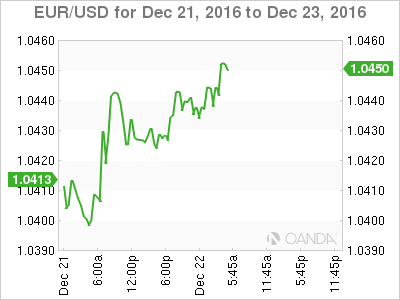

The euro has posted slight gains on Thursday, as EUR/USD trades at 1.0450. On the release front, there are no major Eurozone releases. In the US, today’s highlight is US Final GDP. We’ll also get a look at Core Durable Goods Orders and unemployment claims. On Friday, there are two key indicators – New Home Sales and Revised UoM Consumer Sentiment.

The US economy continues to expand in impressive fashion, as underscored by strong GDP forecasts for the third quarter. Preliminary GDP came in at 3.2%, beating the forecast of 3.0%. Final GDP is expected to be even stronger, with an estimate of 3.3%. If the indicator matches or beats this rosy prediction, the US dollar could respond with gains.

December seems to be that special time of year for the Federal Reserve. When the Federal Reserve raised interest rates in December 2015, the Fed confidently predicted a series of rate hikes in 2016 in order to keep a hot US economy in check. However, the Fed remained on the sidelines throughout 2016 and refrained from any rate hikes until last week. There were several false starts along the way, as expectations that the Fed would raise rates earlier in 2016 failed to materialize.

This led to sharp criticism of Janet Yellen for failing to provide a clear monetary policy. Yellen seems to have been keenly aware of this, as the Fed did everything short of buying advertisements in daily newspapers to get out the message that it planned to raise rates in December. Indeed, a rate hike was priced in as high as 100% by some analysts. Yellen should certainly be commended for sending a clear message to the markets in the weeks leading up to the December hike.

With the Fed finally pressing the rate trigger, what’s next for Janet Yellen & Co.? In September, Fed officials said they expected two rate hikes in 2017, but the Fed is now projecting three or even four hikes next year. However, projections need to be adjusted to economic conditions, and the markets will understandably be somewhat skeptical about Fed rate forecasts.

As well, the wild card of Donald Trump could also play a critical role in monetary policy. Trump’s economic platform remains sketchy, apart from declarations that he will increase government spending and cut taxes. Still, there is growing talk about ‘Trumpflation’, with the markets predicting that Trump’s policies will increase inflation levels, which have been persistently weak. If inflation levels do heat up, there will be pressure on the Fed to step in and raise interest rates.

EUR/USD Fundamentals

Thursday (December 22)

- 9:00 ECB Economic Bulletin

- 10:00 Italian Retail Sales. Estimate 0.4%

- 13:30 US Core Durable Goods Orders. Estimate 0.2%

- 13:30 US Final GDP. Estimate 3.3%

- 13:30 US Unemployment Claims. Estimate 255K

- 13:30 US Durable Goods Orders. Estimate -4.9%

- 13:30 US Final GDP Price Index. Estimate 1.4%

- 14:00 US HPI. Estimate 0.4%

- 15:00 US Core PCE Price Index. Estimate 0.1%

- 15:00 US Personal Spending. Estimate 0.4%

- 15:00 US CB Leading Index. Estimate 0.2%

- 15:00 US Personal Income. Estimate 0.3%

- 15:30 US Natural Gas Storage. Estimate -201B

Friday (December 23)

- 15:00 US New Home Sales. Estimate 575K

- 15:00 US Revised UoM Consumer Sentiment. Estimate 98.2

*All release times are GMT

* Key events are in bold

EUR/USD for Thursday, December 22, 2016

EUR/USD December 22 at 9:30 GMT

Open: 1.0426 High: 1.0456 Low: 1.0425 Close: 1.0452

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.0170 | 1.0287 | 1.0414 | 1.0506 | 1.0616 | 1.0708 |

- EUR/USD posted small gains in the Asian session and is flat in the European session

- 1.0414 is providing support

- 1.0506 is the next resistance line

Further levels in both directions:

- Below: 1.0414, 1.0287, 1.0170 and 1.0028

- Above: 1.0506, 1.0616 and 1.0708

- Current range: 1.0414 to 1.0506

OANDA’s Open Positions Ratio

EUR/USD ratio remains unchanged this week. Currently, long positions have a majority (57%), indicative of trader bias towards EUR/USD continuing to move upwards.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.