Selective Insurance Group, Inc. (NASDAQ:SIGI) and its subsidiaries recently received rating action from credit rating giant, A.M. Best. The rating agency has affirmed the issuer credit ratings (ICR) of “bbb+” and the issue ratings of Selective Insurance.

In addition, the rating agency affirmed the financial strength rating (FSR) of A (Excellent) and the ICR of “a+” of Selective Insurance Company of America and its nine pooled units. Selective Insurance Company and the nine affiliates are collectively known as “Selective”. Outlook remains stable.

The affirmations came on the back of sturdy risk-adjusted capitalization, strong position in targeted regional markets supported by the robust independent agency relationships, continued profitable operational performance, and strong market dominance.

Also, Selective Insurance’s loss reserves have consistently remained stable, which in turn, has improved its balance sheet strength. Further, the company’s operational performance has gained from the recognition of positive development of loss reserves.

However, rising gross and net underwriting leverage and weak investment yields, weigh on the positives.

Nevertheless, Selective Insurance’s debt-to-total capital ratio of 19.8%, adjusted debt-to-tangible capital ratio of 19.9% and interest coverage ratio were well within the rating giant’s guidelines.

Rating affirmations or upgrades from credit rating agencies play an important role in retaining investor confidence on the stock as well as maintaining credit worthiness in the market. Hence, it is expected that such ratings will help the company write more business in the future.

Zacks Rank and Stocks to Consider

Currently, Selective Insurance carries a Zacks Rank #3 (Hold). Some better-ranked stocks include Allied World Assurance Company Holdings, AG (NYSE:AWH) , Argo Group International Holdings, Ltd. (NASDAQ:AGII) and National Interstate Corporation (NASDAQ:NATL) . Each of these stocks sports a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.Click to get this free report >>

ARGO GROUP INTL (AGII): Free Stock Analysis Report

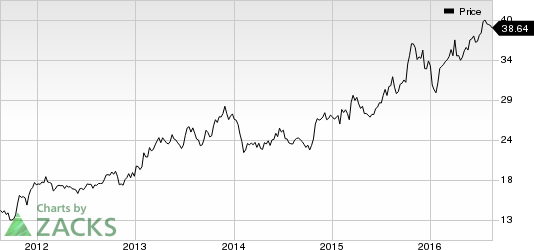

SELECT INS GRP (SIGI): Free Stock Analysis Report

NATL INTERST CP (NATL): Free Stock Analysis Report

ALLIED WORLD AS (AWH): Free Stock Analysis Report

Original post

Zacks Investment Research