The price of copper is known to reflect the state of the world economy. It is closely related to infrastructure and manufacturing spending, which tend to increase during a strong economy and contract in a weak one.

So it is a little surprising to see copper prices rally in the middle of the greatest crisis since the Great Depression. Doctor Copper topped $3/lb for the first time in two years earlier today. The industrial metal is up 54% from its March bottom. Can the rally continue or are copper bulls getting ahead of themselves? Let’s examine the Elliott Wave structure of the recovery and see what we’ll find.

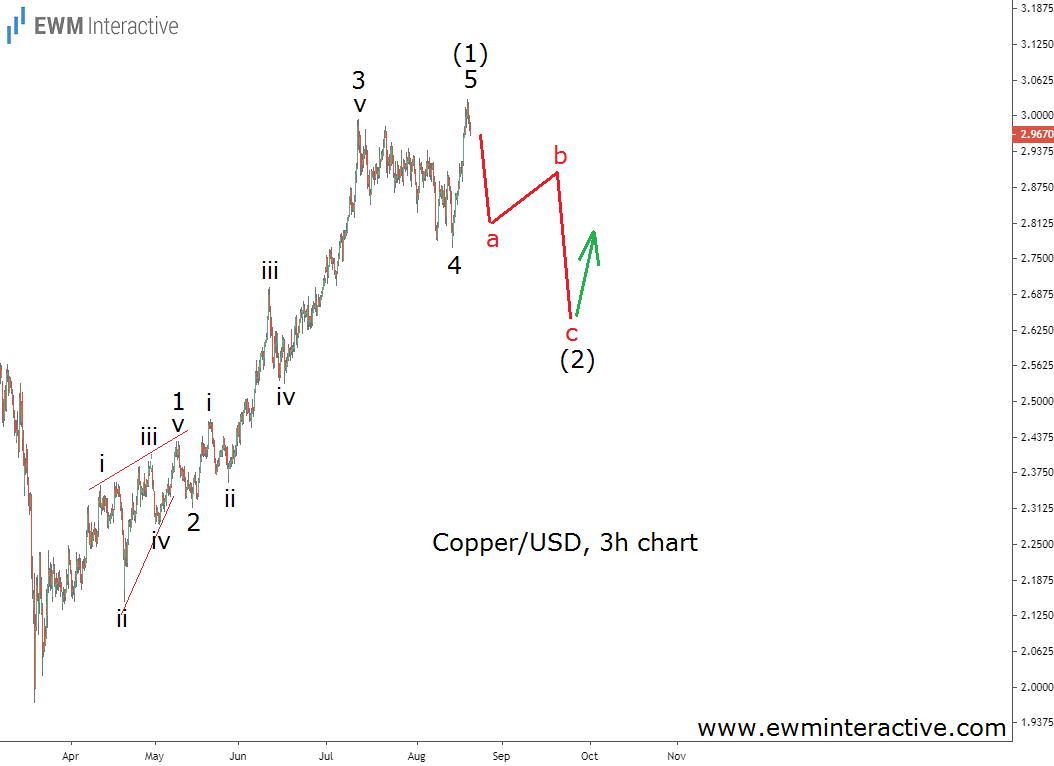

The 3-hour chart reveals that copper’s rally from $1.97 to $3.03 can be seen as a five-wave impulse. The pattern is labeled 1-2-3-4-5, where wave 1 is a leading diagonal and wave 3 is extended. The five sub-waves of both are also visible and marked i-ii-iii-iv-v.

If this count is correct, today’s high is part of the fifth and final wave of the sequence. According to the theory, a three-wave decline follows every impulse before the trend can continue. This means that instead of joining the bulls near the $3 mark, traders should prepare for a bearish reversal.

The support of wave 4 near $2.80 looks like an easy target. Judging from the bigger picture, the bears also have a good chance to drag the price of copper to $2.60 in wave (2). It has been a good run, indeed, but it appears the bulls could use a rest now.