FOMC, Alabama Moore Vote, Tax Reform Test Trump Rally

I will update around 6:55 a.m.

Pre-Open Market Analysis

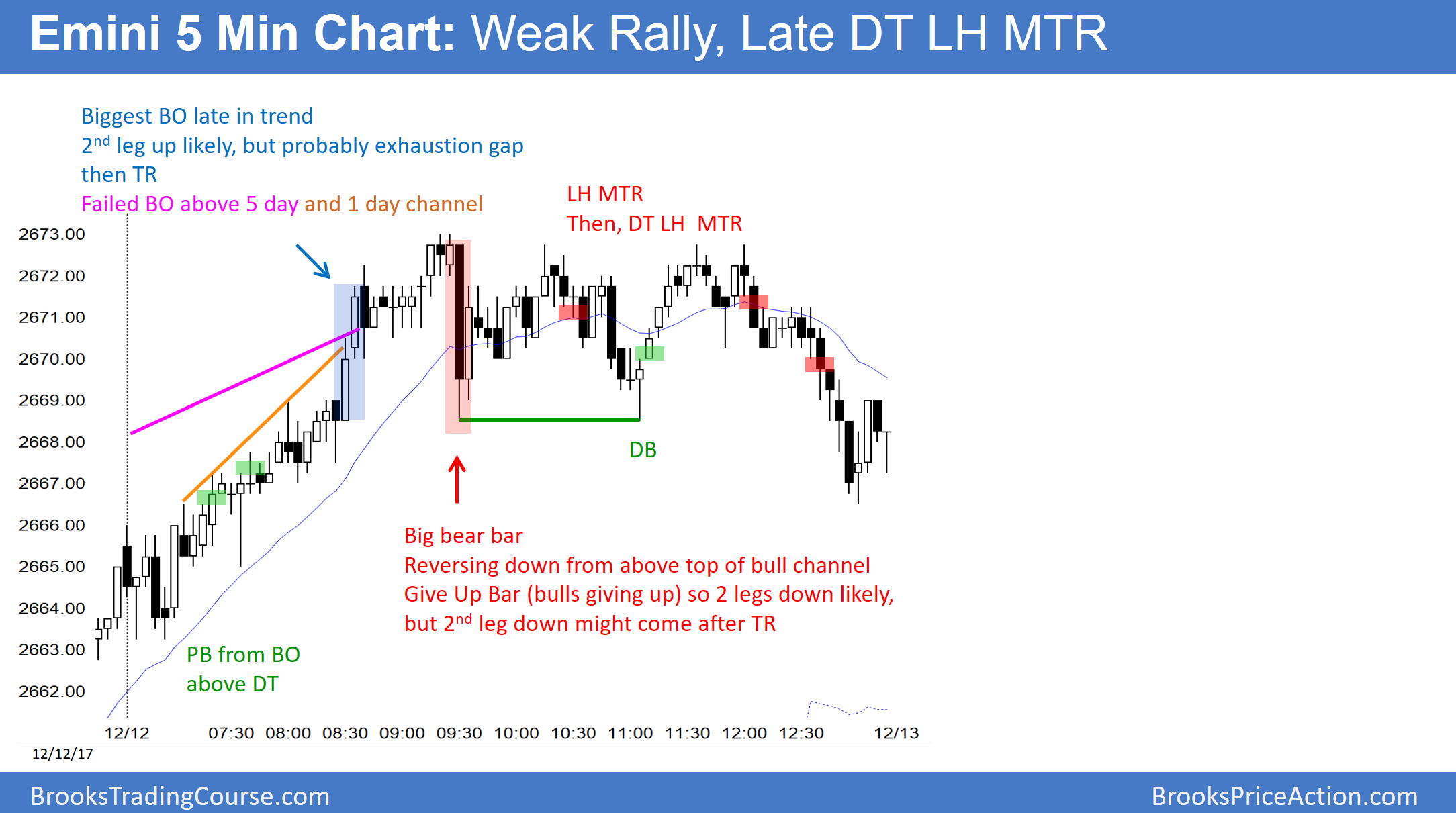

Yesterday was a bull trend day and the Emini made a new all-time high. Because it closed around its middle, it is a sell signal bar for today. However, after 5 bull days, the odds are against a big selloff today, at least until after the 11 a.m. FOMC report.

The market will digest the Alabama Senate vote from yesterday. In addition, the FOMC announcement comes out at 11 a.m. today. Traders expect the Fed to raise interest rates today. However, they do not expect a significant change to the wording of the Fed’s statement.

The Emini often enters a trading range before the report. Most day traders should stop trading around 10 a.m. PST. The 1st breakout after the report has a 50% chance reversing within 10 minutes. Day traders should wait until at least 11:10 a.m. before resuming trading.

Most FOMC reports over the past 2 years have led to trading ranges for the remainder of the day. However, there is an increased chance of a big trend up or down. In addition, the bars and legs can be big, and the reversals and breakouts can be fast. Because this increases risk, a day trader needs to reduce his position size after the report to keep his risk within his comfort zone.

Overnight Emini Globex Trading

The Emini is up 2 points in the Globex market. Traders therefore are ignoring the loss of a republican senate seat. Instead, they are looking to the 11 a.m. FOMC announcement. Today will trade like any other day until around 10 a.m.

Then, most day traders should stop trading. There is almost always be a breakout up or down on the 11 a.m. FOMC announcement. Since it reverses within 10 minutes 50% of the time, day traders should wait until after 11:10 a.m. before looking for trades again.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.