- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

IBM (IBM) Stock Pops On Q3 Cloud Revenue Growth

International Business Machines (NYSE:IBM) just released its third-quarter 2017 financial results, posting earnings of $3.30 per share and revenues of $19.15 billion. Currently, IBM is a Zacks Rank #4 (Sell), and is up 3.43% to $151.57 per share in after-hours trading shortly after its earnings report was released.

IBM:

Beat earnings estimates. The company posted earnings of $3.30 per share (excluding $0.38 from non-recurring items), beating the Zacks Consensus Estimate of $3.28 per share.

Beat revenue estimates. The company saw revenue figures of $19.15 billion, topping our consensus estimate of $18.67 billion.

The company experienced a marginal gain in its third-quarter earnings from the $3.29 per share IBM posted in the year-ago period. IBM’s overall revenues fell 0.4% from last year as slower sales from its core business were offset slightly by gains in newer sectors.

IBM’s cloud revenues soared 20% in the quarter to hit $4.1 billion. This brings the company’s vitally important cloud computing revenues to $15.8 billion over the last 12 months. The firm’s analytics revenues gained 5%, while mobile sales grew 7%. On top of these gains, IBM’s security sector revenues jumped 51%.

At the end of its third-quarter, IBM had $2.5 billion in free cash flow and returned $1.4 billion in dividends. As of the end of September, the technology giant had $1.5 billion remaining in its current share repurchase authorization plan. And the company closed the quarter with $11.5 billion of cash on hand.

For its full-year, IBM now projects to post diluted, non-GAAP earnings of at least $13.80 per share. IBM also reaffirmed its flat free cash flow projection.

“In the third quarter we achieved double-digit growth in our strategic imperatives, extended our enterprise cloud leadership, and expanded our cognitive solutions business,” IBM chairman, president and CEO Ginni Rometty said in a statement. “There was enthusiastic adoption of IBM's new z Systems mainframe, which delivers breakthrough security capabilities to our clients.”

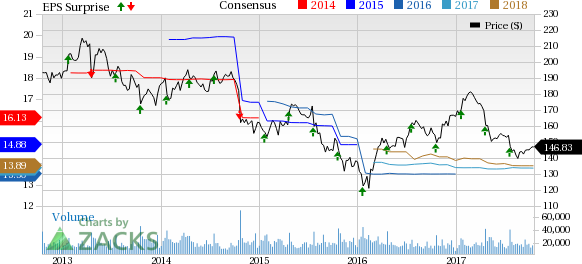

Here’s a graph that looks at IBM’s Price, Consensus and EPS Surprise history:

IBM is an information technology (IT) company. The company operates in five segments: Global Technology Services, Global Business Services, Software, Systems and Technology, and Global Financing. The Global Technology Services segment provides IT infrastructure services and business process services. The Global Business Services segment offers professional services and application management services. The Software segment consists primarily of middleware and operating systems software. The Systems and Technology segment provides computing power and storage solutions; and semiconductor technology products and packaging solutions. The Global Financing segment invests in financing assets, leverages with debt and manages the associated risks. IBM is headquartered in Armonk, New York.

Check back later for our full analysis on IBM’s earnings report!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

International Business Machines Corporation (IBM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Nvidia’s earnings beat didn’t erase investor concerns over slowing growth. Soft Q1 guidance and valuation worries may limit the stock’s upside. Weak network and gaming sales...

Shares of Etsy (NASDAQ:ETSY) are down approximately 7% since the company reported earnings on February 19. Concerns over slowing growth are overriding revenue and earnings that...

The price-to-earnings (P/E) ratio is one of the most commonly used metrics to determine whether a stock is expensive or cheap. Generally, the higher the P/E ratio, the more...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.