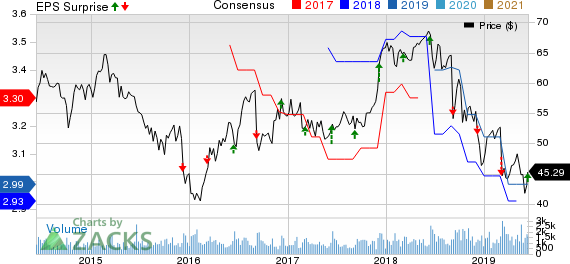

After three consecutive negative earnings and revenue surprises, John Wiley & Sons, Inc. JW.A surprised investors with better-than-expected fourth-quarter fiscal 2019 results. Both top and bottom lines improved year over year and came ahead of the Zacks Consensus Estimate. Shares of the company gained 5.1% during yesterday’s trading session.

This helped the company’s shares increase 2.6% in the past three months against the industry’s decline of 6.4%.

Results in the quarter were backed by Research and Solutions segments improvement, which was somewhat negated by softness in the Publishing division. Additionally, the company is on track with digital transformation. In fact, digital products and tech-enabled services contributed nearly 75% of total revenues in fiscal 2019.

Q4 in Detail

John Wiley & Sons’ adjusted earnings of $1.05 per share increased close to 12% year over year and 19% on a constant-currency (cc) basis. Excluding the impact of Learning House acquisition, adjusted earnings improved 26% at cc. Further, the bottom line beat the Zacks Consensus Estimate of $1.01, which crushed the company’s three-quarter long trend of negative earnings surprise.

Revenues of $491.2 million advanced 3% year over year (up 7% at cc). Excluding impacts from the aforementioned acquisition, revenues grew 3% at cc. Revenues came slightly ahead of the Zacks Consensus Estimate of $490 million. Strength in Research and Solutions segments was partly countered by continued weakness in the Publishing division.

Adjusted operating income came in at around $79.6 million compared with $74.7 million in the year-ago quarter. Adjusted operating income increased 14% at cc, and 17% at cc, excluding the impacts from Learnings House buyout. The upside was driven by higher revenues, and reduced operating and administrative costs. Also, adjusted operating margin expanded 50 basis points to 16.2%.

Segmental Details

Research revenues were flat year over year, while it rose 4% at cc. Results were fueled by growth in Open Access and Journal subscriptions, which increased 19% and 5% at cc, respectively. The segment’s adjusted contribution to profit increased 6% at cc on account of higher revenues.

Publishing revenues dropped 3% on a reported basis and 1% at cc due to dismal performance by Educational Publishing, STM and Professional Publishing. This was somewhat offset by growth in WileyPLUS, and Test Preparation and Certification. Adjusted contribution to profit rallied 23% at cc due to reduced employment expenses.

At the Solutions segment, revenues increased 30% on a reported basis and 32% at cc. The upside was backed by gains from the Learning House buyout, and advancements in Professional Assessment and Education Services, which were partly offset by declines in Corporate Learning. Excluding the impact of Learnings House acquisition, segment sales improved 3% at cc. However, adjusted contribution to profit from the Solutions segment declined 25% at cc, owing to the buyout of Learnings House and high marketing expenses.

Other Financial Update

John Wiley ended the quarter with cash and cash equivalents of $92.9 million, long-term debt of $478.8 million and total shareholders’ equity of $1,181.3 million.

The company generated $250.8 million of cash from operating activities in fiscal 2019. Further, it generated free cash flow (net of Product Development Spending) of $149.2 million. For fiscal 2020, the company anticipates free cash flow of $210-$230 million.

In fiscal 2019, John Wiley paid dividends worth nearly $76 million and bought back shares of roughly $60 million. This included repurchases of approximately $25 million made in the fourth quarter.

Other Developments & Guidance

On May 31, the company took over Knewton, which strengthens its position in adaptive learnings and affordable content category.

This Zacks Rank #3 (Hold) company is impressed with its performance, as it successfully met its revenue and earnings targets. The company is witnessing growth in strategic fields like Research Test Preparation and Certification, Open Access publishing, corporate training, and Education Services. Furthermore, John Wiley’s two significant buyouts in the education category bode well, and it has also started to see returns from its business optimization program.

Going ahead, management intends to align its reporting segments according to its areas of focus. The three planned segments include Research Publishing and Platforms, (similar to the existing “Research” business), Education and Professional Publishing, (including the existing “Publishing” unit and Corporate Learning and Professional Assessment sub-units) and Education Services (similar to the company’s existing “Education Services” sub-segment, online program management (OPM) and other rapidly-growing services businesses).

All said, management anticipates revenues for fiscal 2020 to be $1.84-$1.87 billion. This includes $950-$960 million from Research Publishing and Platforms segment, $690-$700 million from Education and Professional Publishing segment and $200-$210 million from Education Services segment.

John Wiley expects adjusted EBITDA for fiscal 2020 to range between $360 million and $375 million. Finally, adjusted EPS is envisioned to be $2.45-$2.55, which is well below the Zacks Consensus Estimate of $2.99.

Looking for Consumer Staples Stocks? Check These

General Mills (NYSE:GIS) , with a Zacks Rank #1 (Strong Buy), has a long-term EPS growth rate of 7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Flowers Foods (NYSE:FLO) , with a Zacks Rank #2 (Buy), delivered back-to-back surprises in the last two quarters.

J&J (NYSE:JNJ) Snack Foods (NASDAQ:JJSF) , also with a Zacks Rank #2, also delivered back-to-back surprises in the last two quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

General Mills, Inc. (GIS): Free Stock Analysis Report

Flowers Foods, Inc. (FLO): Free Stock Analysis Report

J & J Snack Foods Corp. (JJSF): Free Stock Analysis Report

John Wiley & Sons, Inc. (JW.A): Free Stock Analysis Report

Original post

Zacks Investment Research