- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Does Netflix Have Room For Further Upside In 2018?

On Tuesday, Netflix, Inc. (NASDAQ:NFLX) hit its third successive all-time high of $325.27. The streaming video giant had already enjoyed a strong showing on Monday, powered by its second-ever Oscar win for the documentary Icarus. In contrast, other major media names mopped up only meager gains despite garnering multiple awards.

More importantly, shares of Netflix have surged nearly 70% year to date, edging out larger tech names like Amazon (NASDAQ:AMZN) , Apple (NASDAQ:AAPL) Microsoft (NASDAQ:MSFT) and Alphabet (NASDAQ:GOOGL) , which have gained only 31.5%, 4.4%, 9.1% and 4.5%, respectively over the same period.

But does the stock’s price have further room for improvement in the days ahead? A wide swathe of analysts believes that the stock has the potential to move even higher in 2018. A carefully built up competitive moat and the rapid adoption of ultra-HD content are some of the reasons that could fuel Netflix’s ascent in the days ahead.

Oscars’ Biggest Winner?

On Monday, Netflix’s stock gained 4.6% after it picked up its second Oscar in the documentary category. The prestige factors must surely have added to the sheen of the stock since the real big winners on Academy Awards night had little to show for their efforts in terms of price gains.

Disney (NYSE:DIS) , Time Warner (NYSE:TWX) , Fox (NASDAQ:FOXA) and Comcast’s (NASDAQ:CMCSA) Universal all picked up multiple awards. But each of these companies’ shares failed to increase more than 1% on Monday during a session when the Dow gained nearly 1.5%. Meanwhile, Netflix notched up another 3.2% gain on Tuesday. Netflix has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competitive Moat, Ultra-HD Adoption to Drive Upside

Of course, there is another section of analysts which believe that movies are only incidental to Netflix’s larger game plan, give its massive library of original content, Netflix is planning to spend almost $8 billion on producing its own content in 2018. This is a substantial jump from the $6 billion that it spent on content in 2017.

Analysts at UBS AG (NYSE:UBS) believe that investment in original content is one of the major factors which have helped Netflix to build a formidable competitive moat. And this moat is one of global proportions. Going forward, analysts at the Wall Street firms think that Netflix has created a virtuous circle for itself since its international success reduces the incremental cost of acquiring and servicing fresh subscribers.

This is UBS has revised its price target for Netflix upward, from $290 to $345. Meanwhile, analysts at Macquarie have revised their Netflix price target higher for a completely different reason. This firm believes that the widespread proliferation of ultra-HD content will help Netflix gain further headroom.

Since Netflix charges a $4 premium over its standard service for ultra-HD content, this is likely to result in higher revenues. On Monday, Macquarie’s 12-month price target stood at $330.

Does Netflix Sport Sufficient Upside?

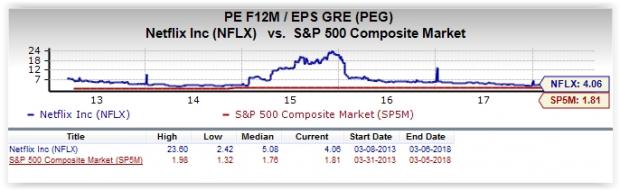

With the stock gaining a searing 69.4% year to date, the only factor working against it at this point is valuations. With a PEG ratio of 4.06, Netflix is clearly pricier than the S&P 500, which has a PEG ratio of 1.81.

However, its median PEG ratio over a five year time span is 5.08. Additionally, it high a peak PEG value of 23.60 during the fourth quarter of 2015, which means that it remains pricey but has further room to run.

Also, the ongoing market rally has dispelled such concerns over valuation time and time again. Tech majors have delivered ever stronger earnings performances, as was in evidence during Netflix’s fourth quarter results, to justify such exorbitant valuations. The company added 8.3 million subscribers (highest in history), much more than the expected 6.3 million, which shows how attractive its portfolio is to consumers.

In Conclusion

Over the last three months, Netflix’s Zacks Consensus Earnings estimate for the current year has increased by 19.3%. Additionally, its expected earnings growth for the current year is more than 100%. Meanwhile, its stock remains pricey but well below its peak or even median valuation levels over a five year span.

Given these factors, Netflix is likely to surge even higher in 2018 on the back of its strong original content and international subscriber additions. This makes it a great option for investors going forward.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks’ has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks>>

Time Warner Inc. (TWX): Free Stock Analysis Report

Walt Disney Company (The) (DIS): Free Stock Analysis Report

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

UBS Group AG (UBS): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As markets try to look through the blizzard of policy changes flowing out of Washington, the crowd has shifted its preferences considerably in recent weeks based on a sector lens....

Nvidia’s muted reaction keeps tech on edge, with chipmakers in focus. Nasdaq’s 20980-21000 support holds—for now. A break could mean trouble. With Nvidia done, GDP today and...

Here’s where I see stocks now: Yes, we’ve got some legitimate concerns as some economic warning signs appear—and run up against the tech-driven optimism that’s powered stocks to...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.