Ambarella, Inc. Information Technology -- Semiconductors | Reports March 3, After Market CloseKey Takeaways

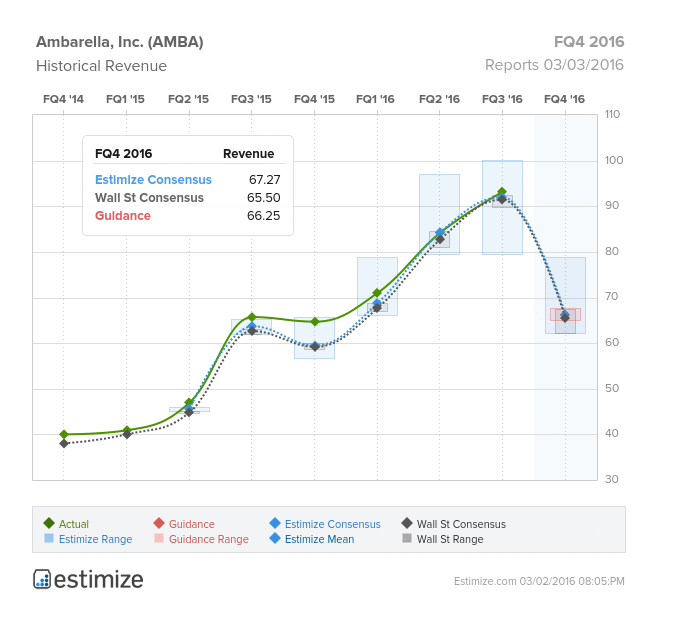

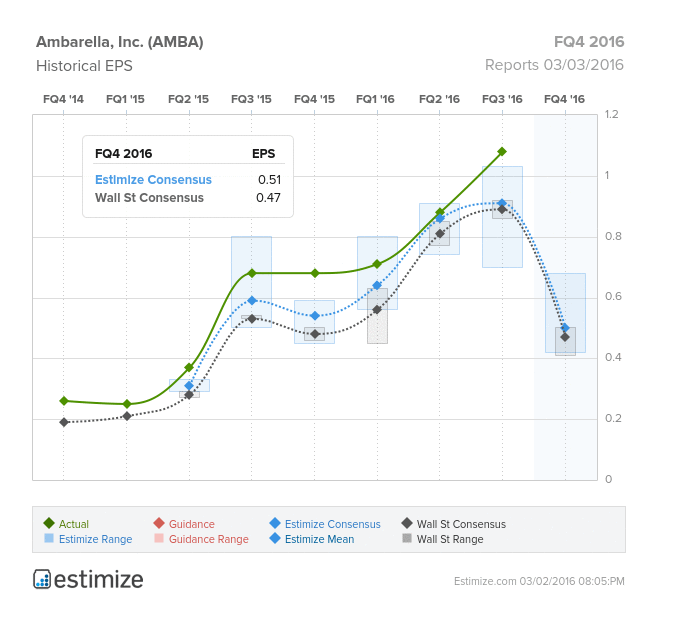

- The Estimize community is looking for EPS of $0.51 and revenue of $67.3 million, 4 cents higher than the Street on the bottom line, and roughly $2 million greater on the top line

- The company’s weak outlook has been closely tied to the disappointing growth of its biggest customer, GoPro

- Historically, Ambarella has consistently beat expectations, trumping Wall Street in each of the past 6 quarters.

Ambarella (NASDAQ:AMBA) is scheduled to report fourth-quarter earnings Thursday, after the market closes. Since Ambarella’s sales are so closely tied to GoPro (NASDAQ:GPRO), many investors believe GoPro’s setbacks will hurt the chipmaker this quarter. The Estimize community is looking for EPS of $0.51 and revenue of $67.3 million, 4 cents higher than the Street on the bottom line, and roughly $2 million greater on the top line. The Select Consensus, which heavily weights historically accurate analysts and recent estimates, is slightly more bearish, with EPS of $0.50 and a sales consensus of $66.2 million. Compared to Q4 2014, this represents a project YoY decline on the bottom line of 25% while sales are expected to rise 4%. The Estimize community has been bearish on Ambarella’s earnings, revising EPS estimates down 15% and revenues down 11% in the past 3 months. That said, in the past 6 quarters, the chipmaker has beat Wall Street estimates in 100% of the time. This Thursday investors will know with certainty how much GoPro’s misfortunes will impact Amaberella.

After reaching highs of $126.70 in June 2015, shares of Ambarella have plummeted 65.5% in the past 8 months. The company’s weak outlook has been closely tied to the disappointing growth of its biggest customer, GoPro. Ambarella produces the chips inside all GoPro devices, accounting for a third of the company’s sales. GoPro’s dismal Q4 earnings report foreshadows equally disappointing results for Ambarella come Friday. GoPro severely missed on the bottom line, reporting a loss per share of -$0.08 and a 16% decline in the number of units sold YoY. Ambarella’s relationship with GoPro, which was once a blessing, has become quite the burden. Last quarter, the company warned investors that Q4 sales were only expected to rise 0.5% to 4.3%, compared with to its 62% growth in the March 2015 quarter. Fortunately, Ambarella is attempting to diversify its top line away from action cameras and drones and into less volatile products.