The dollar fell on Wednesday after Federal Reserve Chairman Jerome Powell struck a downbeat tone in congressional testimony, saying trade uncertainties and concerns about the global outlook continued to exert pressure on the U.S. economy.

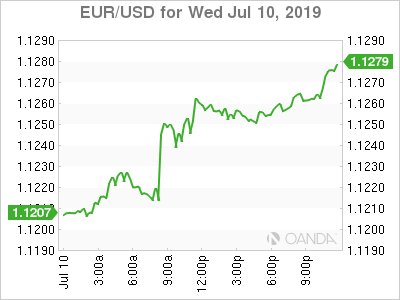

The greenback hit session lows versus the euro and yen after Powell’s comments, which reinforced expectations the Fed will cut interest rates for the first time in a decade at its next monetary policy meeting later this month.

In prepared remarks to a congressional committee, Powell said the Fed stands ready to “act as appropriate” to sustain a decade-long expansion.

He also contrasted the Fed’s “baseline outlook” of continued U.S. growth against a considerable set of risks – including persistently weak inflation, slower growth in other major economies, and a downturn in business investment driven by uncertainty over just how long the Trump administration’s trade war with China and other countries will last and how intense it will become.

“There is now economic evidence that the outlook for the U.S. economy is not that great,” said Juan Perez, senior currency trader at Tempus Inc in Washington. “Ultimately what that means is that the Federal Reserve will need to intervene. … And the dollar will get hurt as a result.”

Expectations for a 50-basis-point rate cut at a Fed meeting later this month have evaporated, but investors still expect a 25-basis-point cut due to weak inflation and worries about growing business fallout from the U.S.-China trade war.

In midmorning trading, the dollar index slid 0.3% to 97.155 . Against the yen, the dollar fell 0.3% versus the yen to 108.657, dropping against the Swiss franc to 0.9894 franc . The euro, meanwhile, rose 0.4% to $1.1248.

“If we see softer-than-expected inflation data tomorrow and if the advance second-quarter GDP (gross domestic product) reading comes in well below 2.0% on July 26th, we will see the case grow for the first cut to be a 50-basis-point one,” said Edward Moya, senior market analyst at OANDA in New York. “Currently, markets see one cut in July and it’s almost a coin flip for another one in September.”