- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

GE Nears 2-Year Low: Value Stock Or Value Trap?

Shares of industrial goods giant General Electric Company (NYSE:GE) continued to fall for the second consecutive day, nearing its two-year low as changes across top management failed to quell negative investor perception. Its shares closed at $23.36 yesterday — very close to the lowest level since Aug 25, 2015.

Glass Half-Full or Half-Empty?

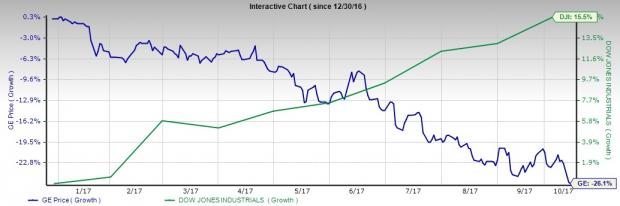

GE has been the worst performer in the Dow Jones Industrial Average this year, with a decline of 26.1% year to date as against a gain of 15.5% for the latter. In order to boost its sagging shares, the company restructured its businesses and focused on core industrial operations after completing the GE Capital exit plan. Also, the company initiated a reshuffle in top management to bring in new ideas as John Flannery took the helm as CEO, replacing Jeff Immelt.

Early last week, Flannery further assumed the role of the Chairman of the company as Immelt retired three months in advance. Three top order exits followed in quick succession with Chief Financial Officer Jeffrey Bornstein stepping down after 28 years of service on Oct 31, 2017 and fellow vice chairs, John Rice and Beth Comstock, retiring at year end after 39 and 27 years of service, respectively. The strategic moves seemed to be an effort by Flannery to start his tenure as the CEO and Chairman with a clean slate and a completely new support staff.

However, such sweeping changes in top management created a negative investor perception and fueled speculations that fundamental challenges within the company are worse than what Wall Street is currently discounting.

Down But Not Out

Despite a dismal stock performance, GE has offered bullish guidance for 2017. The company anticipates operating earnings to be within $1.60-$1.70 (up 7% to 14% year over year), with organic growth of 3-5%. GE intends to return $19-$21 billion to the shareholders in 2017, including $8 billion in dividends and $11-$13 billion in share repurchases.

In addition, the company expects to generate $18-$21 billion in cash flow from industrial operations in 2017. GE has solid long-term earnings growth expectation of 10%. It has beaten earnings estimates thrice in the trailing four quarters with an average positive surprise of 9.7%.

For the first half of 2017, organic revenues improved 4% while operating profit increased 11% year over year. The company has returned $7.8 billion to shareholders in the first six months of the year, half of which was through share repurchases. A healthy dividend yield in the vicinity of 4% is also fully covered by earnings and has enough scope for further appreciation.

With such a favorable outlook and decent dividend yield, investors can expect to profit in the future by buying this blue-chip stock at a discount.

Zacks Rank & Key Picks

GE presently has a Zacks Rank #4 (Sell). Better-ranked stocks in the industry include Danaher Corp. (NYSE:DHR) , Honeywell International Inc. (NYSE:HON) and Leucadia National Corp. (NYSE:LUK) , each carrying Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Danaher has a long-term earnings growth expectation of 11.6%. It has beaten earnings estimates in each of the trailing four quarters with an average positive surprise of 2.5%.

Honeywell has a long-term earnings growth expectation of 9.6%. It has beaten earnings estimates thrice in each of the trailing four quarters with an average positive surprise of 2.1%.

Leucadia has a long-term earnings growth expectation of 18%. It has beaten earnings estimates twice in the trailing four quarters, with an average positive surprise of 5.4%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Danaher Corporation (DHR): Free Stock Analysis Report

Honeywell International Inc. (HON): Free Stock Analysis Report

Leucadia National Corporation (LUK): Free Stock Analysis Report

General Electric Company (GE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Shares of Caesars Entertainment (NASDAQ:CZR), a leading gambling stock, traded around 3% higher on Wednesday morning, though the stock was trading around 1.5% lower shortly before...

Amazon (NASDAQ:AMZN) is making a significant push into the future with a robust investment in robotics and artificial intelligence. The company has earmarked $35 billion for...

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.