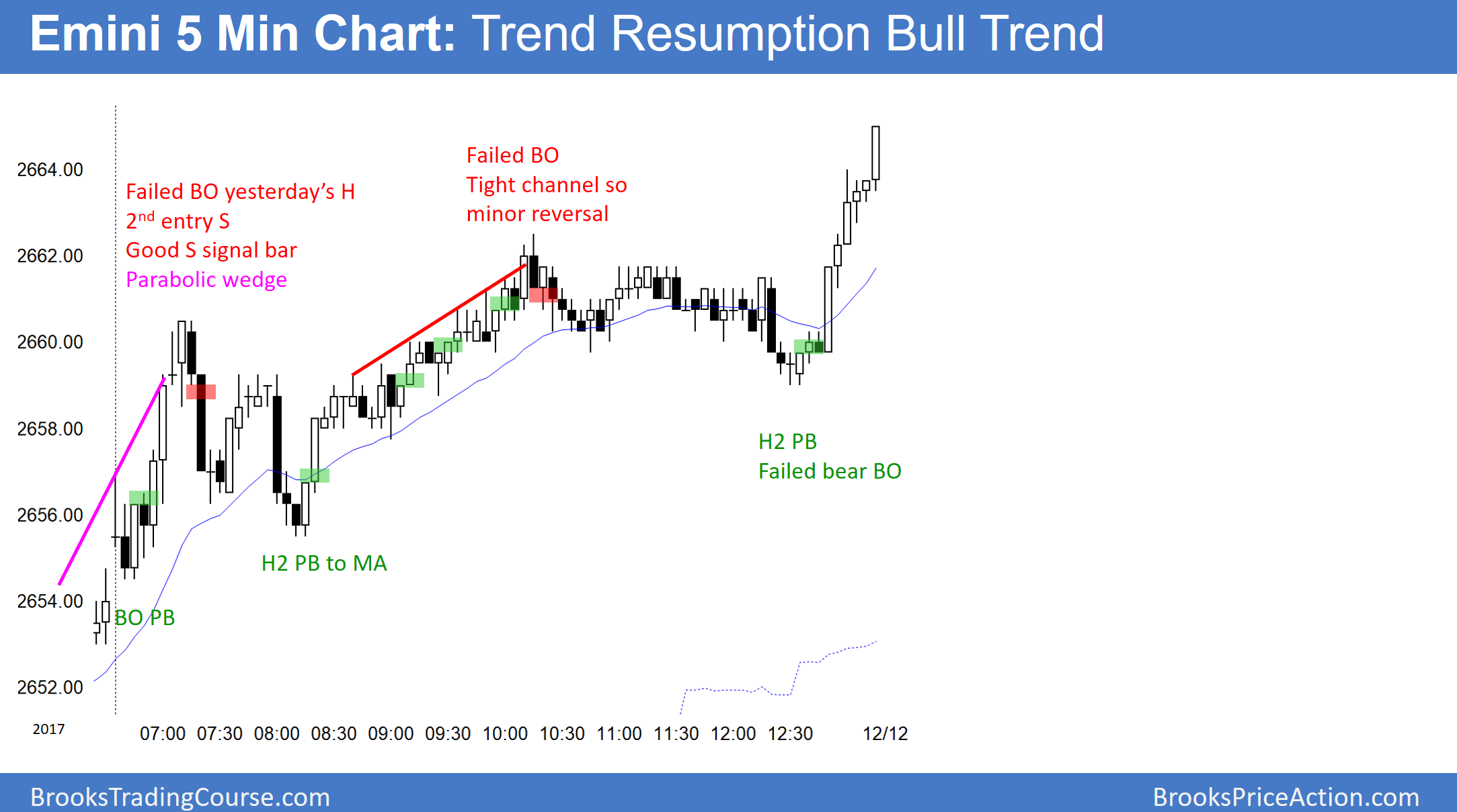

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.