- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ECB May Stand Pat But The Euro Will Still Foot The Bill

Fundamental Forecast for Euro: Neutral

- We’ve identified a key indicator to watch for a turn in EUR/USD, but thus far the downtrend remains intact.

- If the euro is to rally, EUR/AUD may be attempting to breakout of its 2014 downtrend already.

- Have a bullish (or bearish) bias on the euro, but don’t know which pair to use? Use a euro currency basket.

Euro weakness persisted versus the most liquid major currencies this past week, while the rising tides of risk aversion from high yield/high beta names at least allowed the 18 member currency to stay buoyant versus the commodity currency bloc. Indeed, there is nascent evidence that the European currencies may be attempting to break their 2014 downtrends versus the Australian, Canadian, and New Zealand Dollars, truly leaving EUR/GBP and EUR/USD as the two lone representatives of how weak the Euro has been.

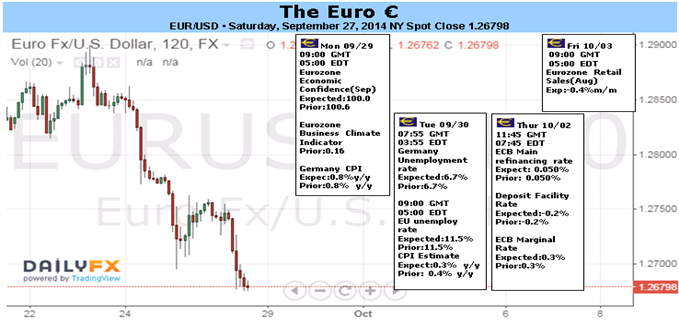

With the US Dollar Index closing higher for the 11 consecutive week, EUR/USD’s closing price below $1.2700 this week marks continuation of what has been abhorrent price action since mid-August. One recent Euro-specific catalyst has been mounting deflation fears. The European Central Bank’s preferred measure of medium-term inflation (by which it measures whether or not it’s +2% yearly price target is being priced by the market), the 5Y5Y inflation break even swaps, finished the week at 1.8776%.

It is worth nothing that over the last few weeks, EUR/USD has had an inverse correlation with US stock markets. In a nutshell, this anecdote would suggest that the euro is almost behaving like a funding currency. No surprise, though given where monetary policy in the region has headed; the ECB will confirm its interest rate corridor of -0.200% to +0.300% at its policy meeting this week.

Such low rates at a time when yields in the United States are set to increase puts interest rate differentials to work against EUR/USD. This week the spread between the US and German 10-year bond yields hit its widest differential since 1999.

At the heart of the issue for the euro is the persistent sluggish state of the Euro-Zone economy. A tracker for economic data momentum, the Citi Economic Surprise Index closed the week at -45.0, hovering near the yearly low set on September 3 at -53.8. (For comparison, the US Dollar CESI closed the week at +26.2.)

Even if the ECB stays put on Thursday – no new measures will be announced, but details regarding the scope of the ABS-program and the potential for QE will most likely be commented on – the Euro economic calendar is otherwise dour. On Monday, the September German CPI report is expected to show deflation on a monthly-basis. On Tuesday, the September German labor market report is due to show that Europe’s largest economy lost jobs, while the +0.3% September Euro-Zone CPI Estimate will be the lowest since October 2009.

Positioning may be a factor going forward, although changes in Euro positioning have been noticeably underwhelming relatively to the changes in spot FX. Since the week ended September 2 (when non-commercials/speculators held 161.4K net-short contracts), positioning has contracted to 142.0K net-short contracts (-12%), yet EUR/USD continued to fall for another -2.16% to the week ended September 23 (and was down -3.42% by the close on September 26). A different gauge of sentiment, FXCM’s SSI, has called for Euro weakness since May – until the crowd flips, the Euro’s troubles may continue.

Related Articles

The US dollar has come under some pressure on the back of the rerating of the US growth outlook and expectations that the Russia-Ukraine conflict is nearing an end. However, we...

The Swiss franc is down for a second straight trading day. In the European session, USD/CHF is trading at 0.8980, up 0.38% on the day. Switzerland’s GDP Eases to 0.2% The Swiss...

USD/JPY is consolidating near 149.33 on Wednesday, with the yen pausing its rally while holding near four-month highs against the USD. This stabilisation follows renewed support...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.