- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

El Pollo Loco Expands Further In Arizona With New Outlet

El Pollo Loco Holdings, Inc. (NASDAQ:LOCO) recently opened its latest outlet in Avondale, AZ. The 2,995-square-foot restaurant that can accommodate 70 guests is the company’s first restaurant in Avondale and 25th in the greater Phoenix area.

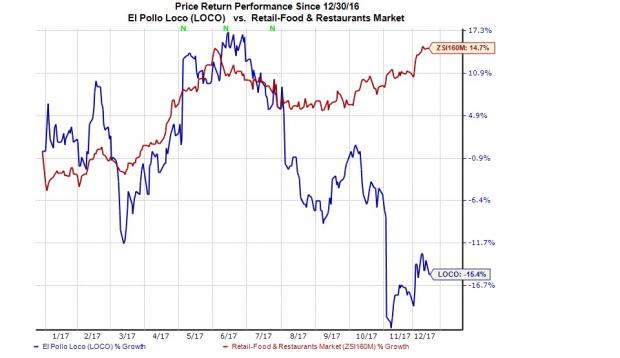

We observe that El Pollo Loco stock has lost 15.4% year to date against the industry’s gain of 14.7%.

Continued Focus on ‘Vision Design’

The new outlet, features the brand’s new ‘Vision Design’ that offers an authentic, Mexican-inspired atmosphere, includes El Pollo Loco’s menu and brand identity, and has an open kitchen layout to display the preparation of its signature dish. The launch appears to be part of the company’s efforts to boost comps through expansion and sales building.

El Pollo Loco Holdings, Inc. Revenue (TTM)

Going Forward

The company expects to boost growth through continuous focus on providing excellent service, reasonable pricing and its advertising campaign, and boosting comps in the process. Banking on menu innovation, limited time offers and a strong brand positioning, the company witnessed traffic growth in the last reported quarter. The trend is expected to continue in the fourth quarter.

El Pollo Loco has more than 470 company-owned and franchised restaurants in Arizona, California, Texas, Nevada and Utah. Also, it is looking to expand its presence in key markets like Oklahoma, New Mexico, Louisiana as well as Arkansas.

However, while other restaurant operators like Yum! Brands (NYSE:YUM) , McDonalds (NYSE:MCD) and Papa John’s (NASDAQ:PZZA) are pursuing aggressive global expansion policies, El Pollo Loco is losing out in terms of international presence.

El Pollo Loco has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Papa John's International, Inc. (PZZA): Free Stock Analysis Report

El Pollo Loco Holdings, Inc. (LOCO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Every investor should know the term CEP, or customer engagement platform, because it is central to businesses' use of AI. CEPs provide software services to connect and communicate...

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.