- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dollar Tree (DLTR) Stock Down On Q4 Earnings & Sales Miss

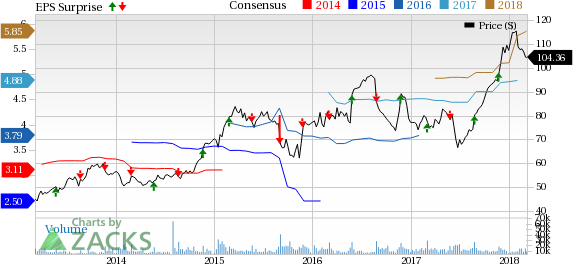

Dollar Tree Inc. (NASDAQ:DLTR) , one of the leading operators of discount stores, delivered fourth-quarter fiscal 2017 adjusted earnings of $1.89 per share that lagged the Zacks Consensus Estimate by a penny.

Earnings Estimate Revision: The Zacks Consensus Estimate for fiscal 2018 has witnessed an uptrend in the last 30 days. If we look at Dollar Tree’s performance in the trailing four quarters (excluding the quarter under review), the company has outperformed the Zacks Consensus Estimate by an average of nearly 7.4%.

Revenues: Dollar Tree generated net sales of $6,360.6 million that advanced 12.9% year over year but missed the Zacks Consensus Estimate of $6,401 million. Total enterprise comparable-store sales (comps) improved 2.4% (on a constant currency basis), with comps for Dollar Tree rose 3.8% and Family Dollar grew 1%.

Outlook: Management issued guidance for first quarter and fiscal 2018. It now forecasts consolidated net sales for the first quarter in the band of $5.53-$5.63 billion, with low single-digits comps growth. Earnings are envisioned in the range of $1.18-$1.25 per share.

For fiscal 2018, it projects consolidated net sales in the range of $22.70-$23.12 billion, with low single-digit comps increase and 3.7% rise in square footage. Further, earnings per share for the fiscal are envisioned in the $5.25-$5.60 range.

The Zacks Consensus Estimate for first-quarter earnings is pegged at $1.32 and for the fiscal year, it stands at $5.85.

Zacks Rank: Currently, Dollar Tree carries a Zacks Rank #2 (Buy), which is subject to change following the earnings announcement.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stock Movement: Dollar Tree’s shares fell 10.3% during pre-market trading following the quarterly results.

Check back later for our full write up on Dollar Tree’s earnings report!

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks’ has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks. >>

Dollar Tree, Inc. (DLTR): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Here’s where I see stocks now: Yes, we’ve got some legitimate concerns as some economic warning signs appear—and run up against the tech-driven optimism that’s powered stocks to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.